Industry Data

This section focuses on analyzing the structural change of the industry. As a service to the printing and publishing industries, WhatTheyThink provides access to economic, industry trends and other data that is valuable to industry executives for strategic planning and research purposes.

JUST RELEASED

The Taktiful/WhatTheyThink 2023 Specialty Digital Ink and Toner Embellishment Study

The new 2023 Specialty Digital Ink and Toner Embellishment Study provides detailed analysis of how current users of digital ink and toner embellishment technologies are utilizing them, what the response from customers has been, how satisfied print providers have been with the sales and profitability of these jobs, where the challenges lie, and their general feelings about the future of digital ink and toner embellishment technologies.

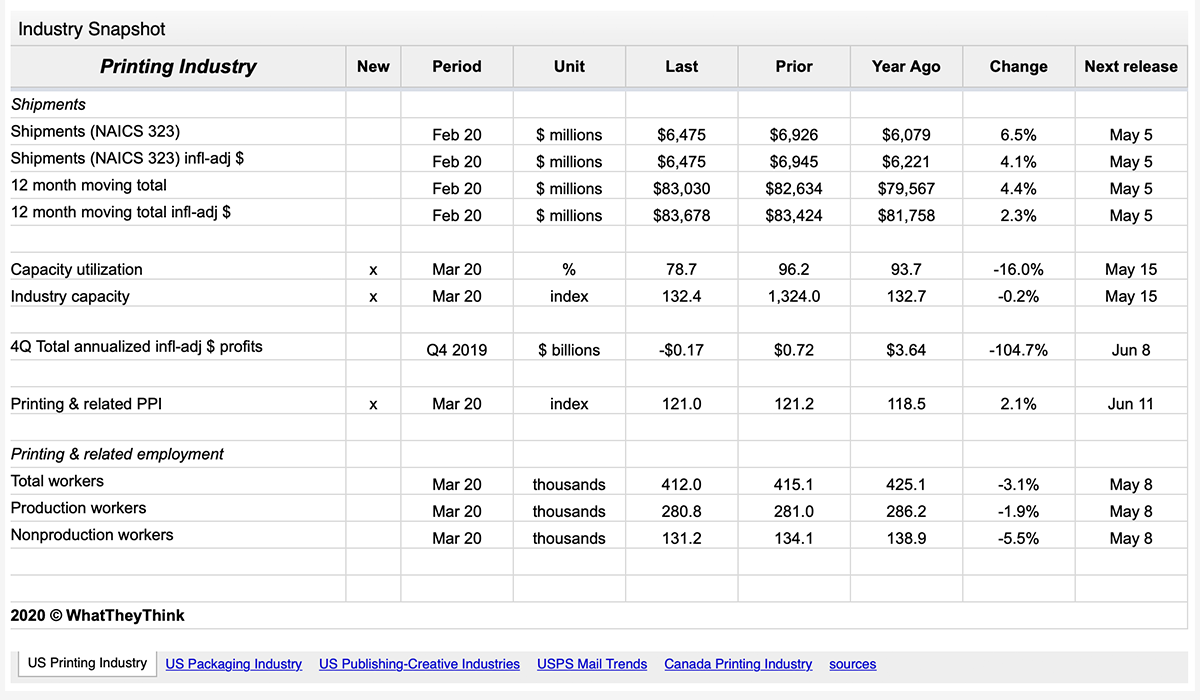

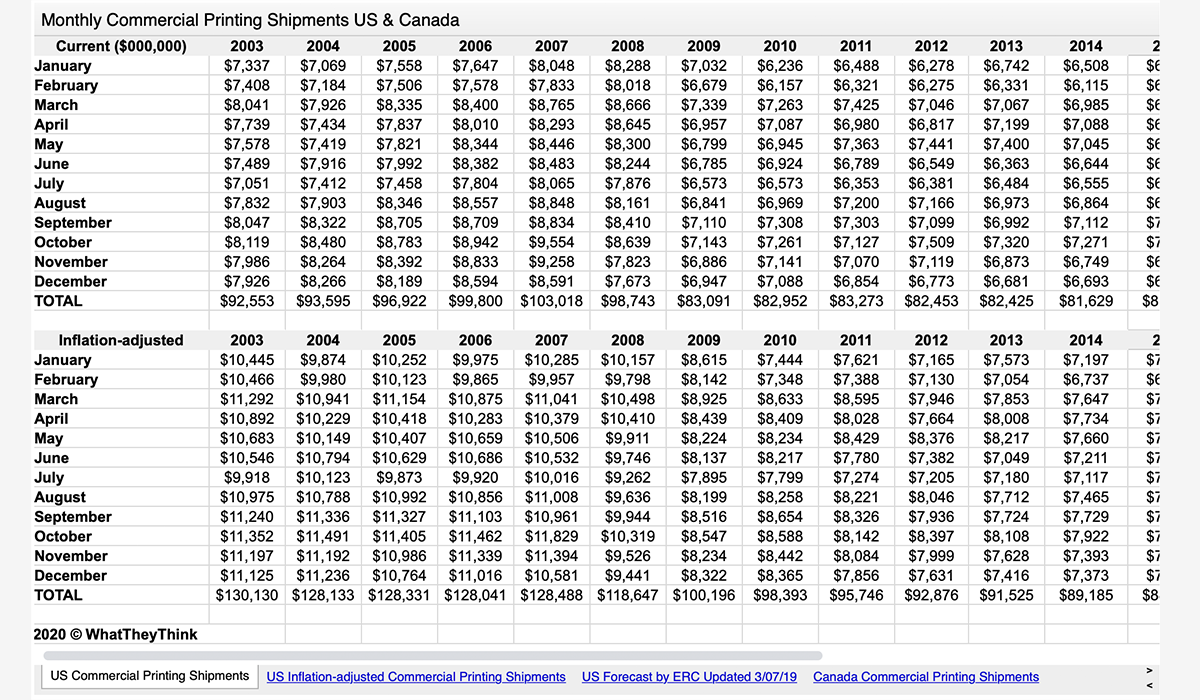

Printing Industry Snapshot

A collection of regularly updated industry data about various measures of business activity. Continuously updated.

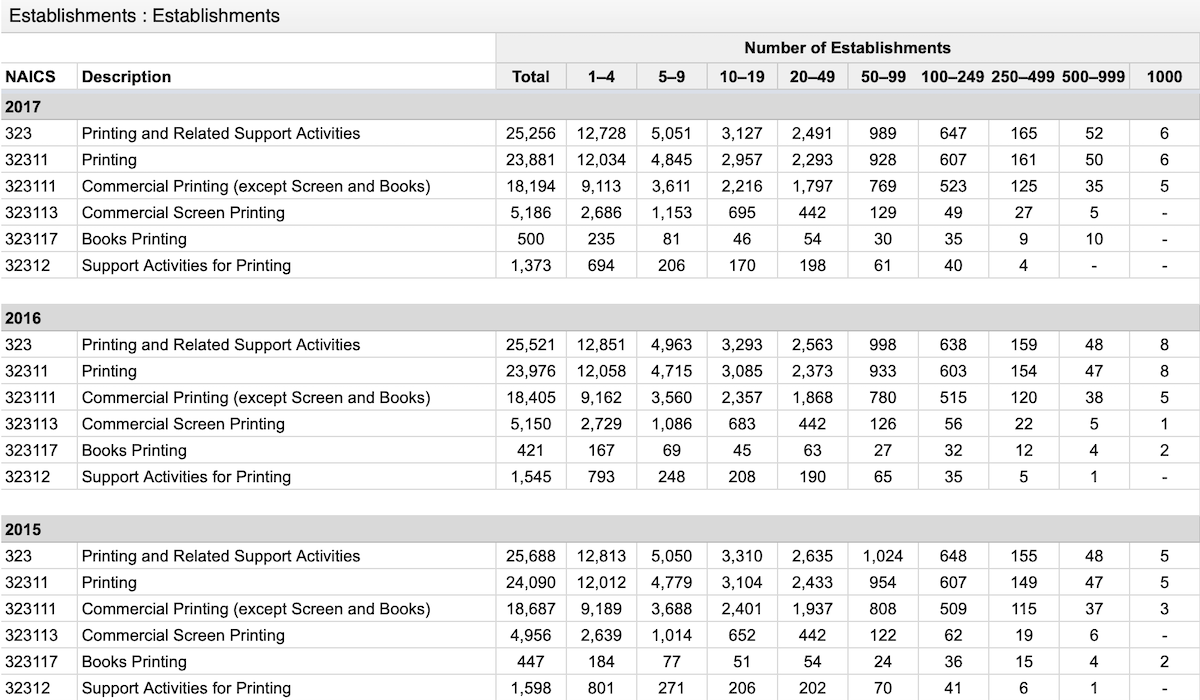

US Commercial Printing Establishments

The number of establishments in the US organized by NAICS (North American Industrial Classification System). Updated annually.

Printing Outlook 2023

The WhatTheyThink Overview of the Current State of the Printing Industry

The new Printing Outlook 2023 report provides detailed analysis of the latest WhatTheyThink Business Outlook Survey, the latest industry economic data and macroeconomic trends, as well as industry and cultural technological trends to look out for in 2023 and beyond.

