Data Analysis

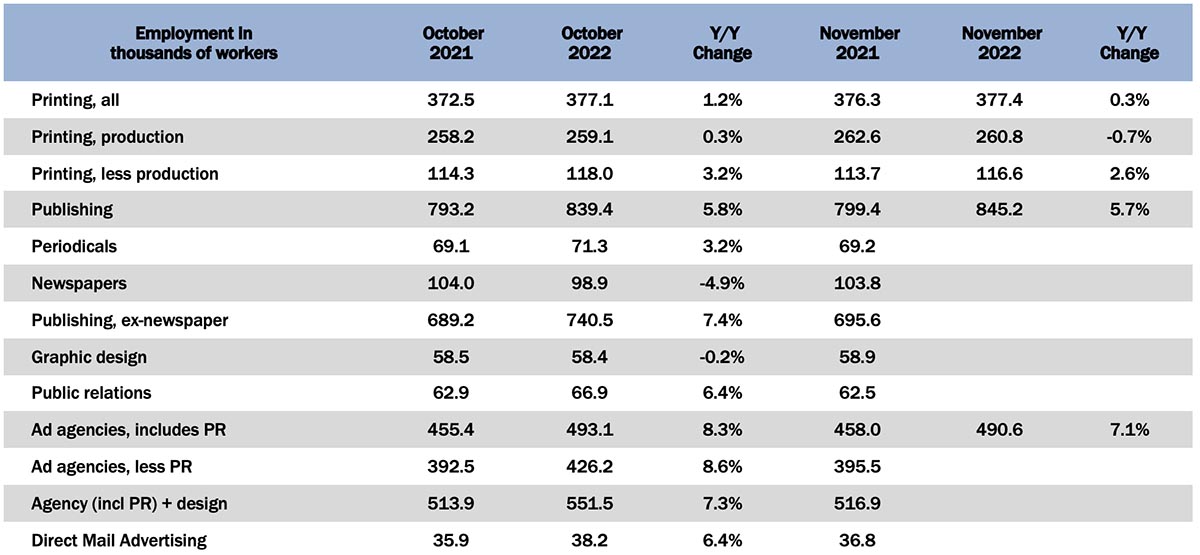

Graphic Arts Employment Essentially Flat in November

Published: January 6, 2023

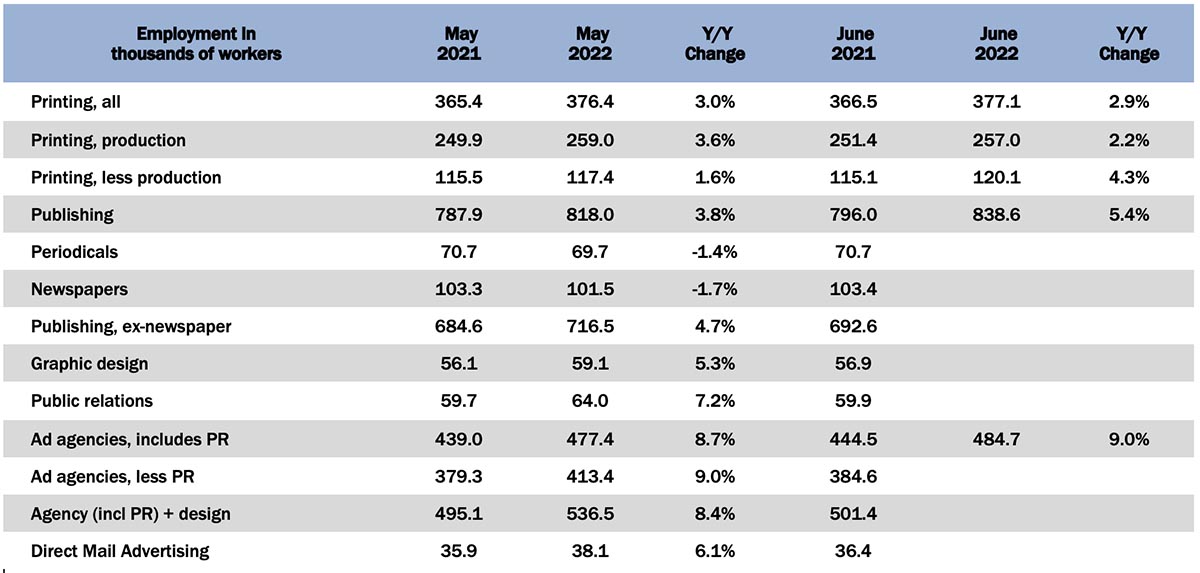

In November 2022, all printing employment was up +0.1% from October. Production employment was up +0.7% and non-production employment was down -1.2%. Full Analysis