Data Analysis

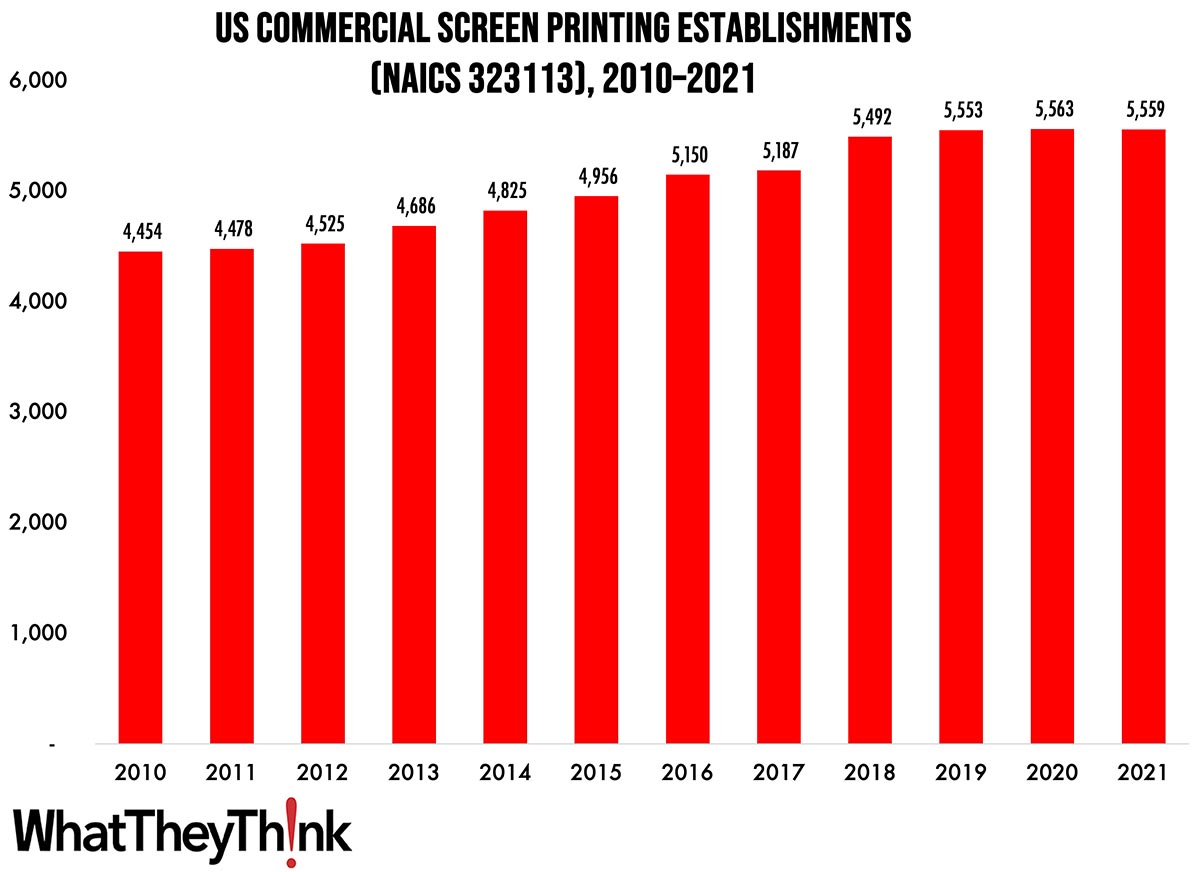

Screen Printing Establishments—2010–2020

According to the latest, recently released edition of County Business Patterns, in 2021 there were 5,559 establishments in NAICS 323113 (Commercial Screen Printing). This represents an increase of 25% since 2010—but a decrease of -0.1% from 2020. In macro news, the third estimate of Q2 GDP is unchanged, but with some subtle changes “under the hood.” Full Analysis