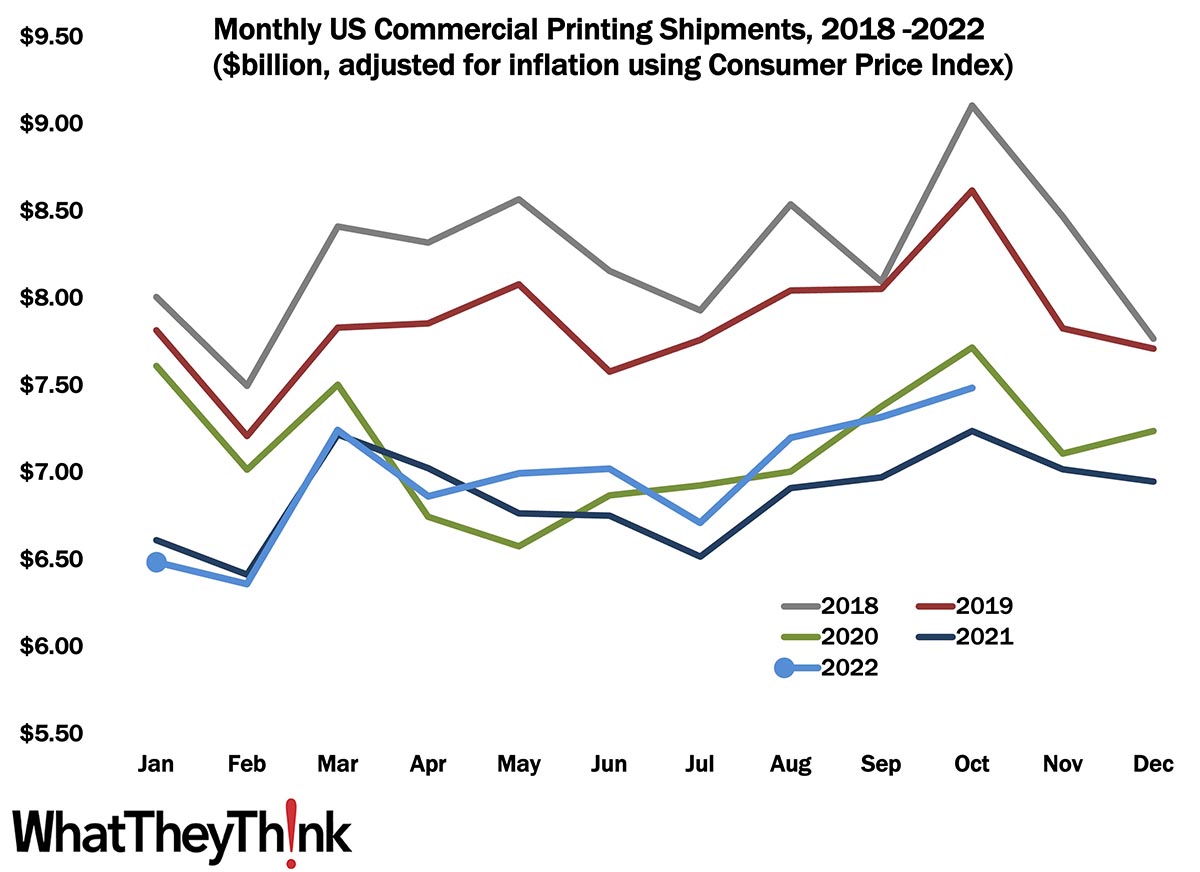

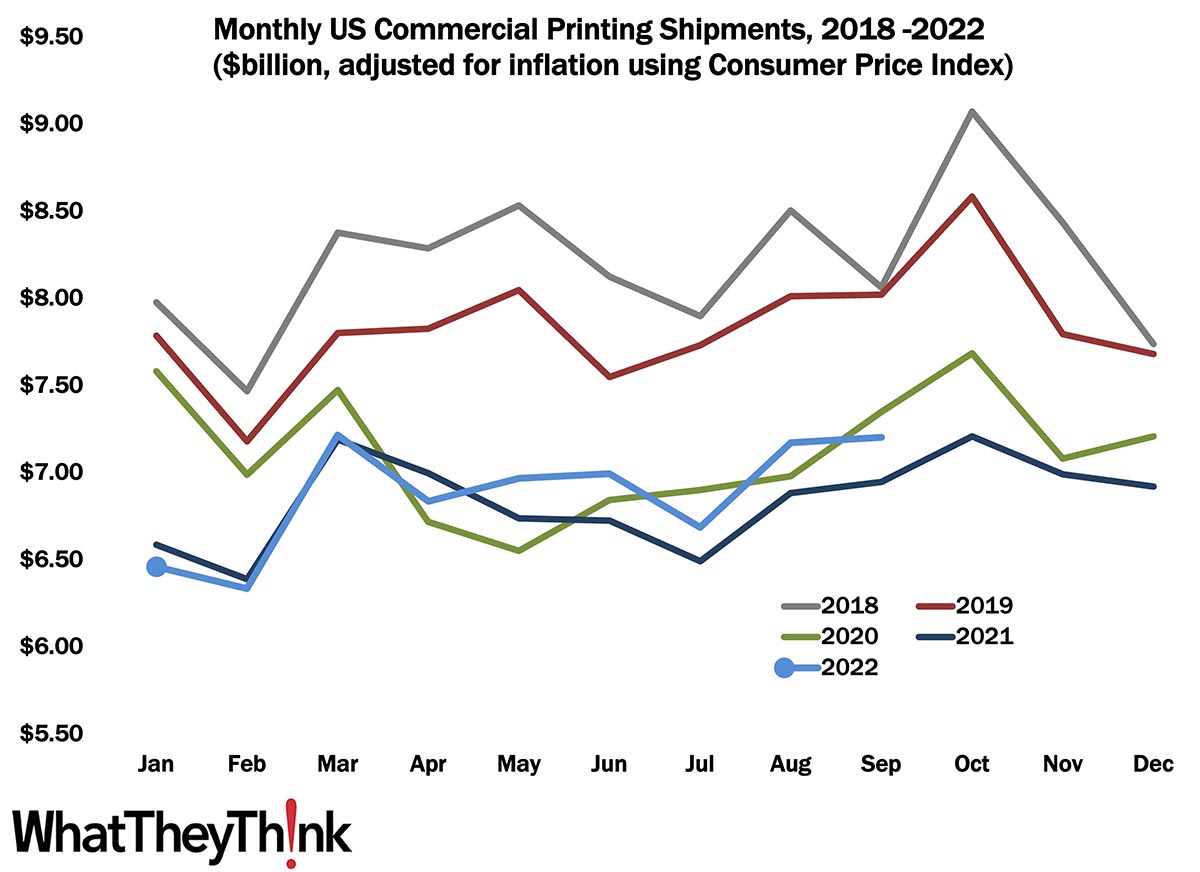

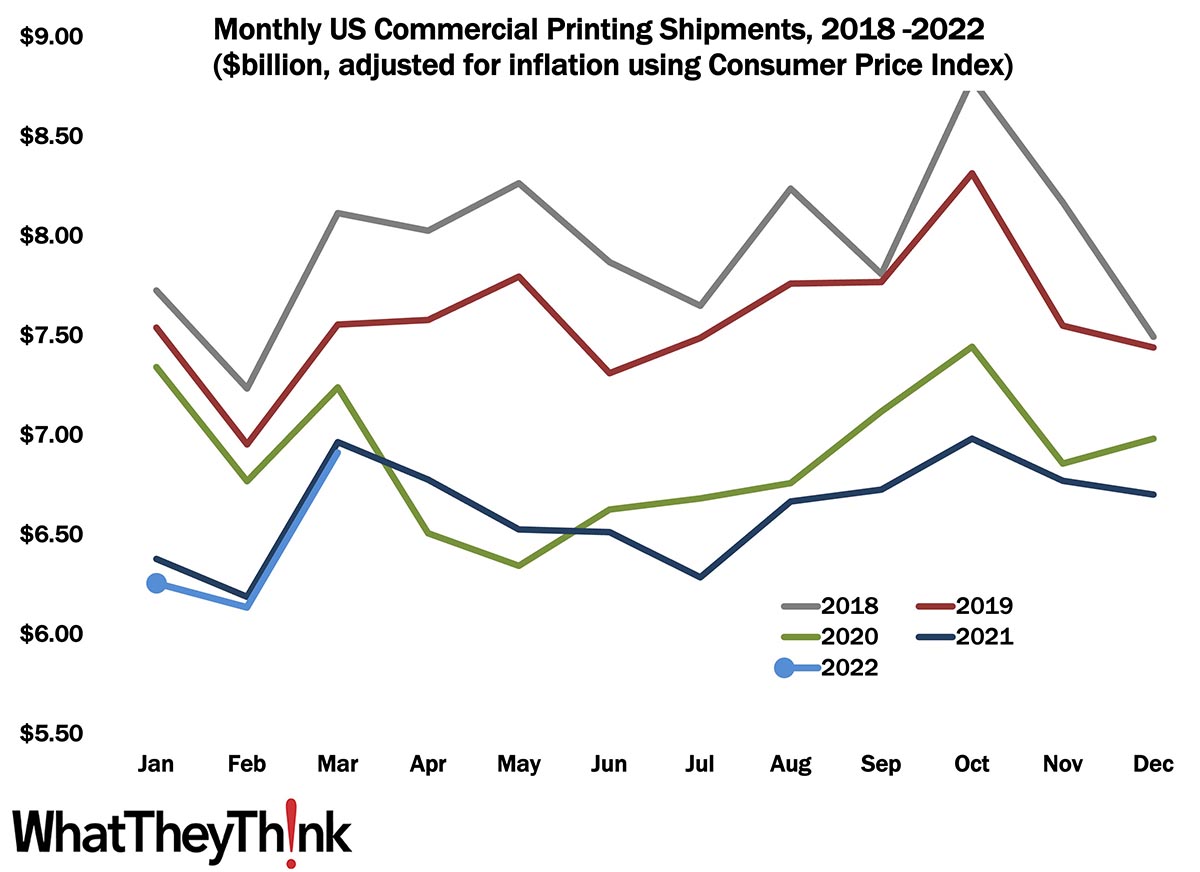

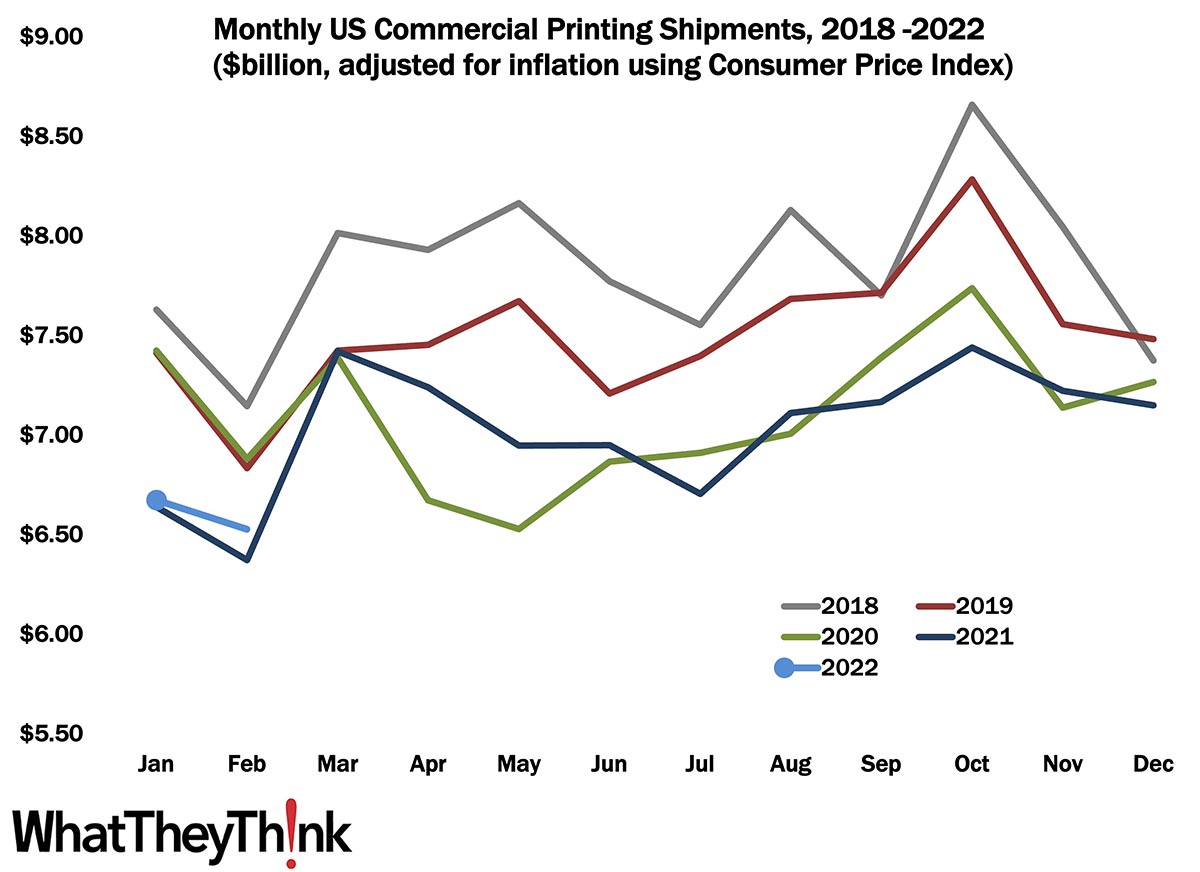

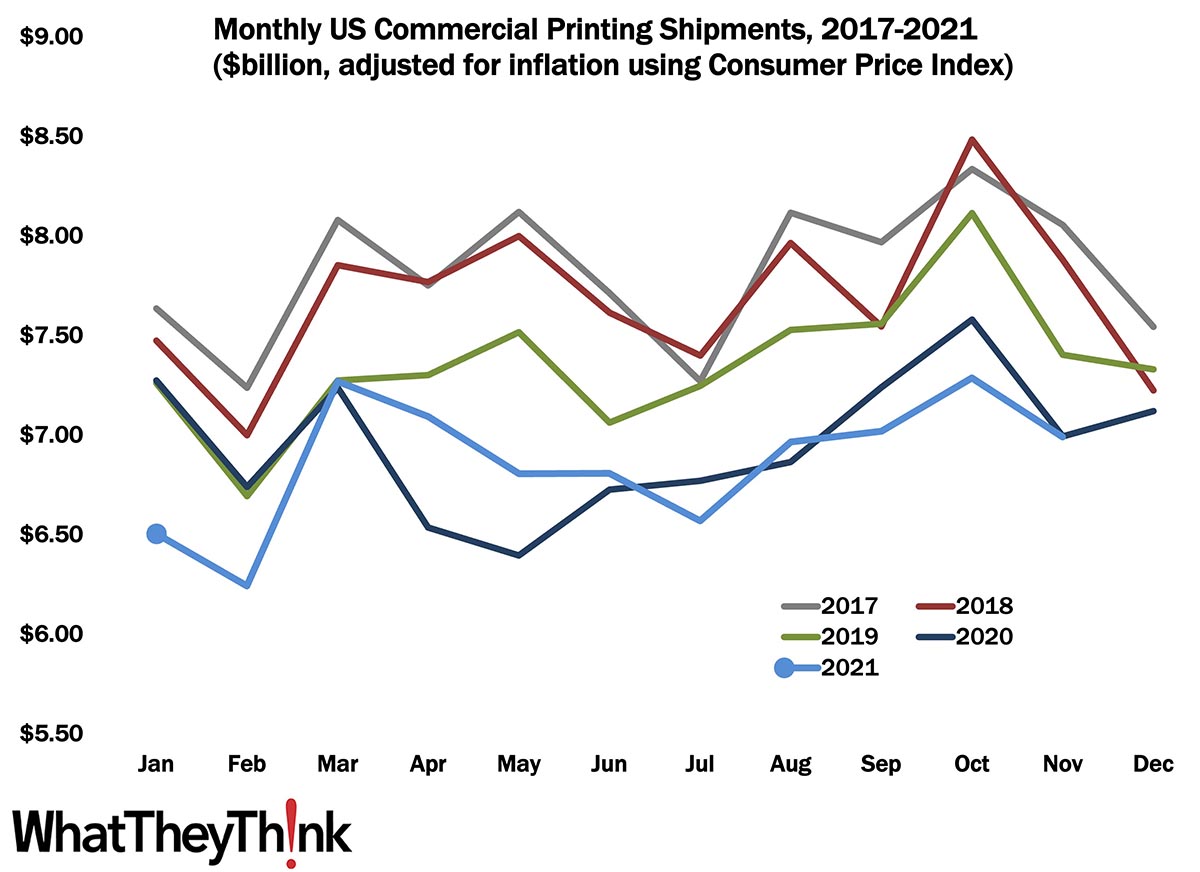

Have a Little Holiday Cheer/October Shipments the Highest All Year

Published: December 16, 2022

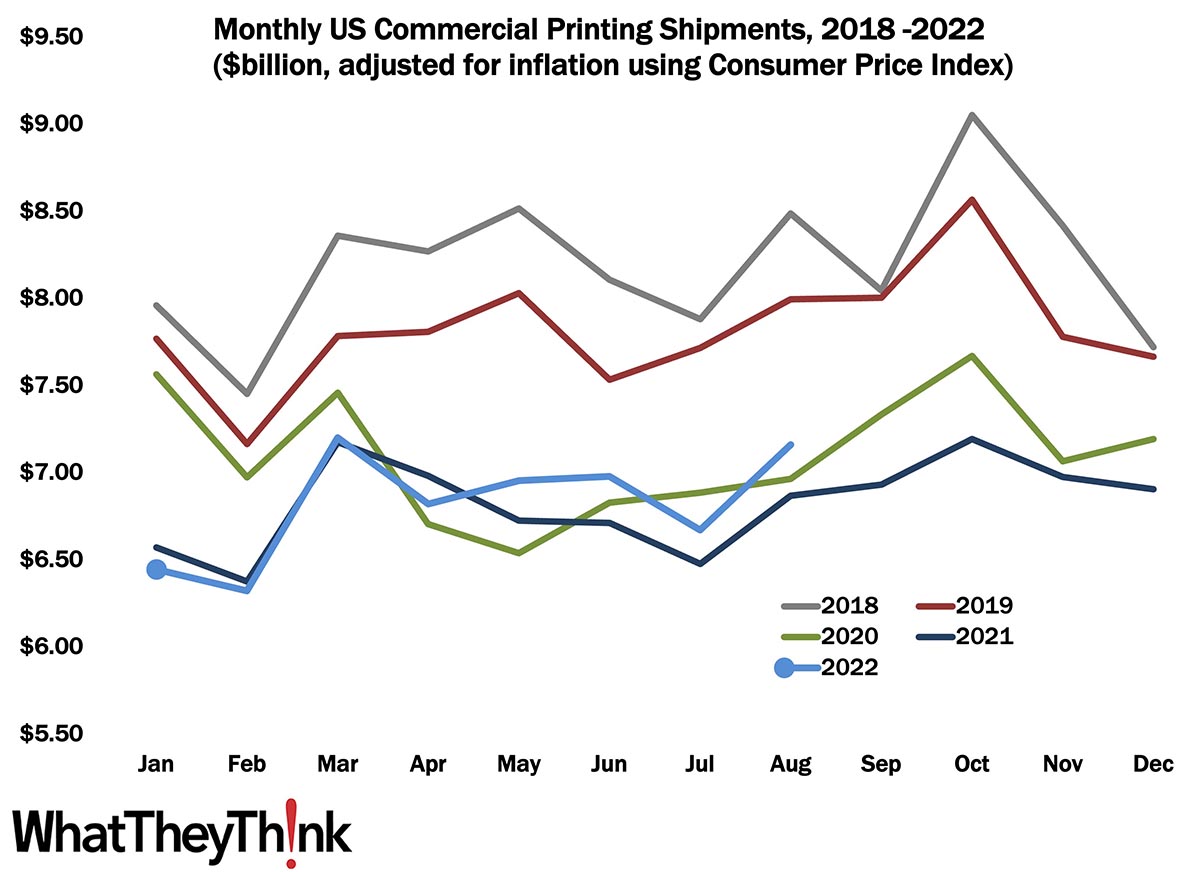

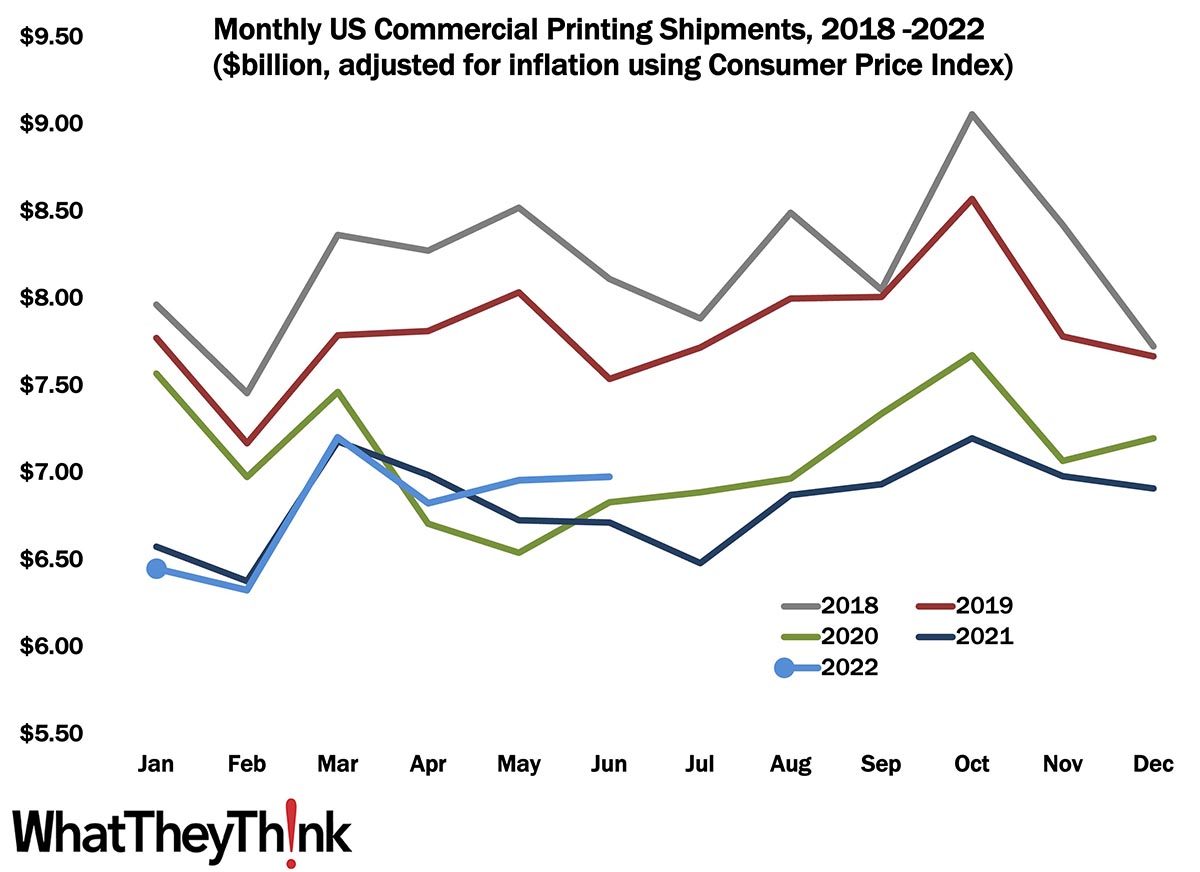

October 2022 shipments came in at $7.48 billion, up from September’s $7.32 billion—the best month of the year for the industry. Full Analysis

Directory and Mailing List Publishing Establishments—2010–2020

Published: December 9, 2022

According to the latest edition of County Business Patterns, in 2020 there were 594 establishments in NAICS 51114 (Directory and Mailing List Publishers). This represents a decrease of 64% since 2010. In macro news, estimates for Q4 GDP are in the +1.4%–3.4% range. Full Analysis

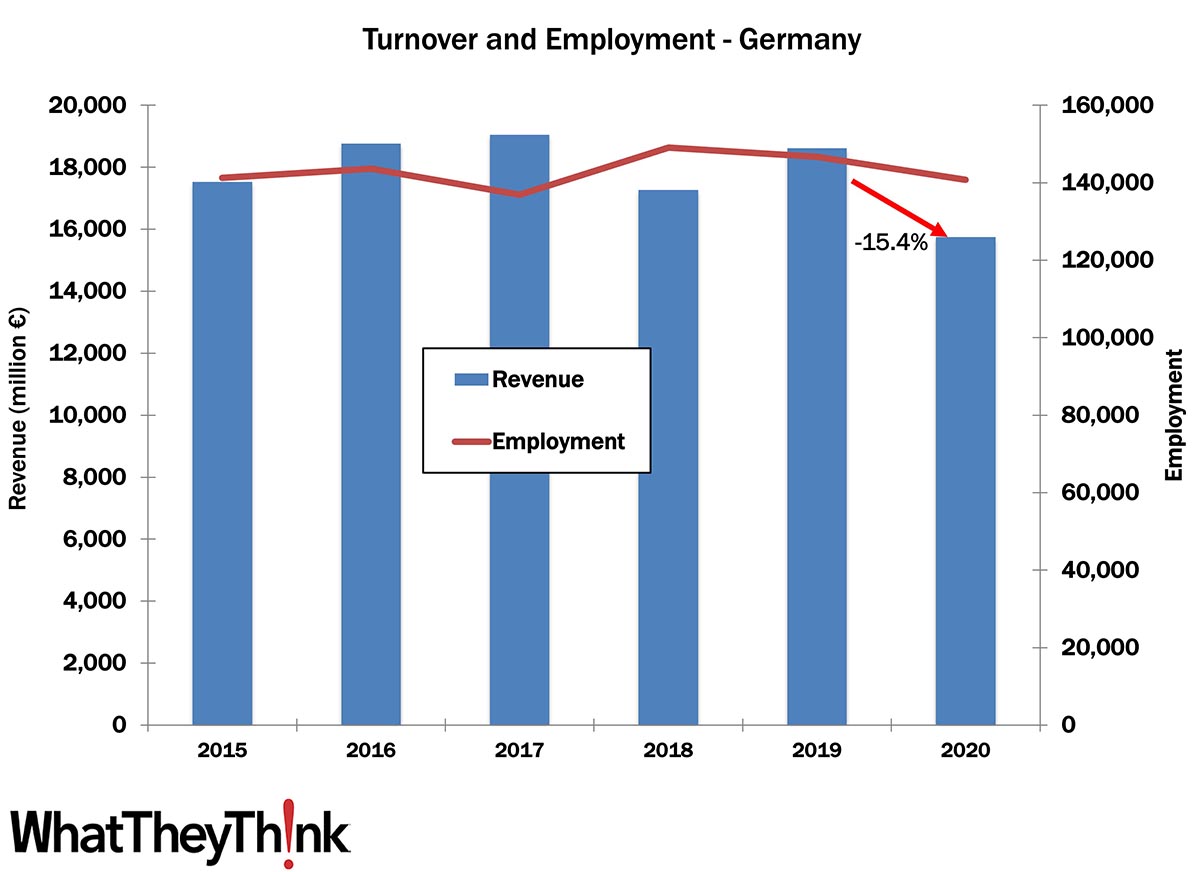

Turnover and Employment in Print in Europe—Germany

Published: December 6, 2022

This bi-weekly series of short articles aims at shedding a spotlight on the size of the printing industry in Europe per country and how revenues and employment developed in 2020, when the pandemic hit the market. Kicking off the series is Germany, the largest printing industry by turnover in Europe. Full Analysis

September Printing Shipments—The High Before the Holidays

Published: December 2, 2022

September 2022 shipments came in at $7.20 billion, up a little from August’s $7.17 billion—reflecting a return to the industry’s regular seasonality. Could we be back to normal? Full Analysis