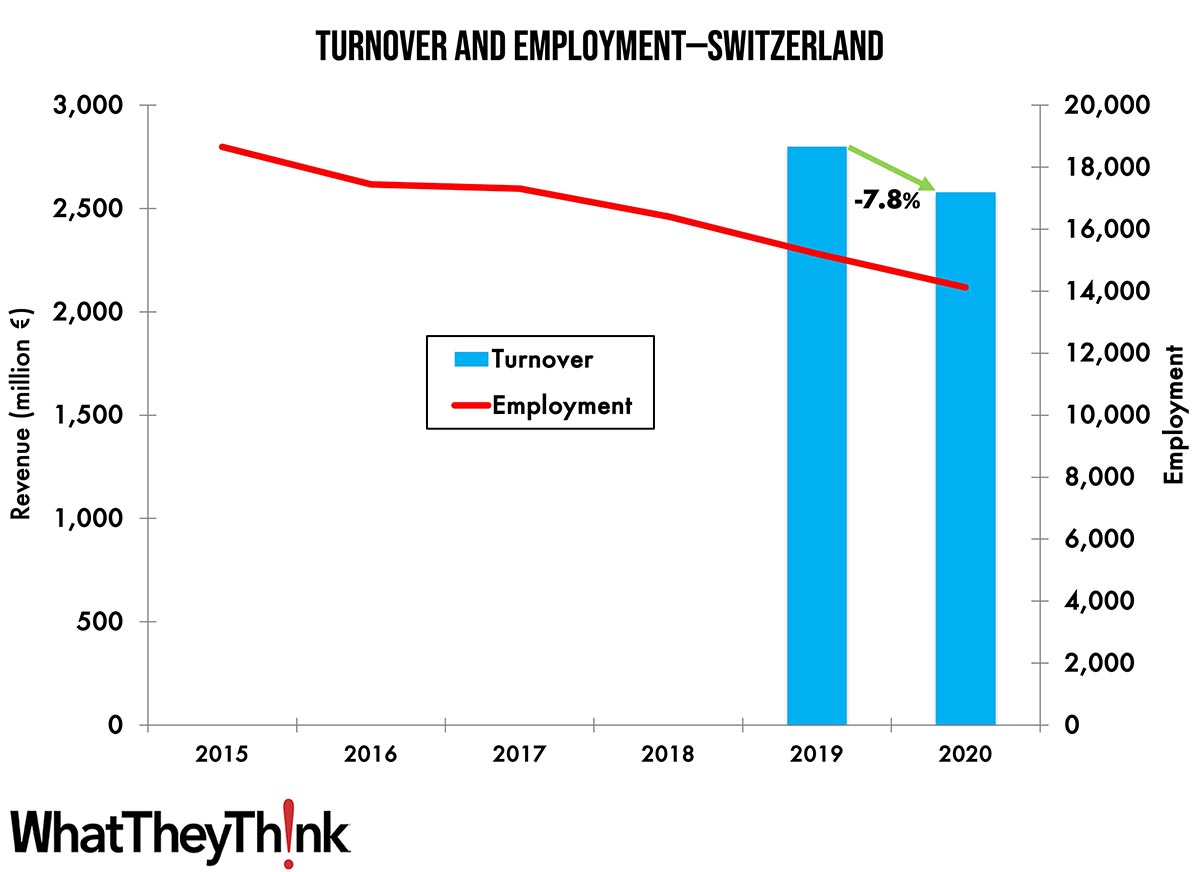

Turnover and Employment in Print in Europe—Switzerland

This bi-weekly series of short articles aims to shed a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Switzerland, the eighth-largest printing industry by turnover in Europe. Full Analysis