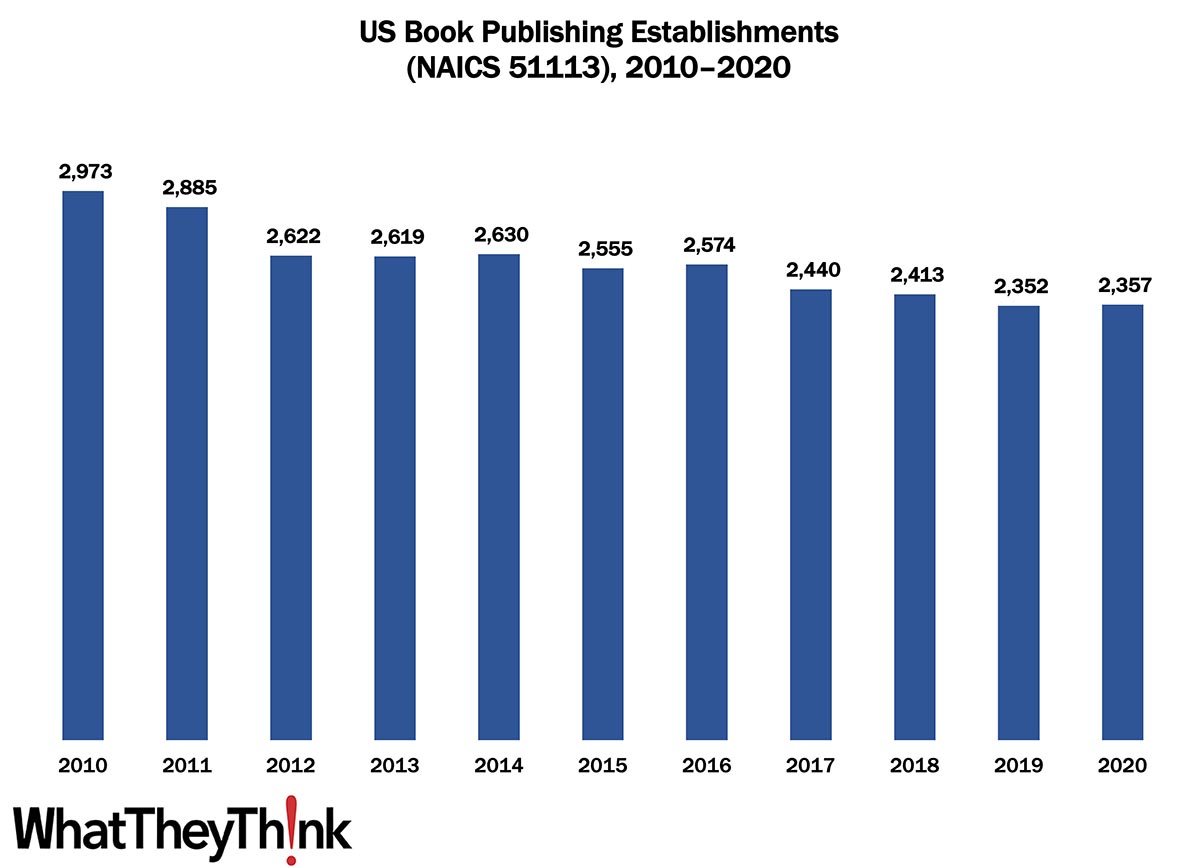

Book Publishing Establishments—2010–2020

Published: November 18, 2022

According to the latest edition of County Business Patterns, in 2020 there were 2,357 establishments in NAICS 51113 (Book Publishing). This represents a decrease of 21% since 2010. In macro news, October retail sales were up. Full Analysis

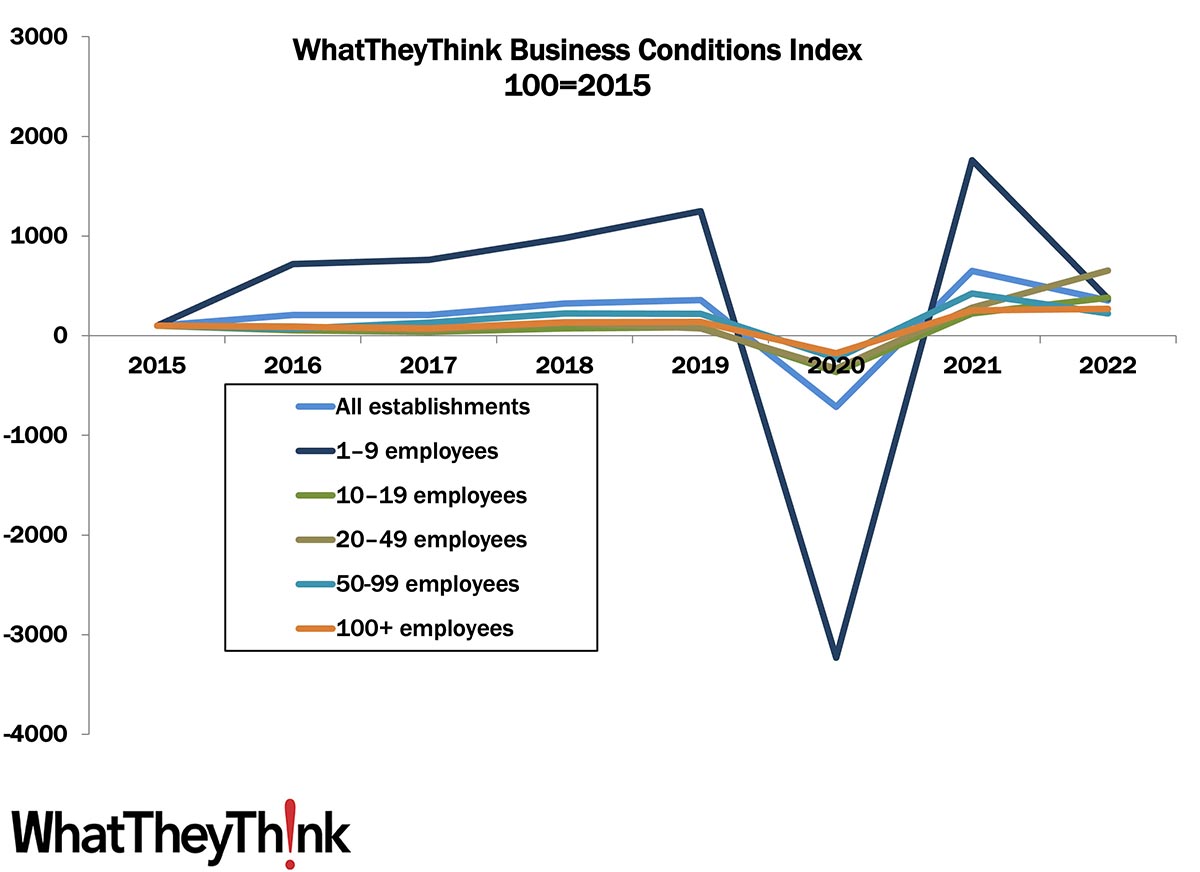

Printing Outlook 2023 Sneak Peek: Business Conditions Slipped in 2022

Published: November 11, 2022

Our preliminary Fall Print Business Survey results are in and our Business Conditions Index dropped slightly from 2021. Last year marked a rebound from the plummeting conditions in 2020, and 2022 likely represents a move toward stability. Full Analysis

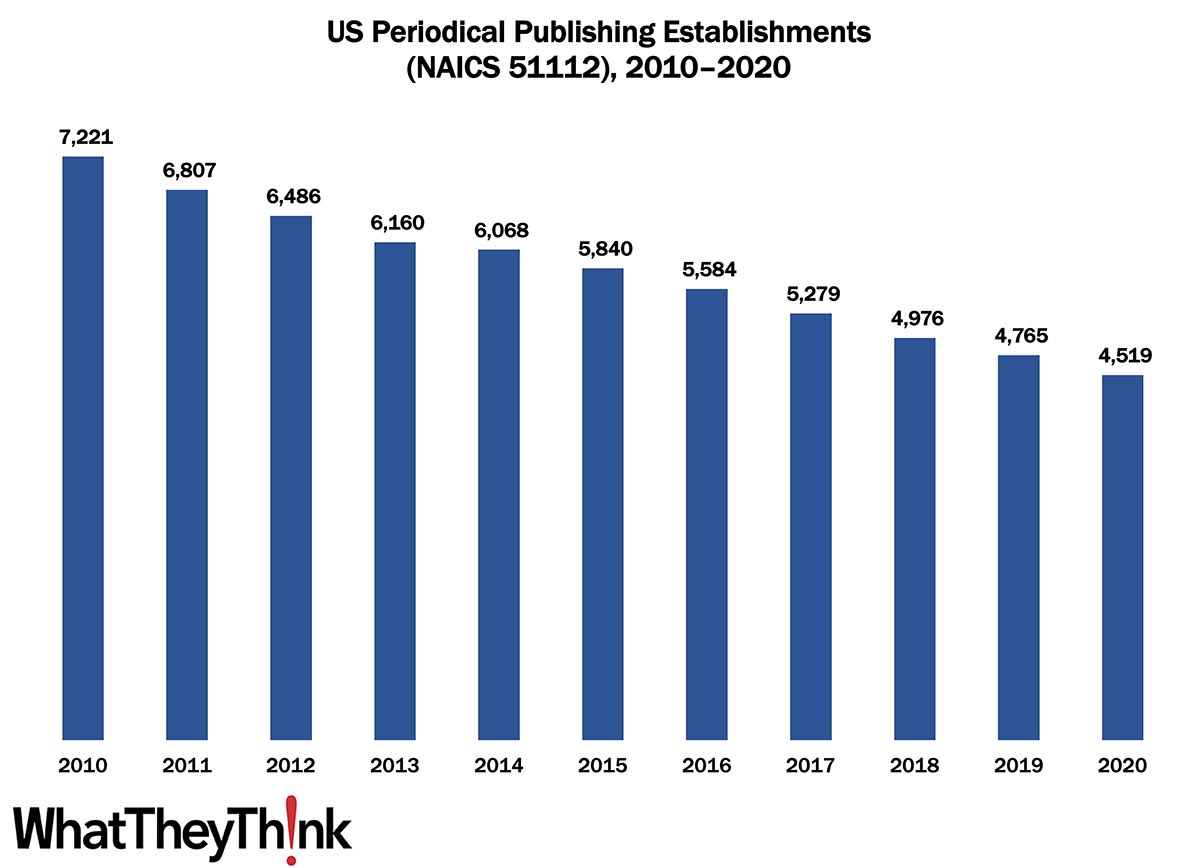

Periodical Publishing Establishments—2010–2020

Published: November 4, 2022

According to the latest edition of County Business Patterns, in 2020 there were 4,519 establishments in NAICS 51112 (Periodical Publishing). This represents a decrease of 37% since 2010. In macro news, actual Q3 GDP was strong. Full Analysis

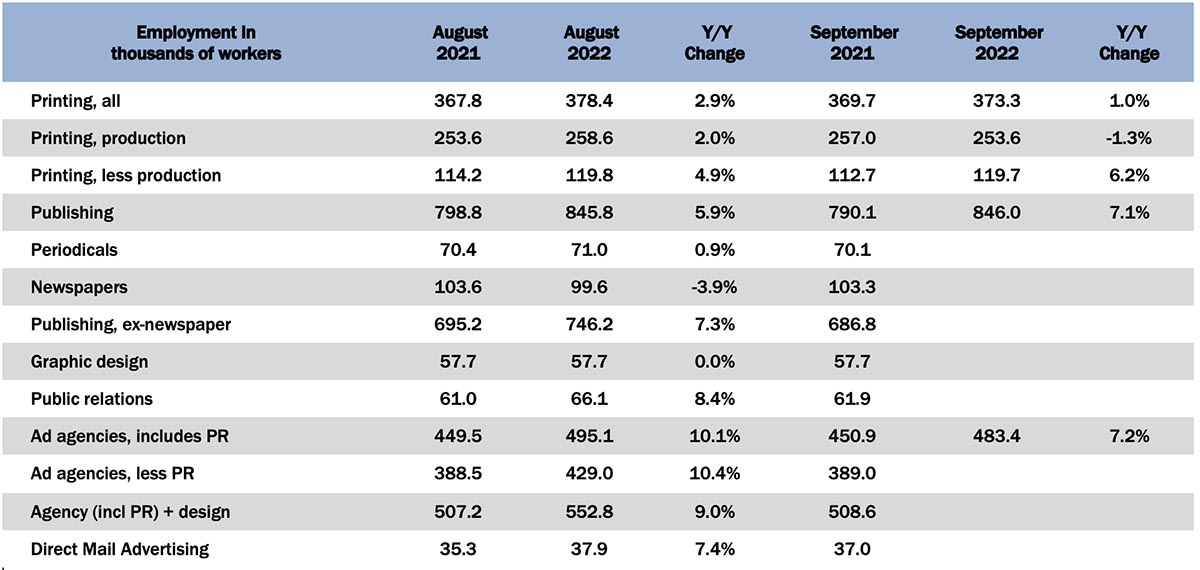

Graphic Arts Employment Down Slightly in September

Published: October 28, 2022

In September 2022, all printing employment was down -1.3% from August. Production employment was down -1.9% and non-production employment was down -0.1%. Full Analysis

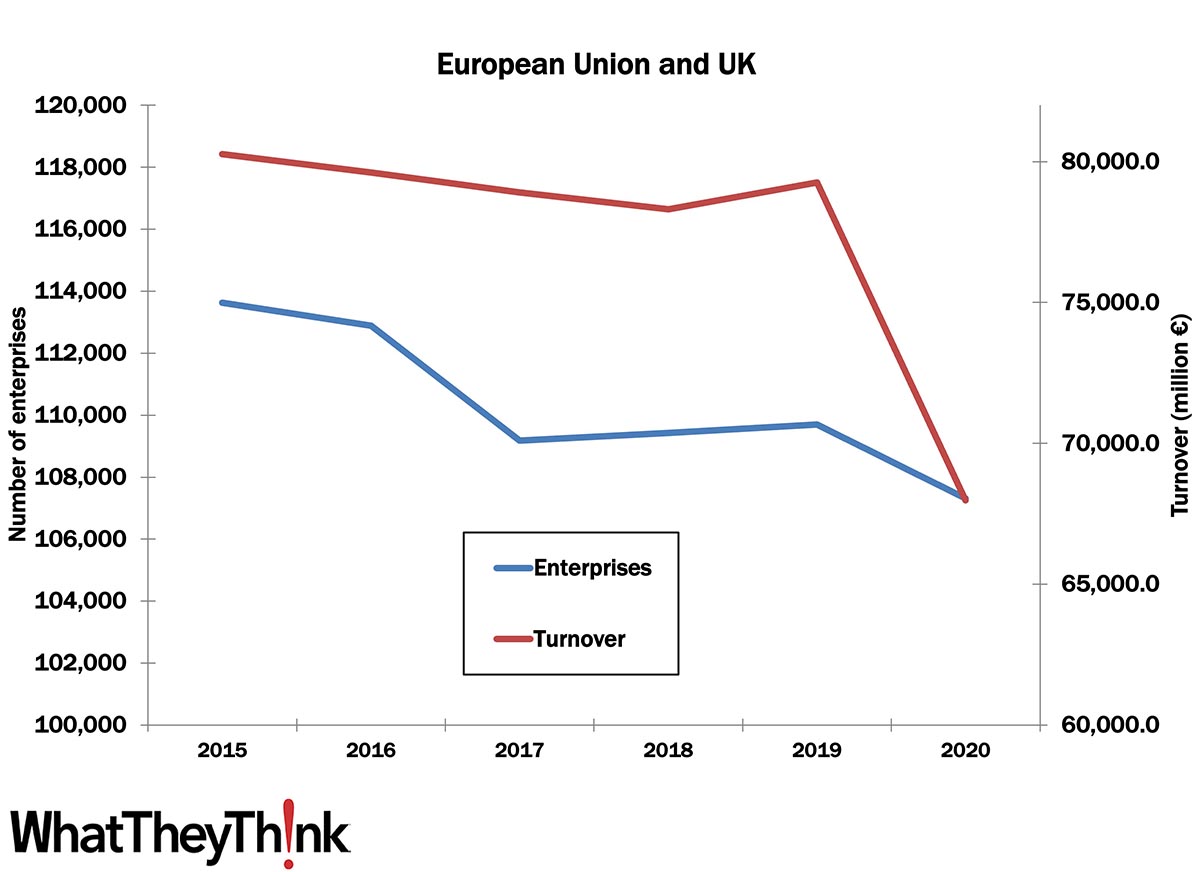

Sizing the European Printing Industry

Published: October 25, 2022

European section editor Ralf Schlözer rounds up the latest data on European and UK printing industry establishments, revenues, and production volumes. Full Analysis