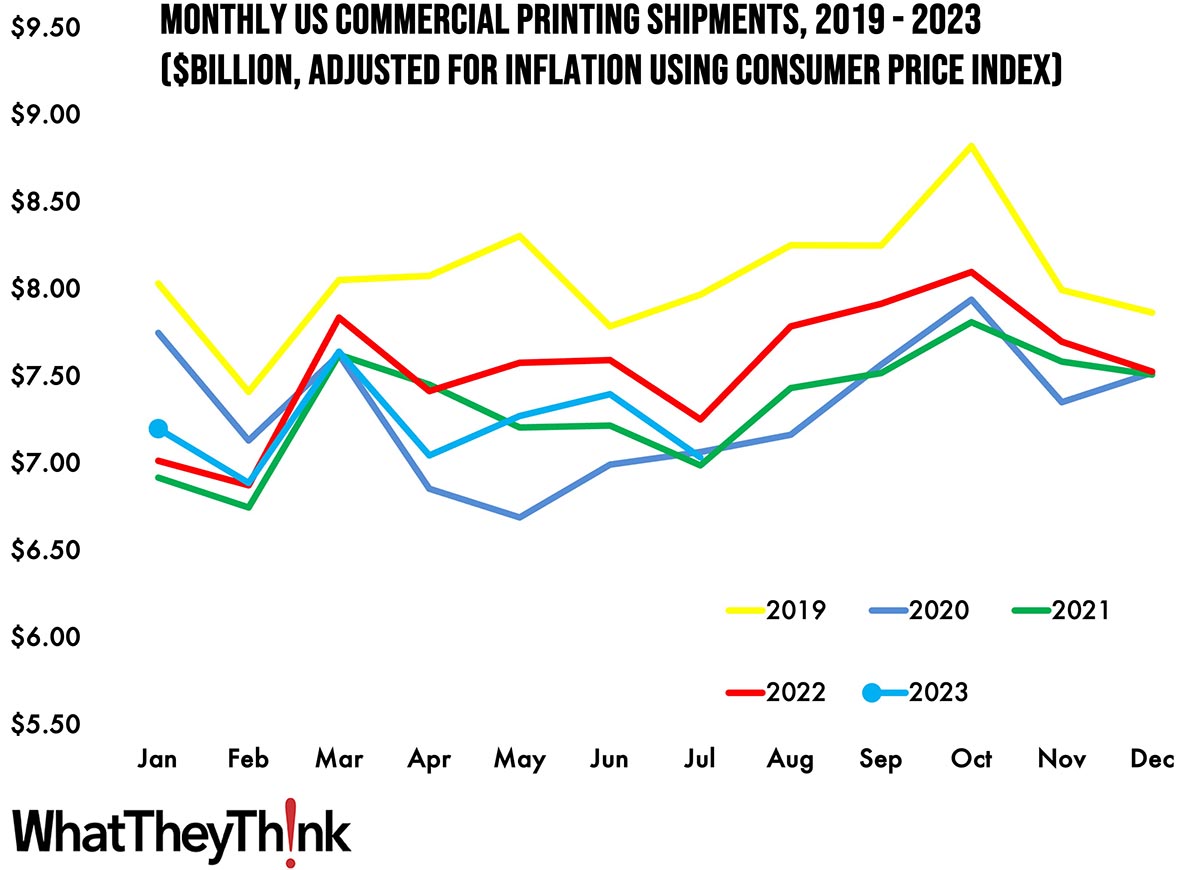

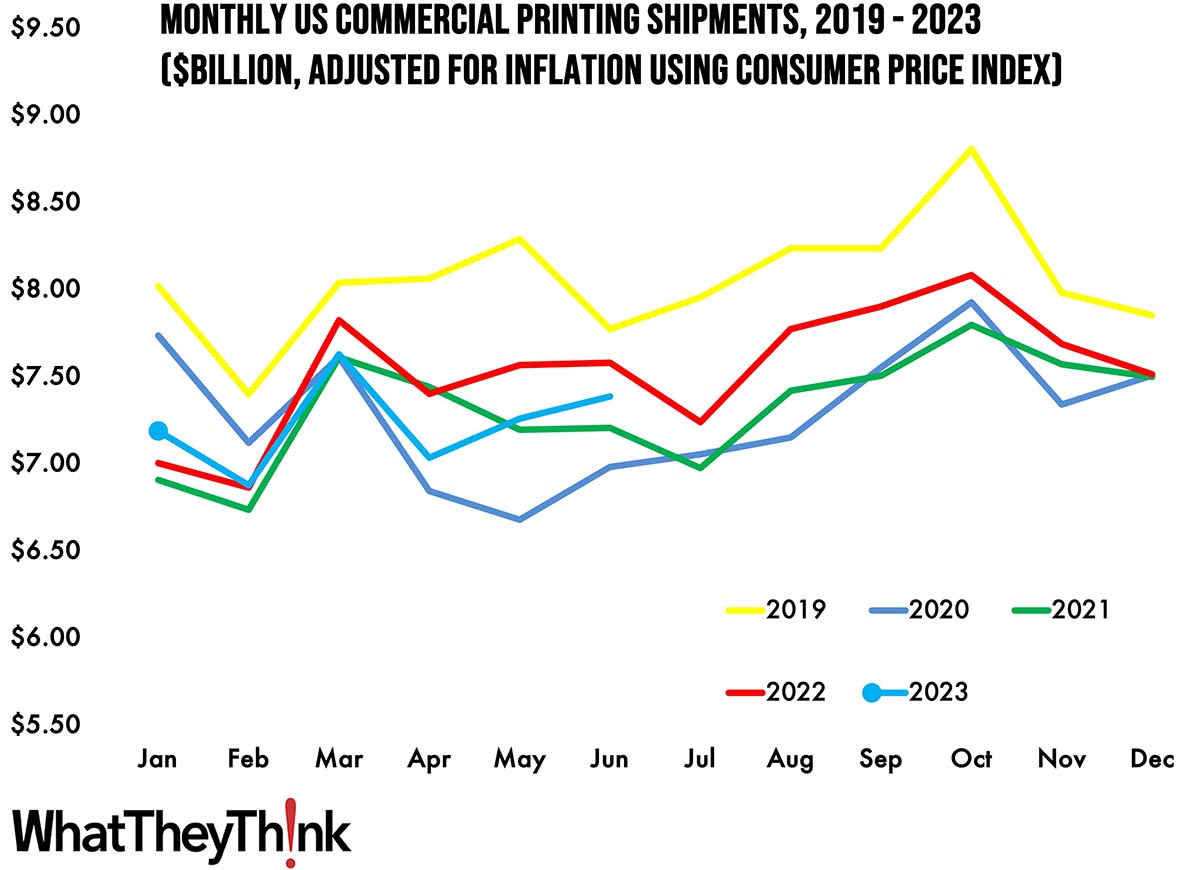

July Shipments: Down, Down We Go

In a year that continues to surprise, July 2023 printing shipments came in at $7.04 billion, down from June’s $7.40 billion. Full Analysis

Commercial Printing Establishments—2010–2021

According to the latest, recently released edition of County Business Patterns, in 2021 there were 15,592 establishments in NAICS 323111 (Commercial Printing except Screen and Books). This represents a decline of 26% since 2010. In macro news, inflation is alas up. Full Analysis