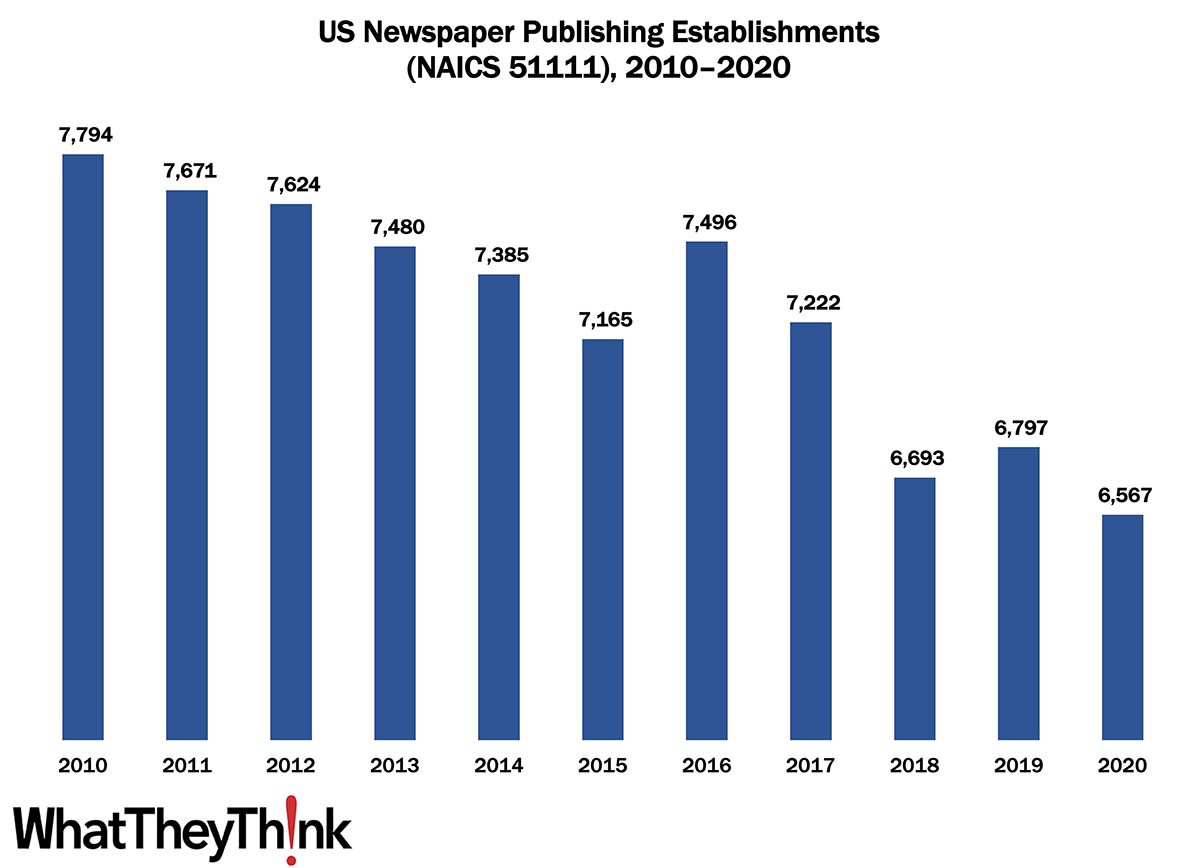

Newspaper Publishing Establishments—2010–2020

Published: October 21, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 6,567 establishments in NAICS 51111 (Newspaper Publishing). This represents a decrease of 16% since 2010. In macro news, early estimates of Q3 GDP getting more bullish. Full Analysis

August August Printing Shipments

Published: October 14, 2022

August 2022 shipments came in at $7.16 billion, up quite a bit from July’s $6.67 billion—august business conditions indeed, and reflecting a return to the industry’s regular seasonality. Full Analysis

Publishing Establishments—2010–2020

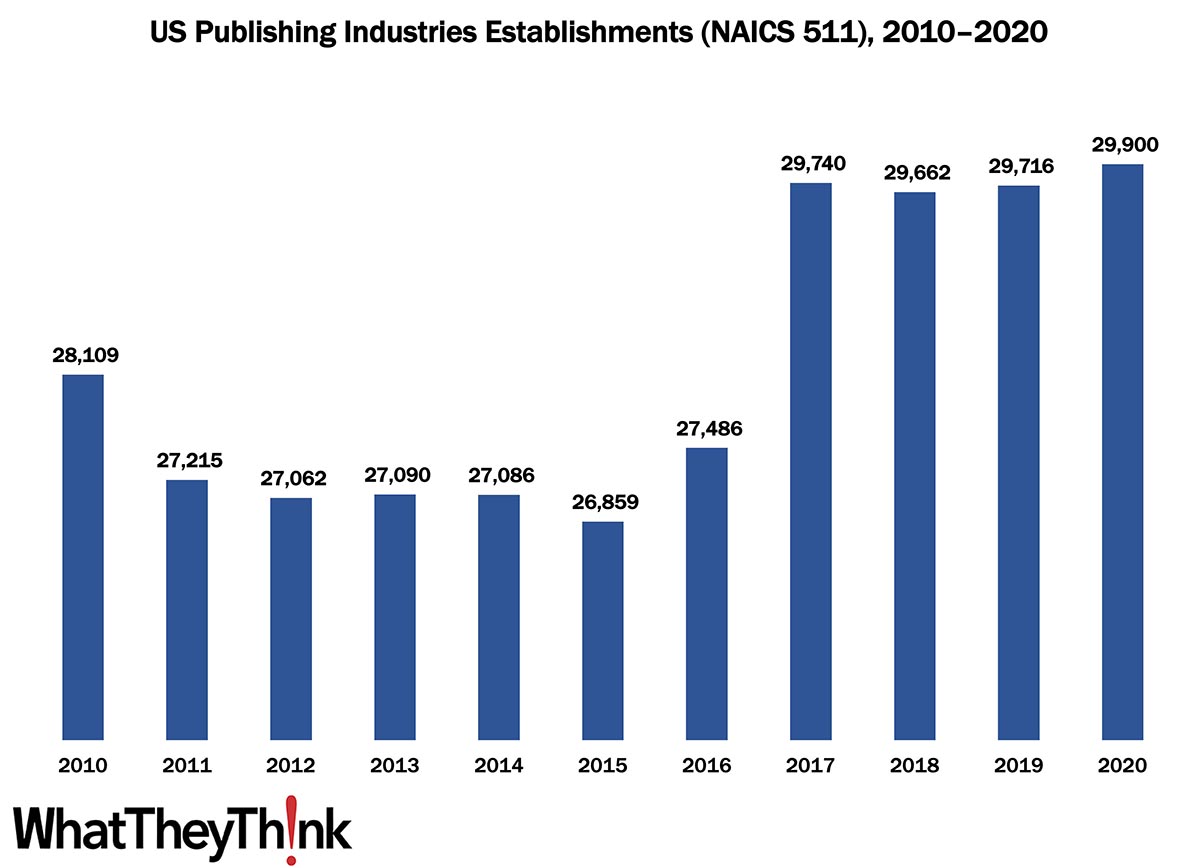

Published: October 7, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 29,900 establishments in NAICS 511 (Publishing Industries [except Internet]). This represents an increase of 6% since 2010 and increase of 9% since 2016. In macro news, job openings were down 1.1 million in August while hires and separations (quits, dismissals, and layoffs) were generally unchanged. Full Analysis

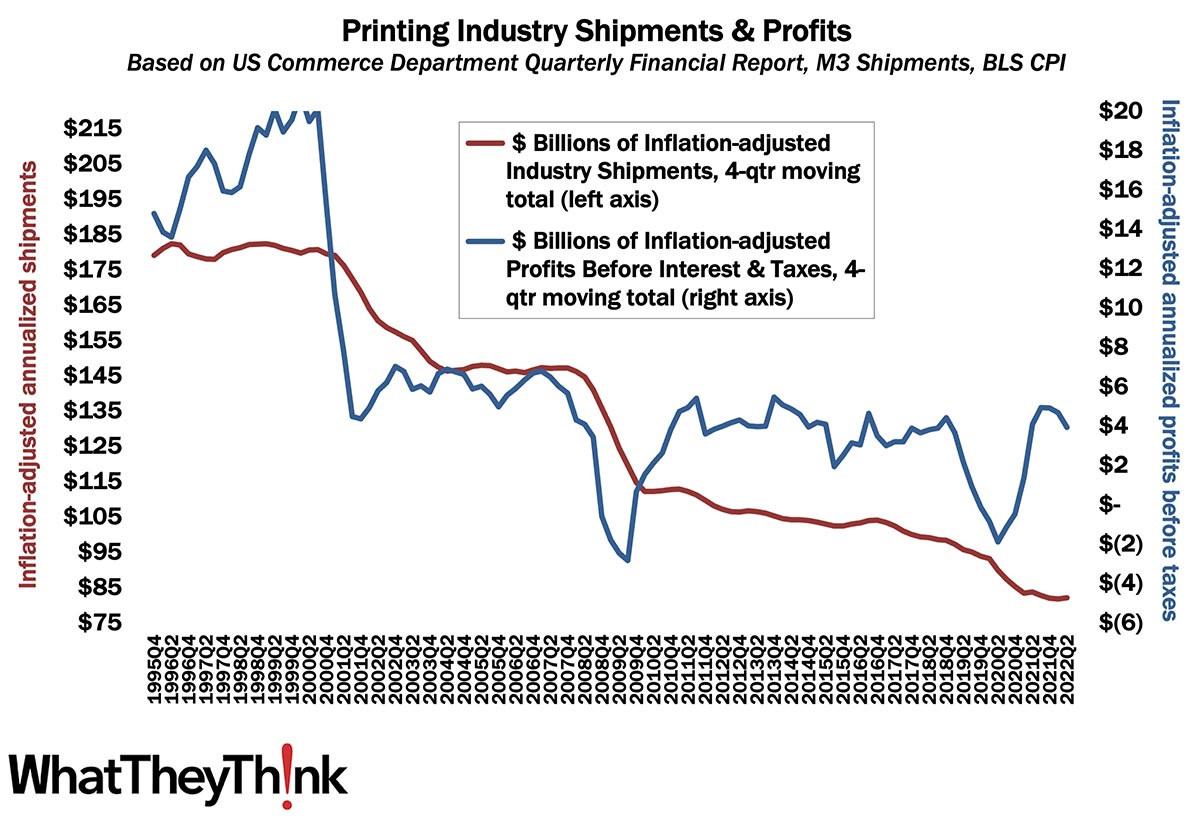

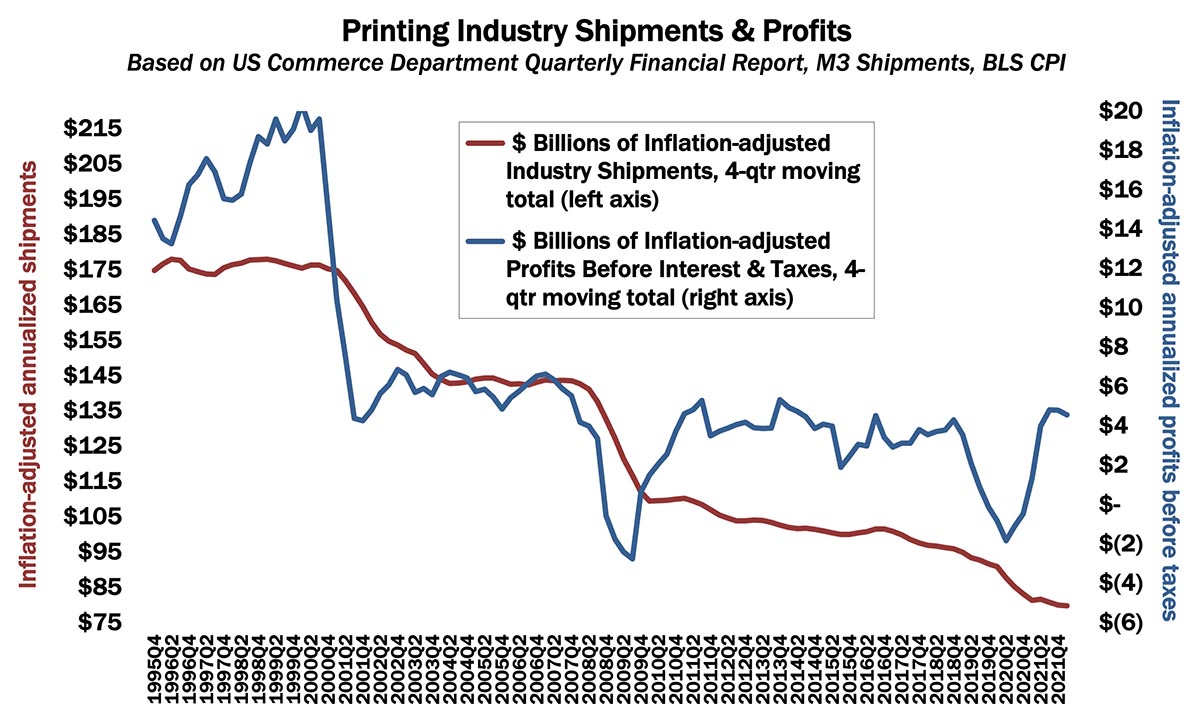

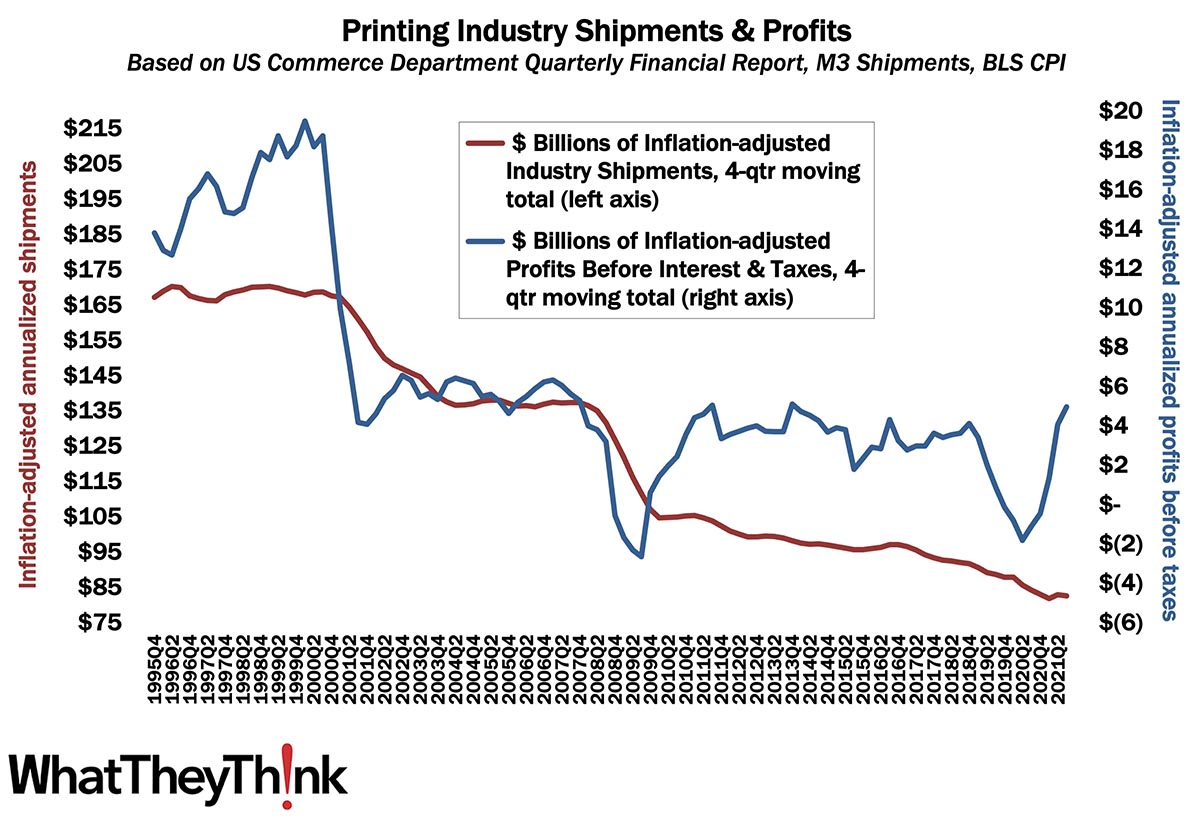

Q2 Printing Profits: An End to the Tale of Two Cities?

Published: September 30, 2022

Printing industry profits plunged during the pandemic peak but rebounded strongly afterward. But after hitting a peak in Q3 of last year, we’re on a downward trend, with annualized profits for Q2 2022 coming in at $3.92 billion, down a tad from $4.68 billion in Q1 2022. Full Analysis

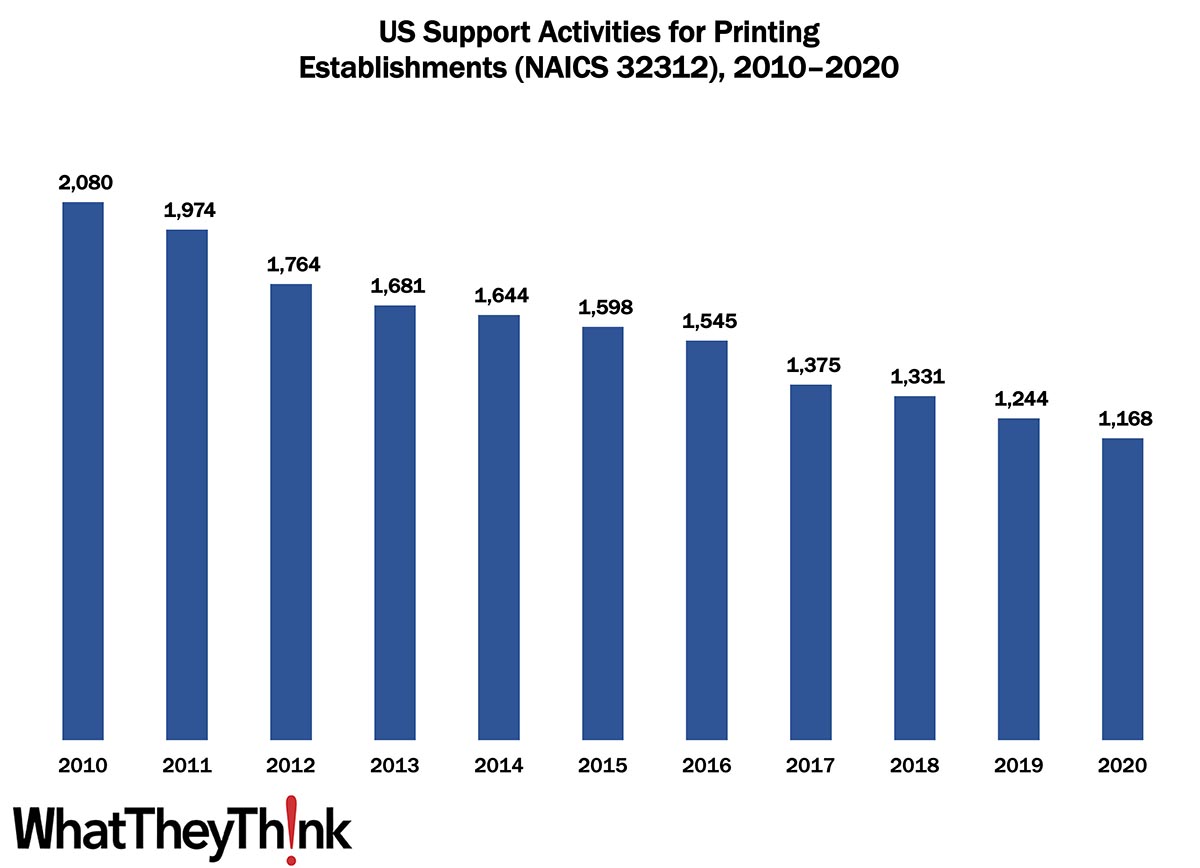

Pre- and Postpress Establishments—2010–2020

Published: September 23, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 1,168 establishments in NAICS 32312 (Support Activities for Printing). This represents a decrease of 44% since 2010. In macro news, AIA’s Architecture Billings Index (ABI) indicates that demand for design services accelerated in August, boding well for commercial real estate construction and thus signage projects. Full Analysis

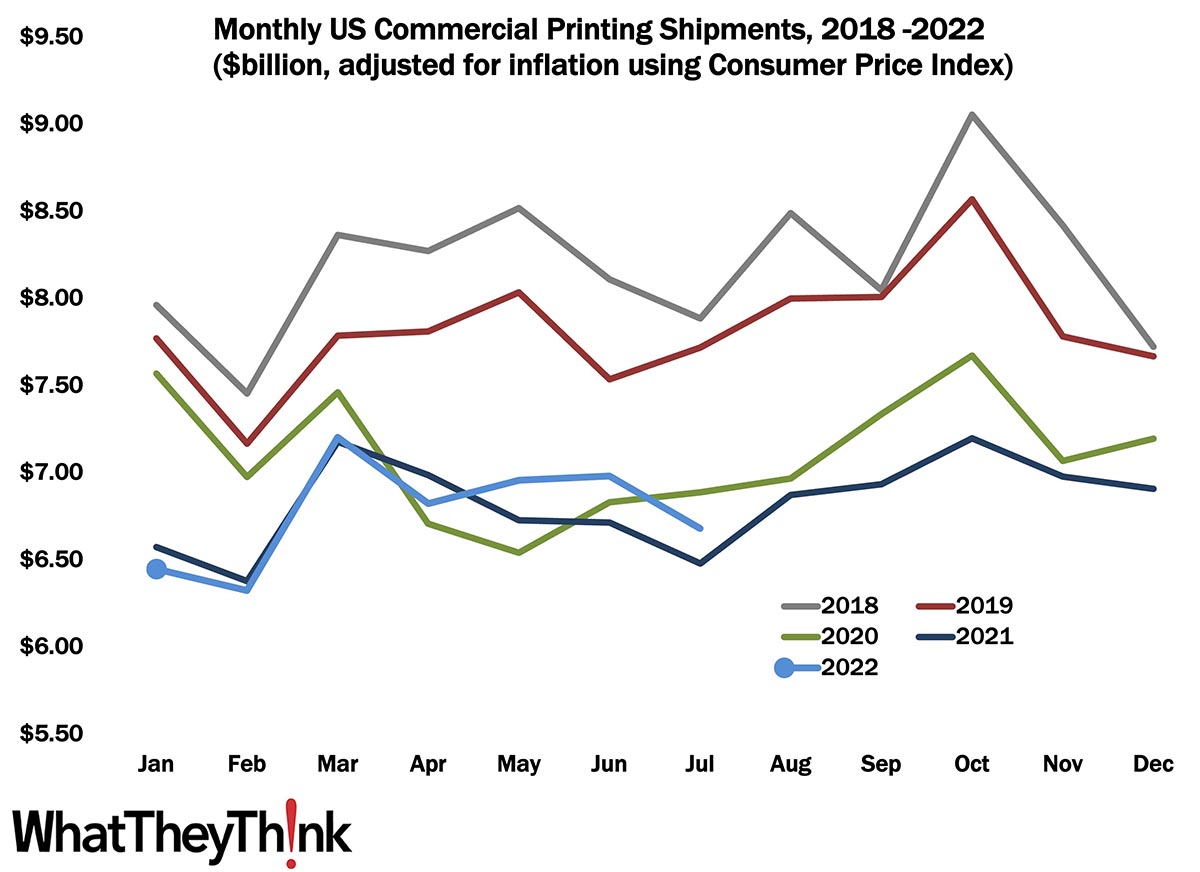

Printing Shipments: July Takes a Tumble

Published: September 16, 2022

July 2022 shipments came in at $6.68 billion, down from June’s $6.98 billion, as the dog days of summer kicked in. Full Analysis

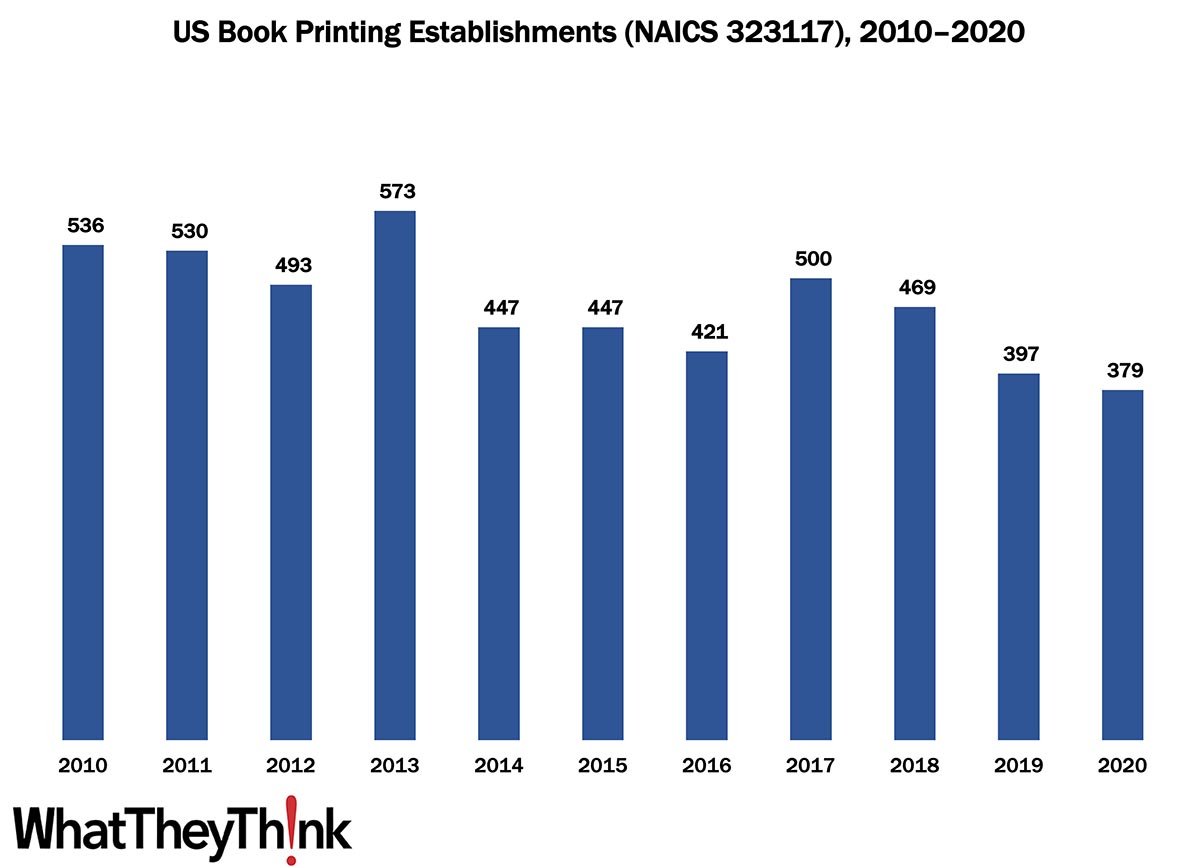

Book Printing Establishments—2010–2020

Published: September 9, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 379 establishments in NAICS 323117 (Books Printing). This represents a decrease of 29% since 2010. In macro news, highlights from the most recent Federal Reserve “Beige Book.” Full Analysis

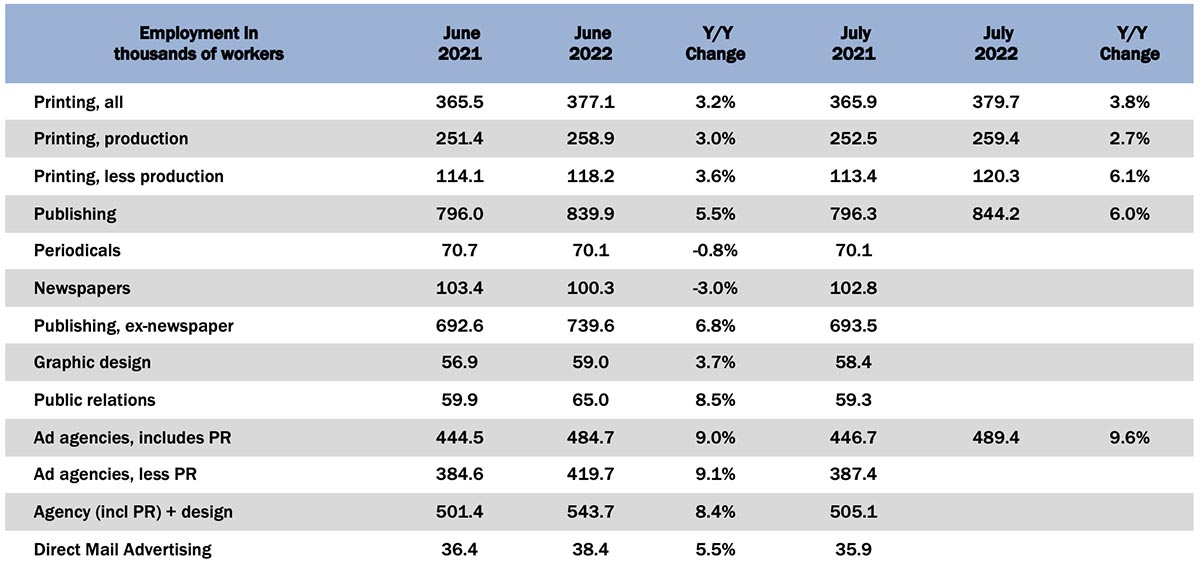

Graphic Arts Employment Up Slightly in July

Published: September 2, 2022

In July 2022, all printing employment was up +0.7% from June. Production employment was up 0.2% and non-production employment was up 1.8%. Full Analysis

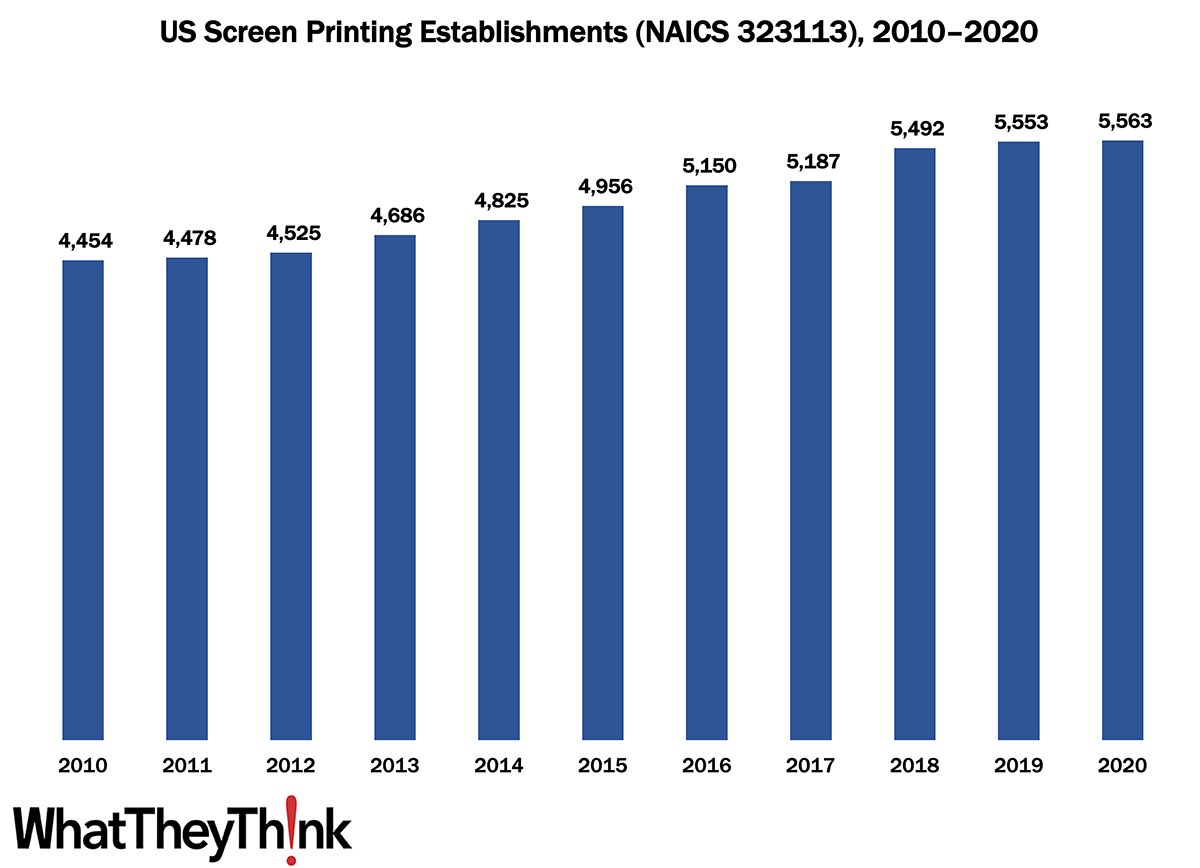

Screen Printing Establishments—2010–2020

Published: August 26, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 5,563 establishments in NAICS 323113 (Commercial Screen Printing). This represents an increase of 25% since 2010. In macro news, 2Q GDP revised up to -0.6%. Full Analysis