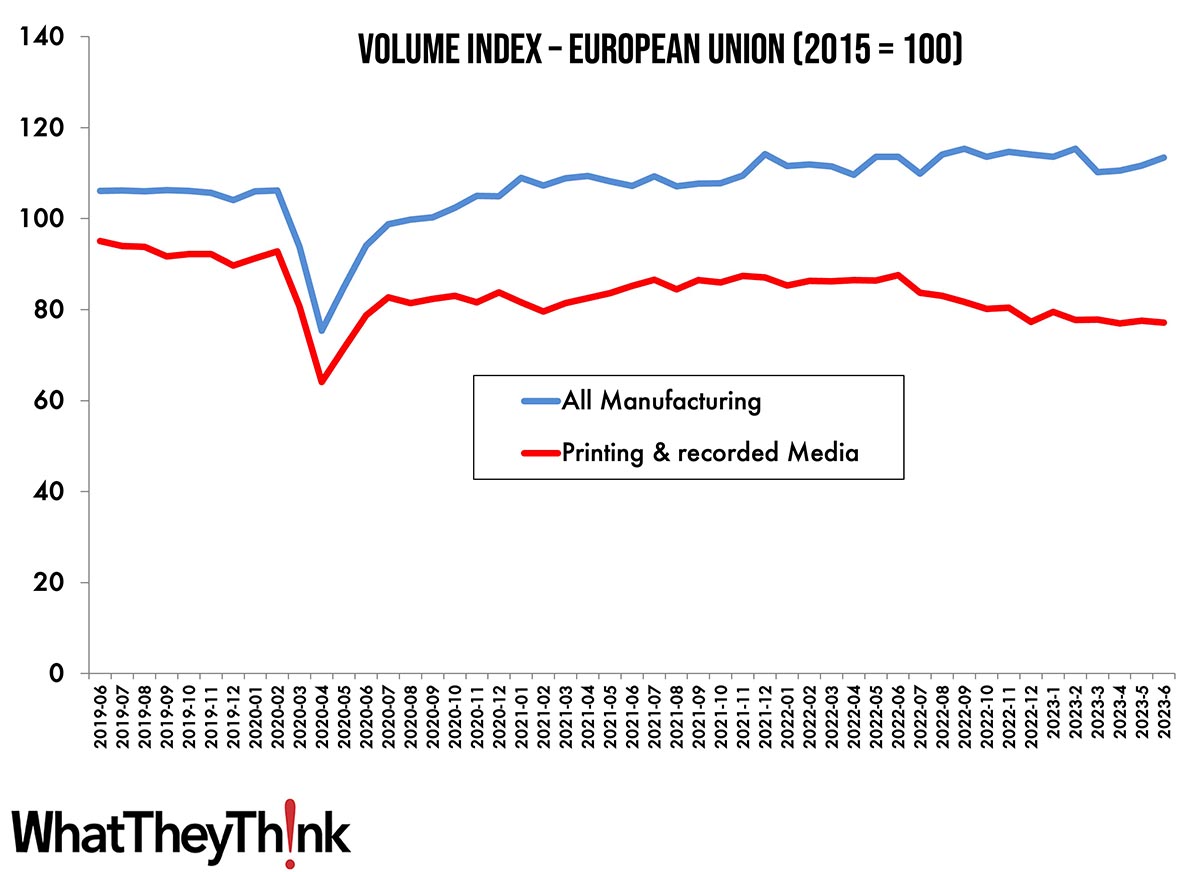

European Print Volume Trends

European section editor Ralf Schlözer takes a break from the Europen country-by-country look at turnover and employment to provide a bigger-picture look at print volumes in Europe pre- and post-pandemic. Full Analysis