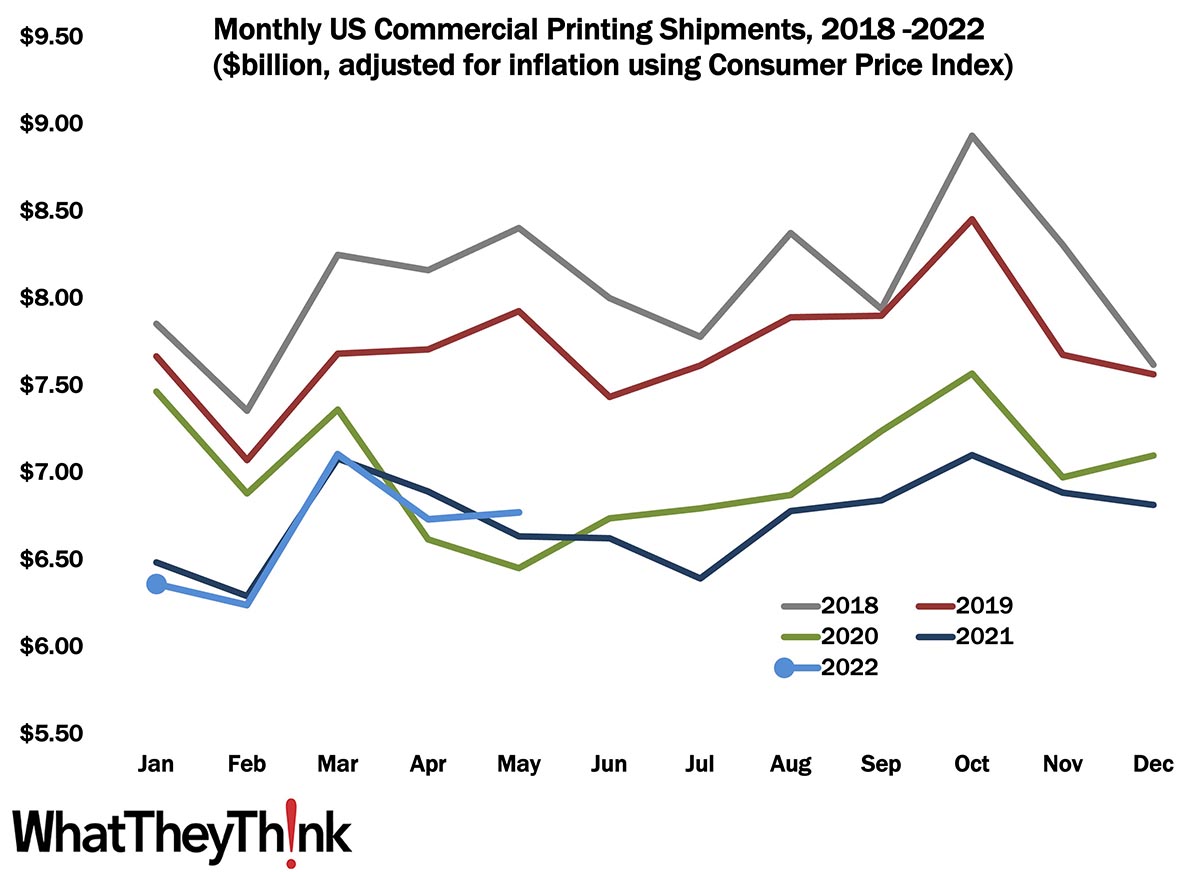

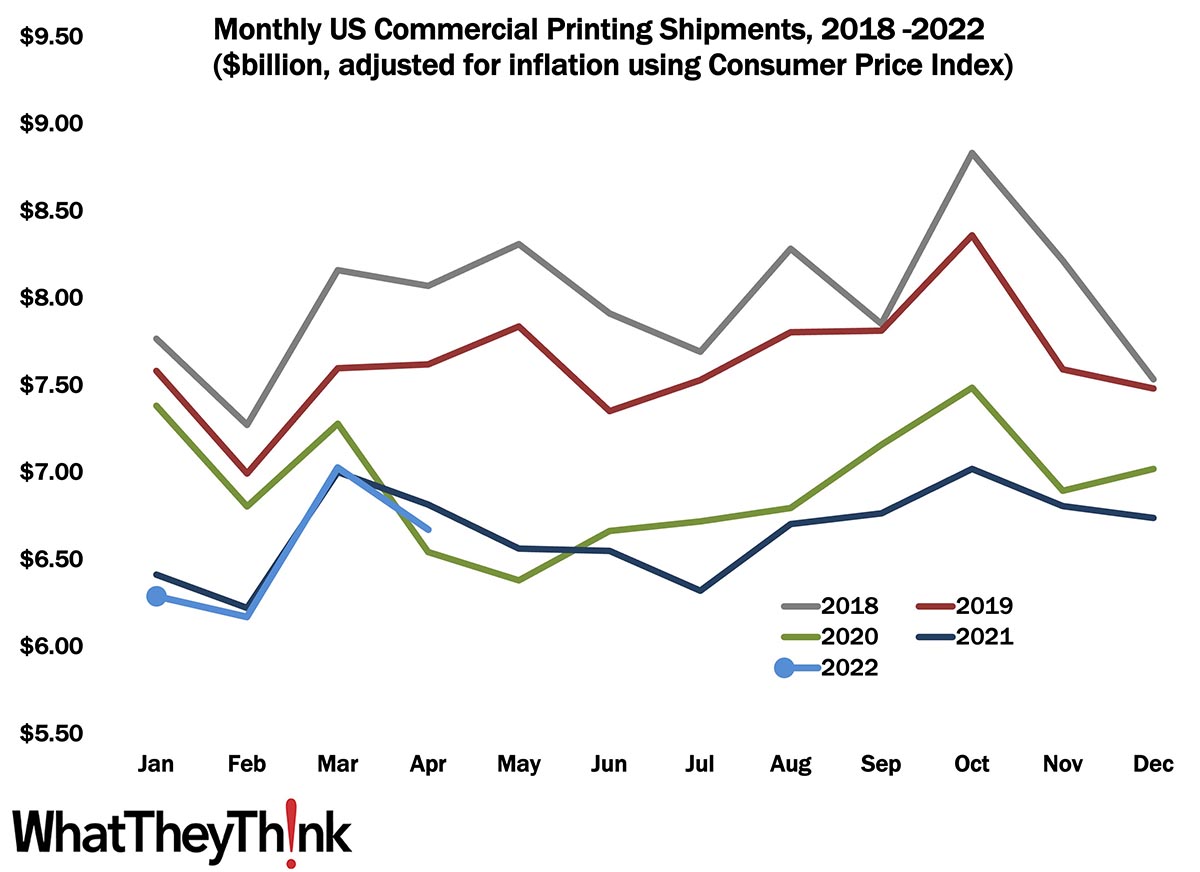

Printing Shipments: The Best June Since the Before Times

Published: August 19, 2022

June 2022 shipments came in at $6.98 billion, up a tad from May’s $6.96 billion. This is the best June the industry has had since 2019—although it’s well below that month’s $7.54 billion. Full Analysis

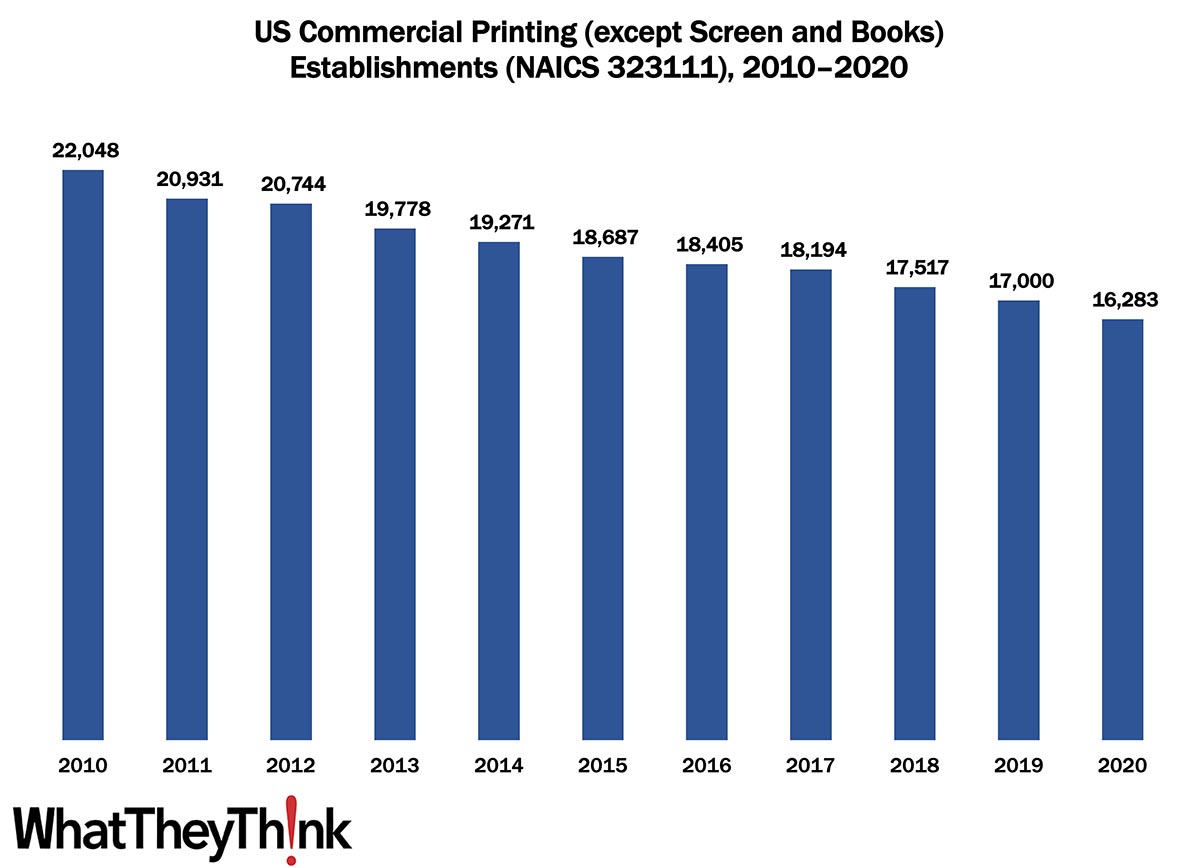

Commercial Printing Establishments—2010–2020

Published: August 12, 2022

According to the latest, recently released edition of County Business Patterns, in 2020 there were 16,283 establishments in NAICS 323111 (Commercial Printing except Screen and Books). This represents a decline of 26% since 2010. In macro news, inflation is flat! Full Analysis

June Graphic Arts Employment—The Production/Non-Production See Saw This Month Favors Non-Production Workers

Published: August 5, 2022

In June 2022, all printing employment was up +0.2% from May. This time, it was production employment that was down (-0.8%) and non-production employment that was up (+2.3%). Full Analysis

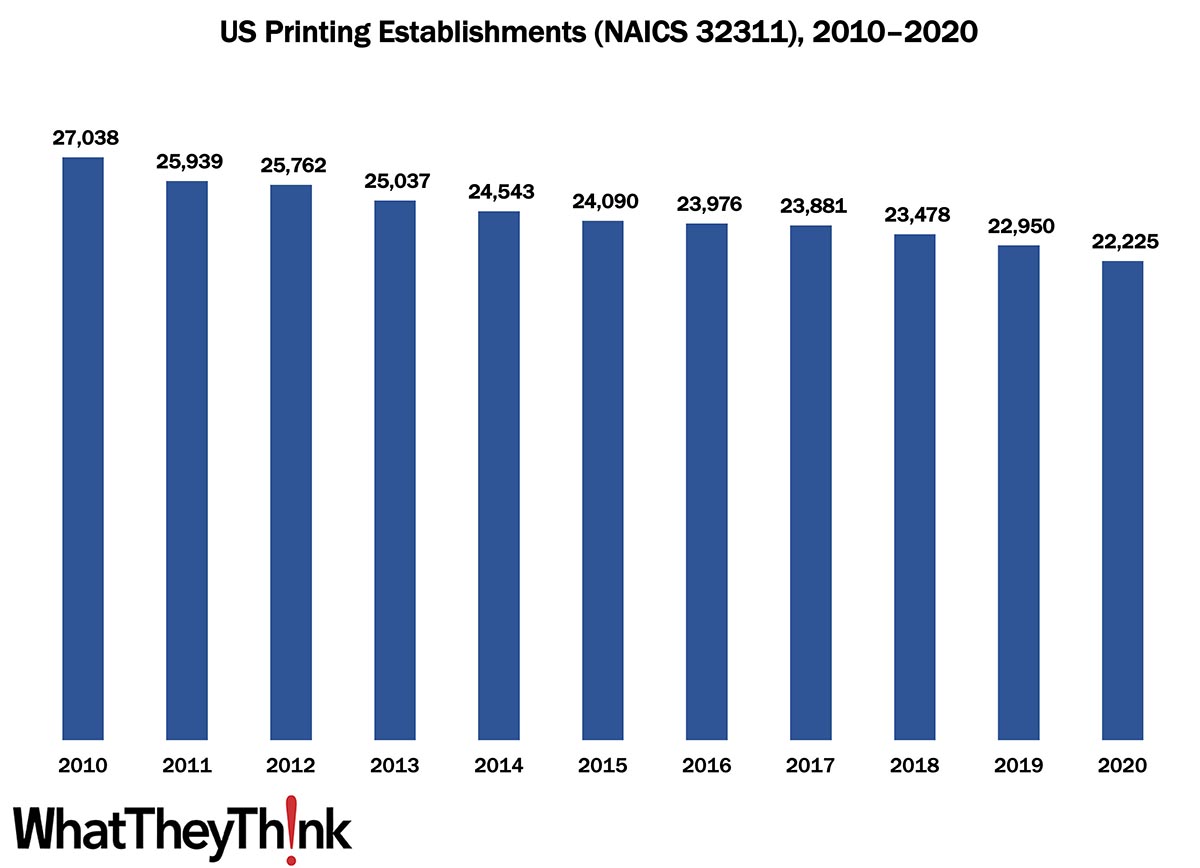

Printing Establishments—2010–2020

Published: July 29, 2022

According to the latest, just-released edition of County Business Patterns, in 2020 there were 22,225 establishments in NAICS 32311 (Printing). This represents a decline of 18% since 2010. In macro news, Q2 GDP declined -0.9%. Full Analysis

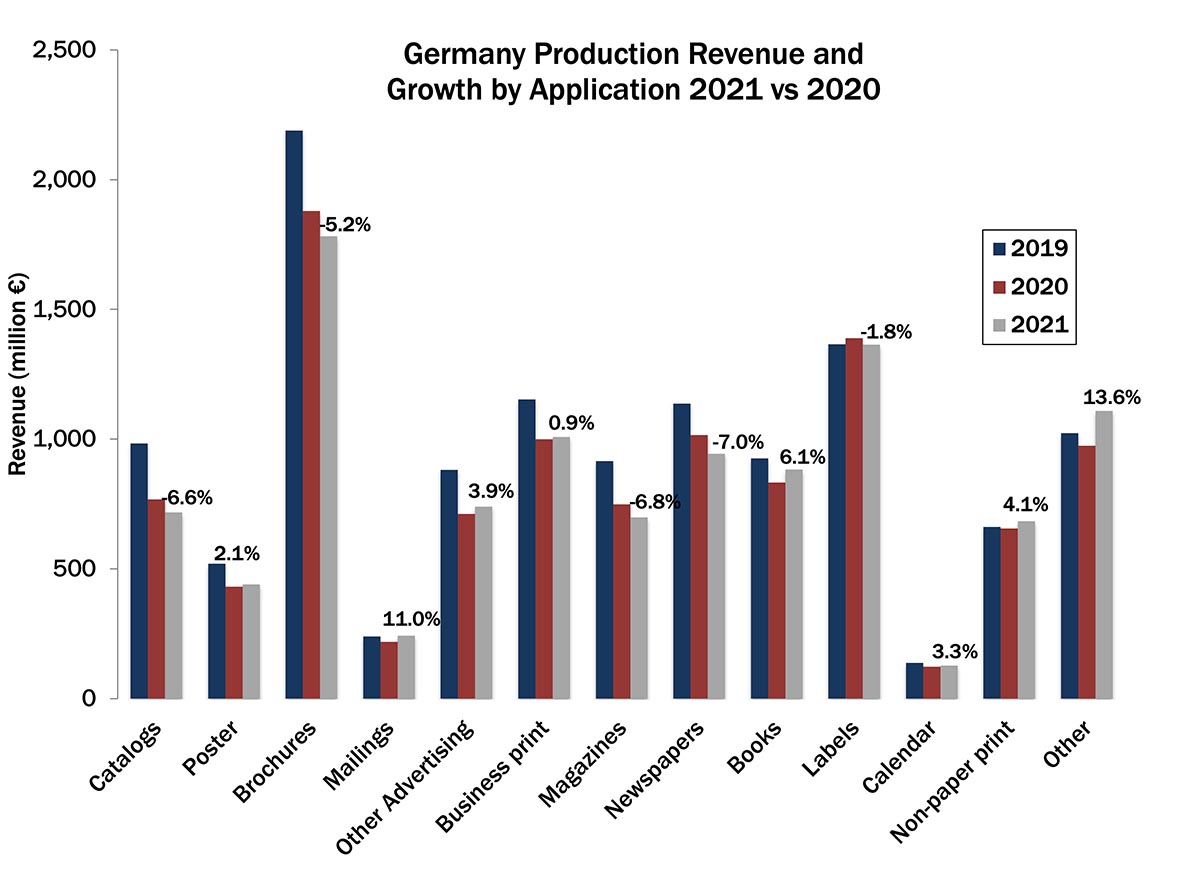

Post-Pandemic Print Applications in Germany—No Drop, No Growth

Published: July 26, 2022

The German printing industry association (BVDM) recently published its 2021 print industry statistics, which includes an overview of print application revenues. Ralf Schlözer takes a look at print revenue growth in Germany and the impact the pandemic and post-pandemic recovery had on individual print applications. Full Analysis