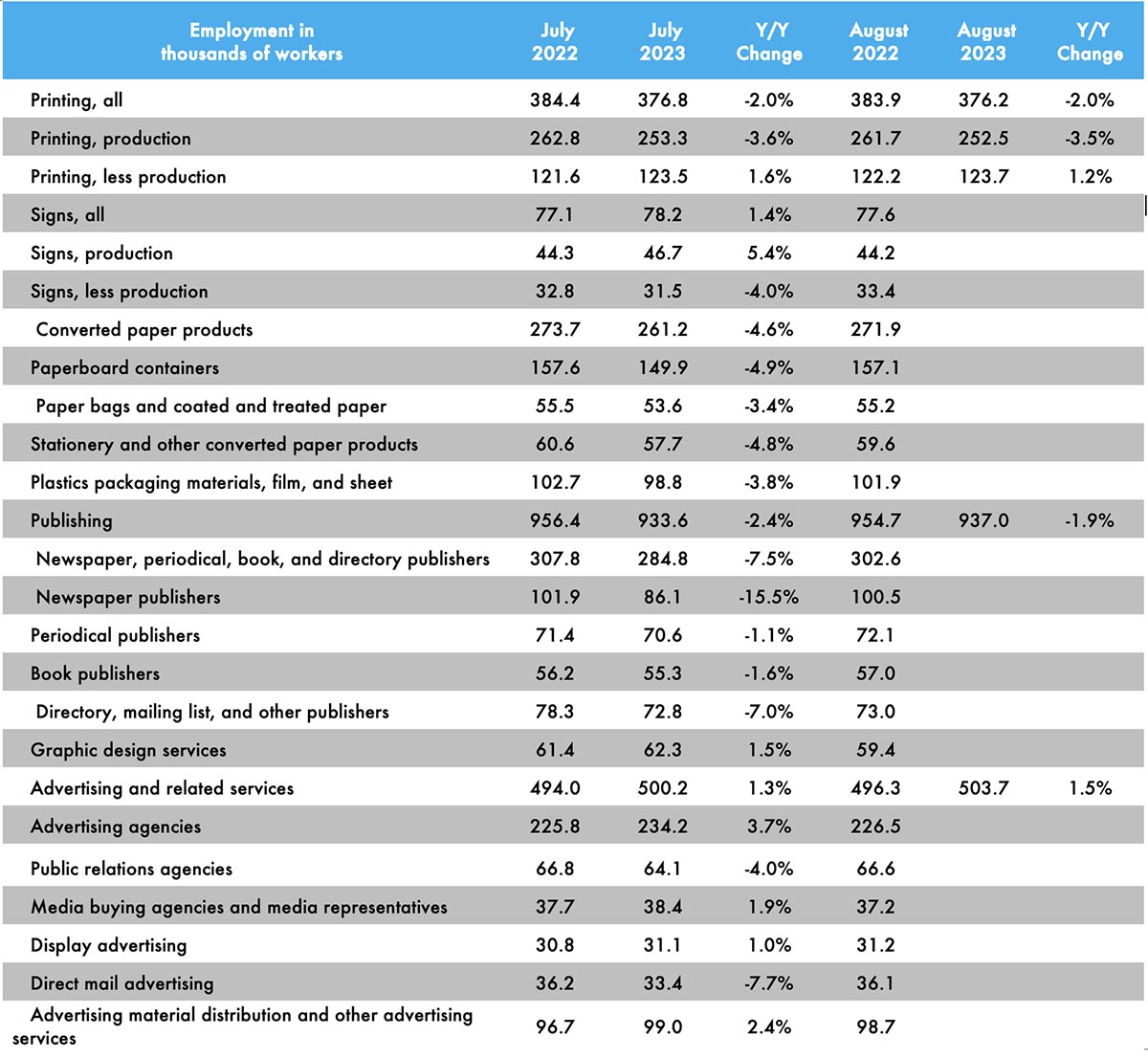

August Printing Production Employment Basically Flat

Overall printing employment in August 2023 was down 0.2% from July. Production employment was down 0.3% while non-production employment was up 0.2%. Full Analysis

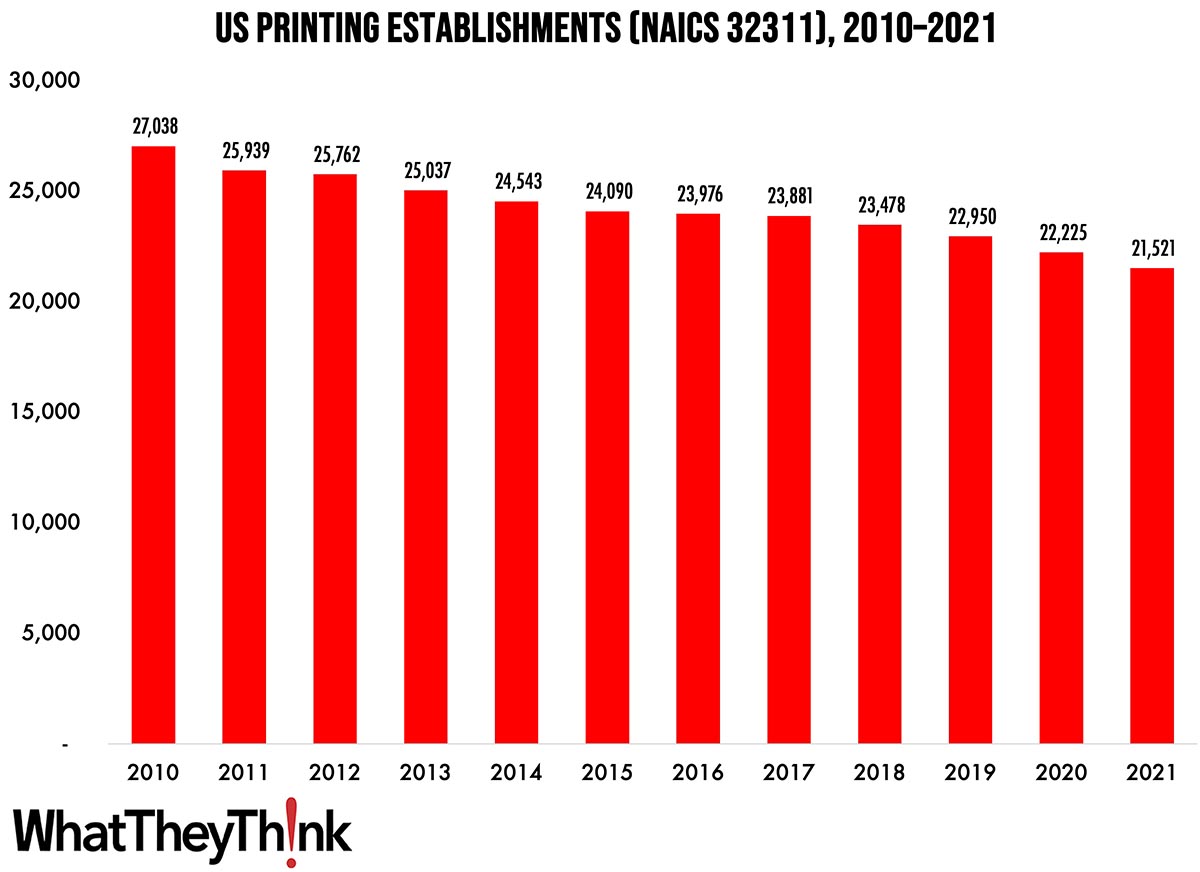

Printing Establishments—2010–2021

According to the latest, just-released edition of County Business Patterns, in 2021 there were 21,521 establishments in NAICS 32311 (Printing). This represents a decline of 20% since 2010. In macro news, Q2 GDP revised downward. Full Analysis