Printing Shipments: The Best May Since the Before Times

Published: July 22, 2022

May 2022 shipments came in at $6.77 billion, up from April’s $6.73 billion. This is the best May the industry has had since 2019—although it’s well below that month’s $7.92 billion. Full Analysis

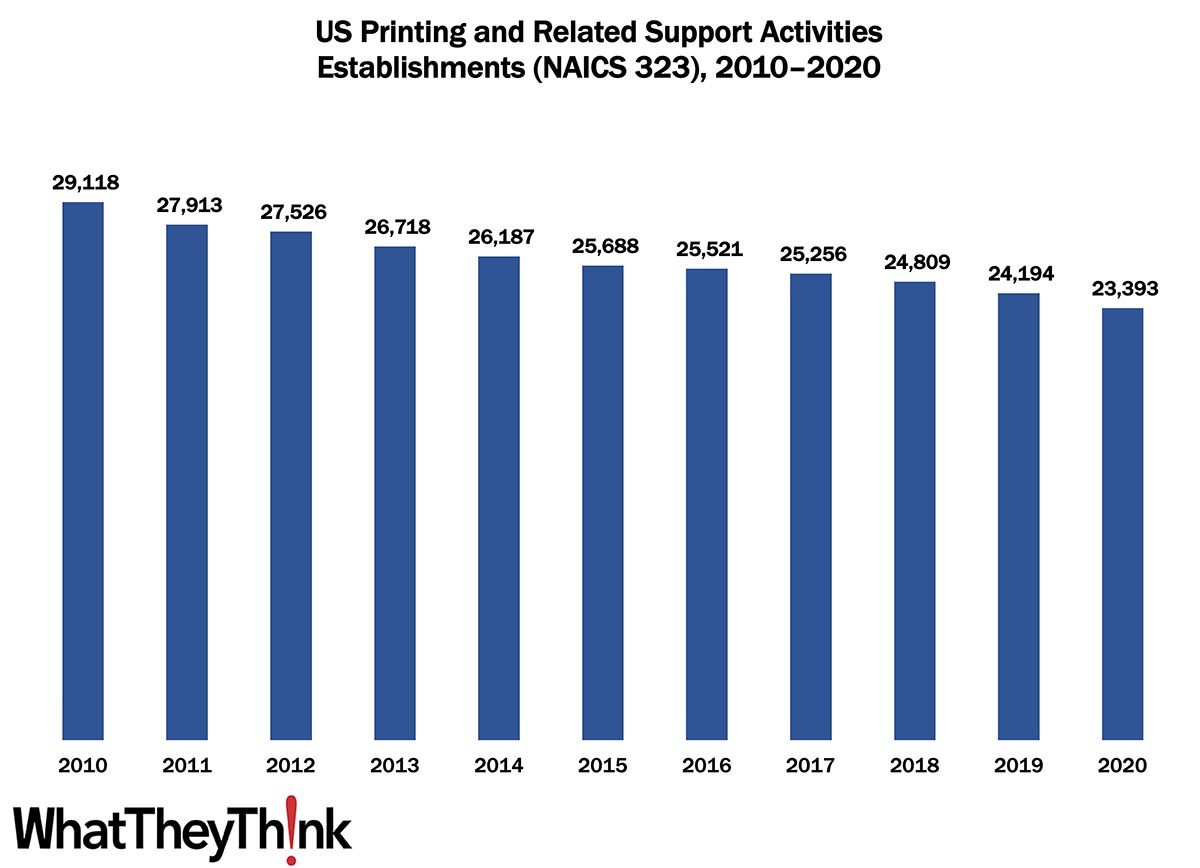

Printing Establishments—2010–2020

Published: July 15, 2022

According to the latest, just-released edition of County Business Patterns, in 2020 there were 23,393 establishments in NAICS 323 (Printing and Related Support Activities). This represents a decline of 20% since 2010. In macro news, Q2 GDP estimates are bearish—but that may not be cause for concern. Full Analysis

Printing Profits: Back to Pre-Pandemic Levels

Published: July 1, 2022

Despite COVID, printing industry profits have been pretty good, with annualized profits for Q1 2022 coming in at $4.55 billion, down from $4.79 billion in Q4 2021. Full Analysis

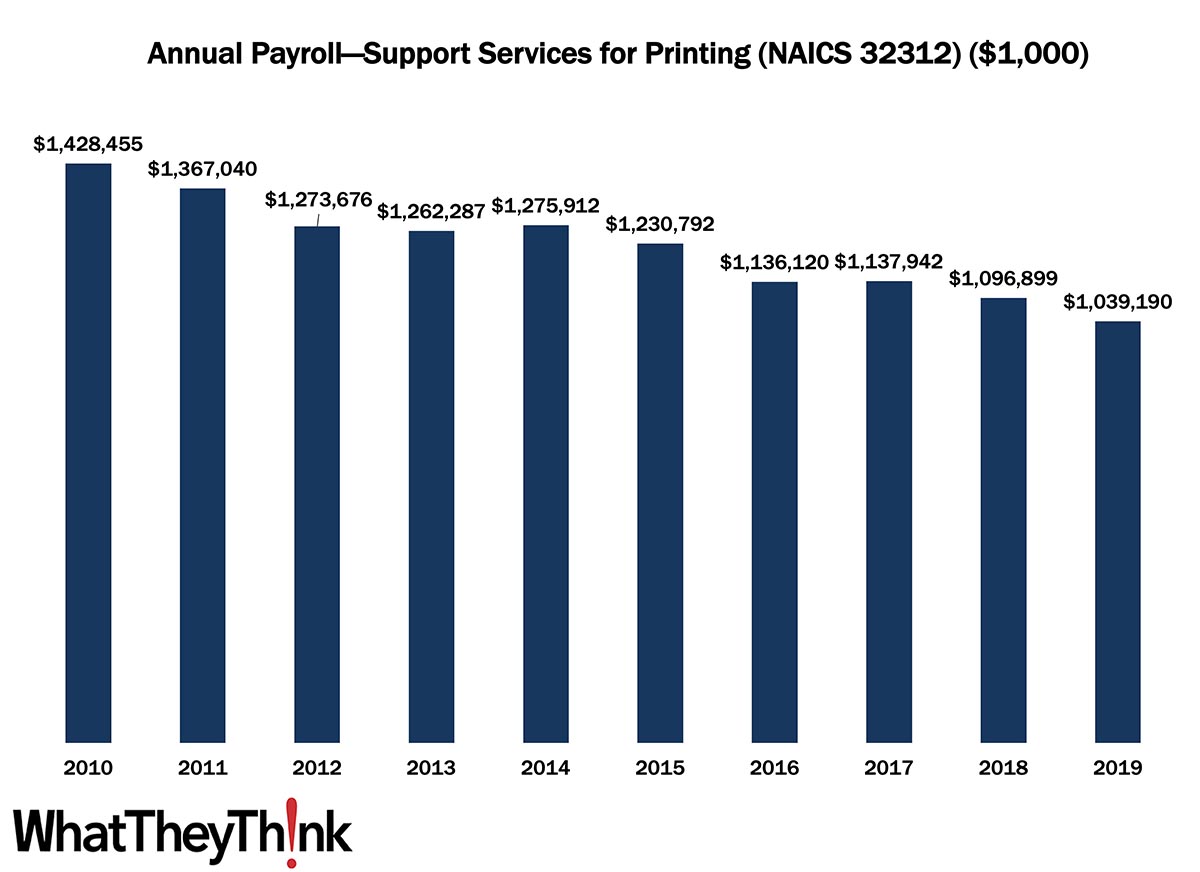

Support Activities for Printing Annual Payroll—2010–2019

Published: June 24, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 32312 had an annual payroll of $1.4 billion. Payrolls declined steadily over the course of the 2010s, closing out the decade at $1.0 billion in 2019. However adjusting for inflation, payrolls declined by -38% over the course of the decade. In macro news: AIA’s Architecture Billings Index (ABI) indicates that demand for design services remains strong, boding well for commercial real estate construction and thus signage projects. Full Analysis

April Shipments: Returning to Regular Seasonality

Published: June 17, 2022

April 2022 shipments came in at $6.67 billion, down from March’s $7.03 billion. The general trend in all but two of the last seven years has been for April shipments to decline from March’s. That’s not really good news but suggests we’re at least getting back to normal. Full Analysis

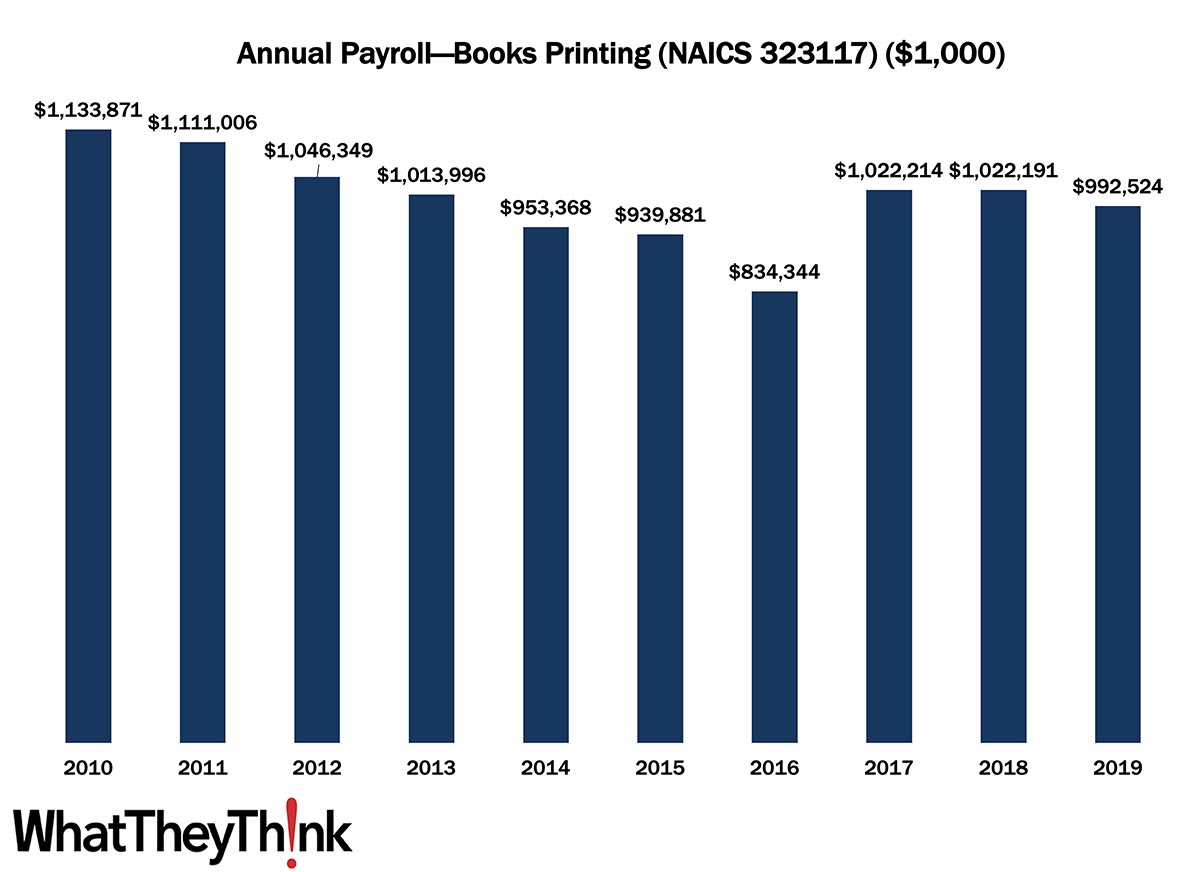

Book Printing Annual Payroll—2010–2019

Published: June 10, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 323117 had an annual payroll of $1.1 billion. Payrolls declined over the first half of the 2010s, at least on a current dollar basis, but started to rise again, closing out the decade at $993 million in 2019. However adjusting for inflation, payrolls declined by -25% over the course of the decade. In macro news: what’s going on with the real estate market? Full Analysis

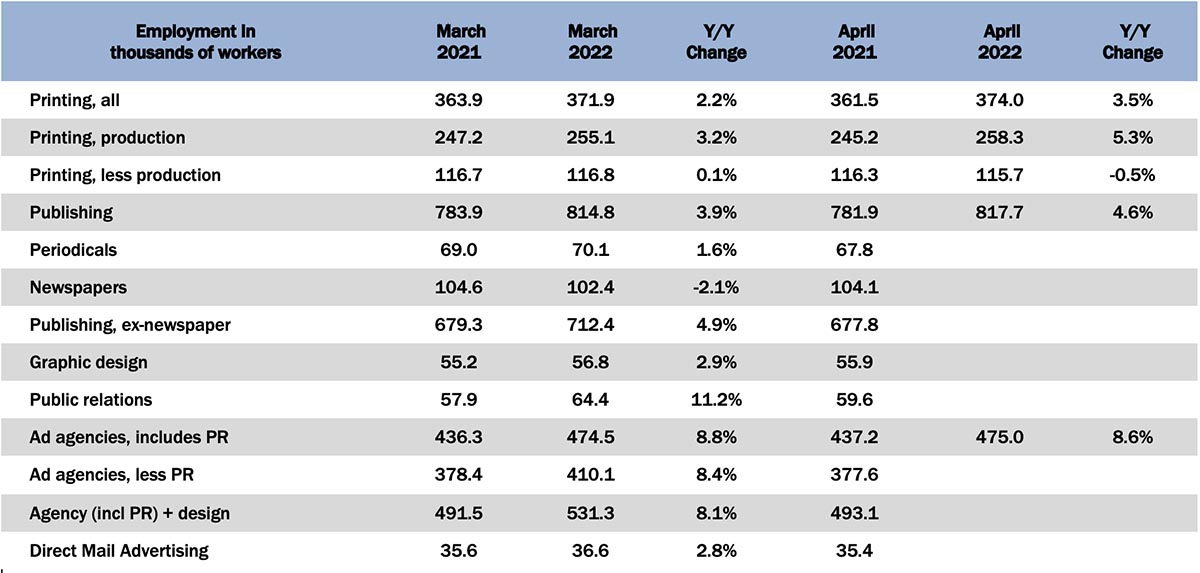

April Graphic Arts Employment—Print Production Up from March, Non-Production Down Slightly

Published: June 3, 2022

In March 2022, all printing employment was up +0.6% from March. This time, it was production employment that was up (+1.6%) and non-production employment that was down (-0.9%). Full Analysis