June Shipments: Up, Up, and Away

In a year that continues to surprise, June 2023 printing shipments came in at $7.38 billion, up from May’s $7.26 billion. Full Analysis

Turnover and Employment in Print in Europe—Portugal

This bi-weekly series of articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic impacted businesses. This time we look at Portugal, the 15th-largest printing industry by turnover in Europe. Full Analysis

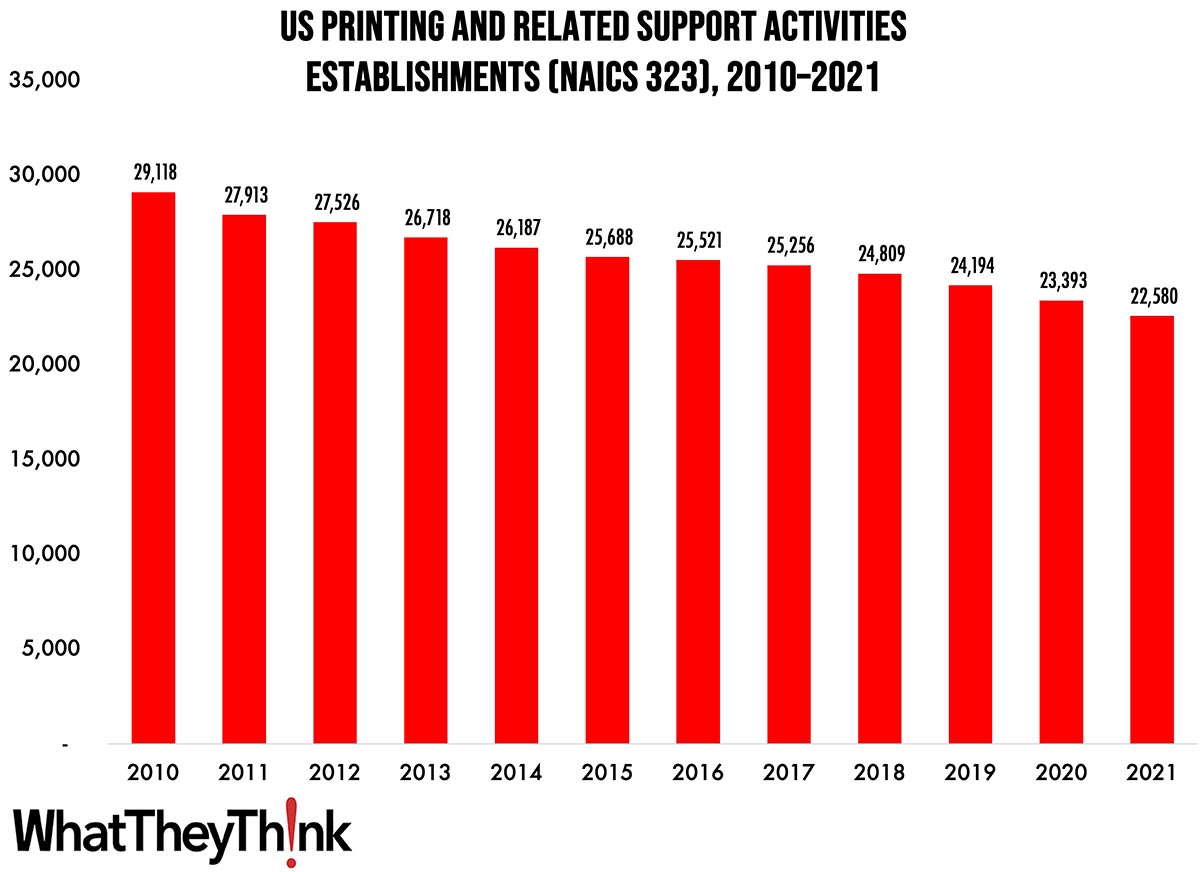

Printing Establishments—2010–2021

According to the latest, just-released edition of County Business Patterns, in 2021 there were 22,580 establishments in NAICS 323 (Printing and Related Support Activities). This represents a decline of 22% since 2010. In macro news, July retail sales came in above expectations. Full Analysis

- Innovations in Inkjet for Textile Production – live webinar

- Buying Inkjet Part 1: Does This Printer Make Me Look Good?

- LabelExpo 2023: Launches and Trends – Part 2

- Driving profitability with cut-sheet inkjet

- Zero Trust Environments for Inkjet Printing

- Kevin Roman on the evolution of professional services needs

- LabelExpo 2023: Launches and Trends – Part 1

- Inkjet Gets into “Hard Core” Applications

© 2023 WhatTheyThink. All Rights Reserved.