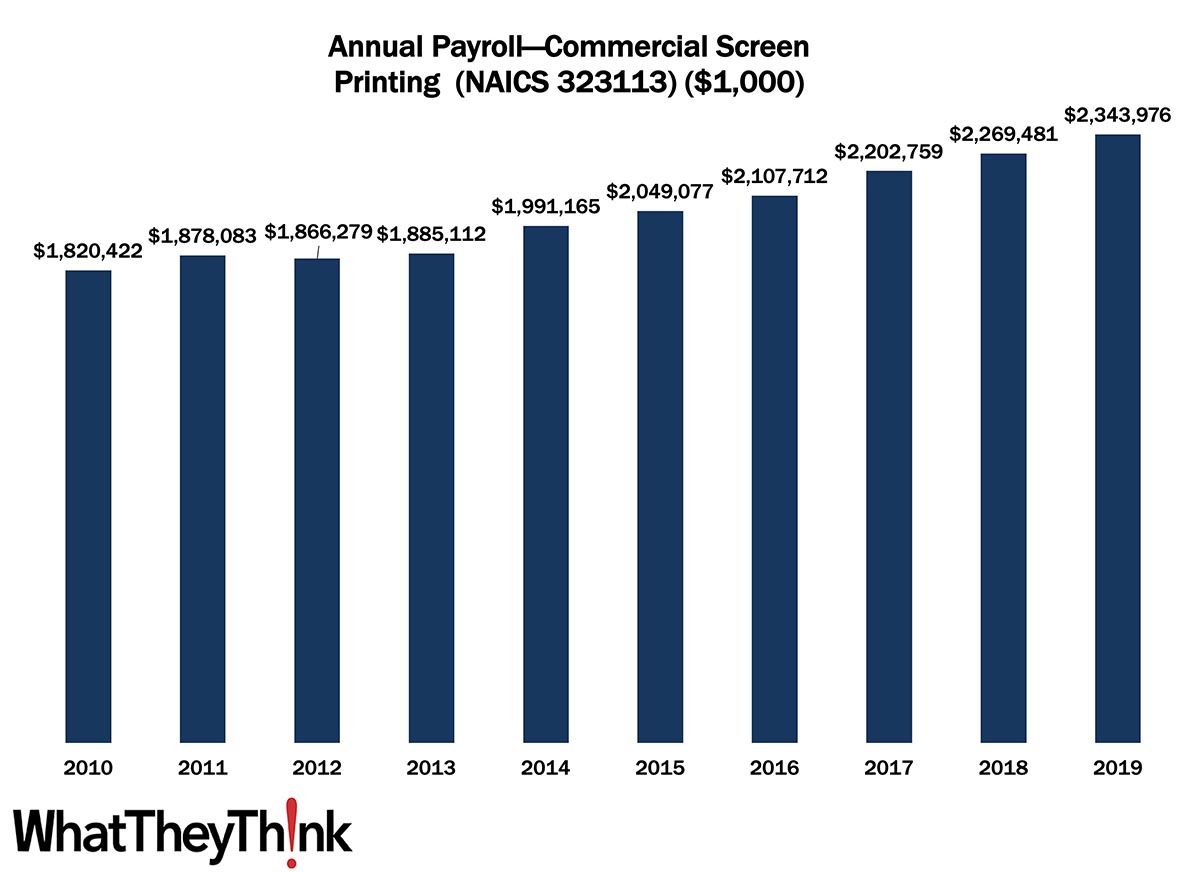

Commercial Screen Printing Annual Payroll—2010–2019

Published: May 27, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 323113 had an annual payroll of $1.8 billion. Payrolls were generally unaffected by the Great Recession and rose over the course of the 2010s, at least on a current dollar basis, finishing out the decade at $2.3 billion in 2019. However adjusting for inflation, payrolls declined by -10% over the course of the decade. In macro news: Q1 GDP revised down. Full Analysis

March Shipments: It’s Déjà Vu All Over Again

Published: May 20, 2022

March 2022 shipments came in at $6.91 billion, up from February’s $6.14 billion. So far, it looks like 2022 is closely mirroring 2021—which isn’t necessarily a bad thing. Full Analysis

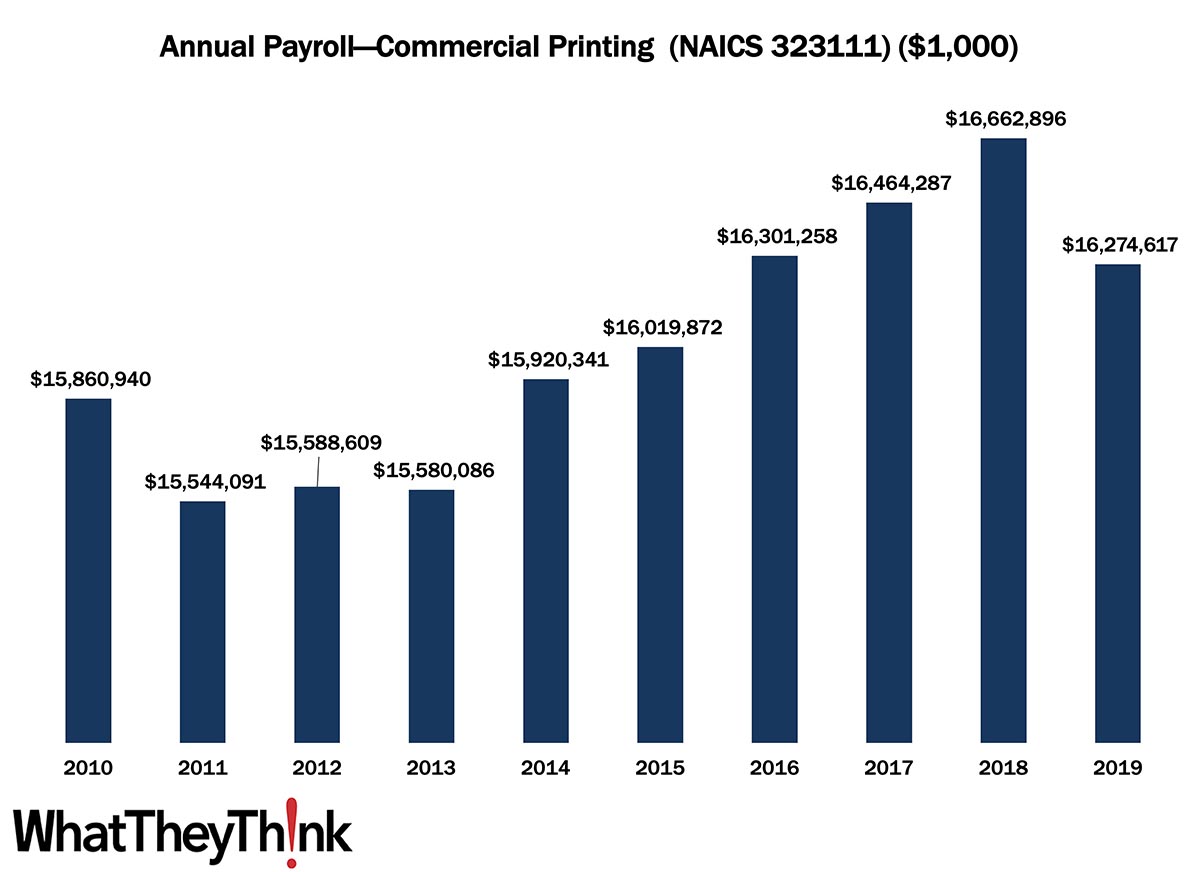

Commercial Printing Annual Payroll—2010–2019

Published: May 13, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 323111 had an annual payroll of $15.9 billion. Payrolls dipped during and in the aftermath of the Great Recession and then rose, at least on a current dollar basis, over the latter half of the decade before dropping in 2019, finishing out the decade at $16.3 billion in 2019. However adjusting for inflation, payrolls declined by -12% over the course of the decade. In macro news: inflation is starting to slow ever so slightly. Full Analysis

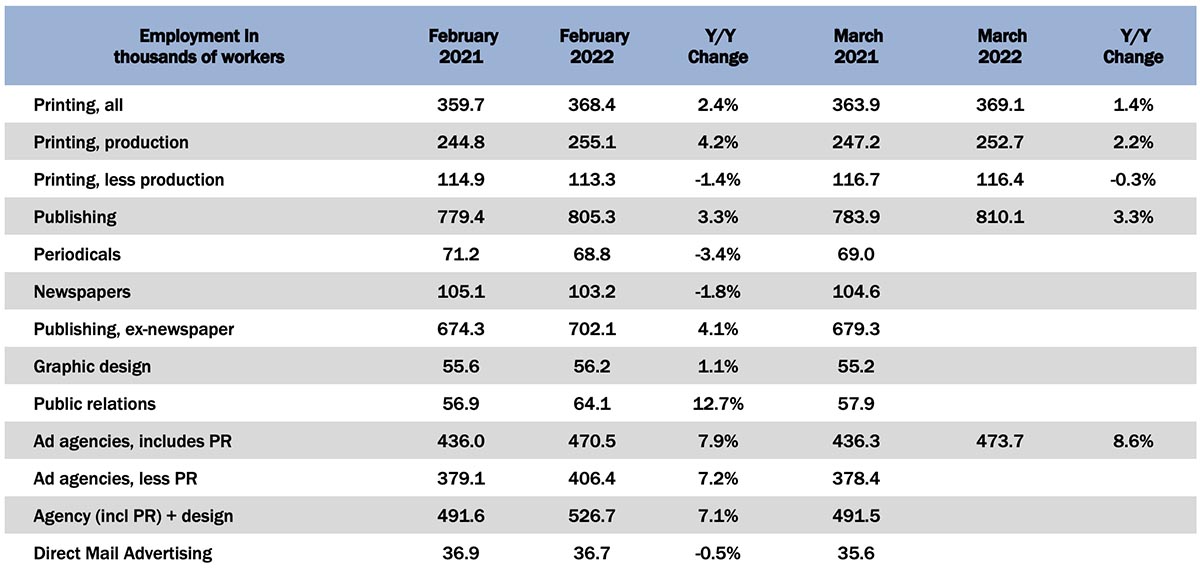

March Graphic Arts Employment—Print Production Drops from February, Non-Production Up a Bit

Published: May 6, 2022

In March 2022, all printing employment was up +0.2% from February. Non-production printing employment was up +2.7%, but production employment was down -0.9%. Full Analysis

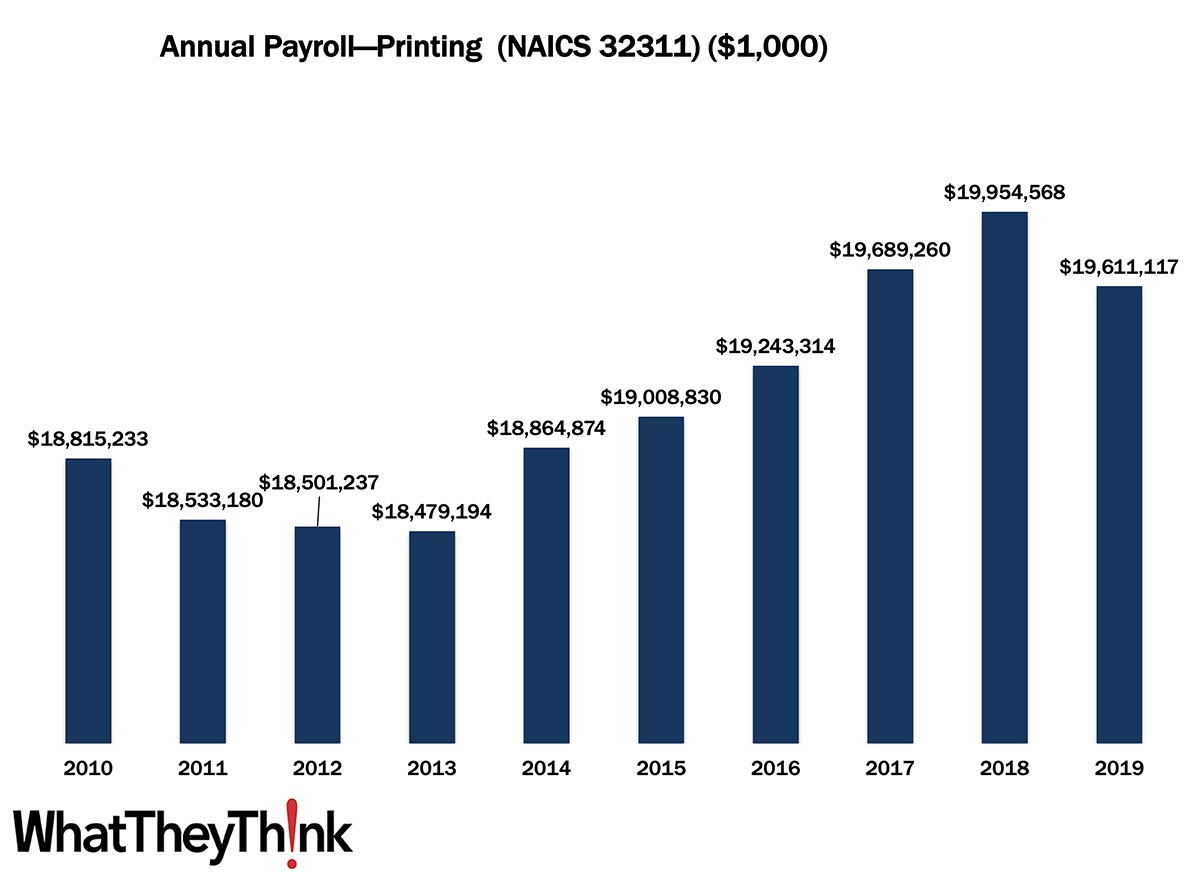

Printing Annual Payroll—2010–2019

Published: April 29, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 32311 had an annual payroll of $18.8 billion. Payrolls dipped during and in the aftermath of the Great Recession and then rose, at least on a current dollar basis, over the latter half of the decade, coming in at $19.6 billion in 2019. However adjusting for inflation, payrolls declined by -11% over the course of the decade. In macro news: GDP decreased by 1.4% in Q1 2022. Full Analysis

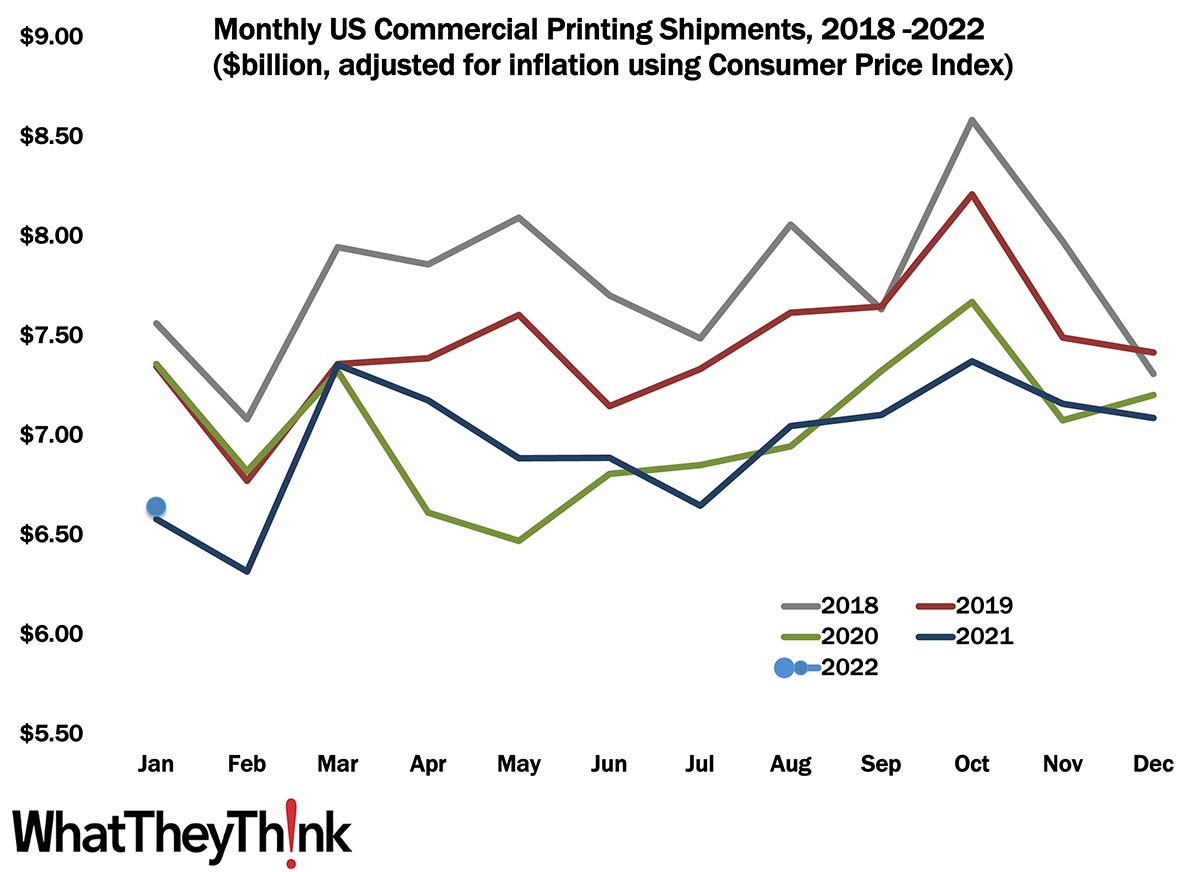

February Shipments: OK, About What We Expected

Published: April 22, 2022

February 2022 shipments came in at $6.53 billion, down from January’s $6.67 billion. As we remarked last month we’re starting the year better than we did 2021 and reverting back to our normal seasonality trends. Full Analysis

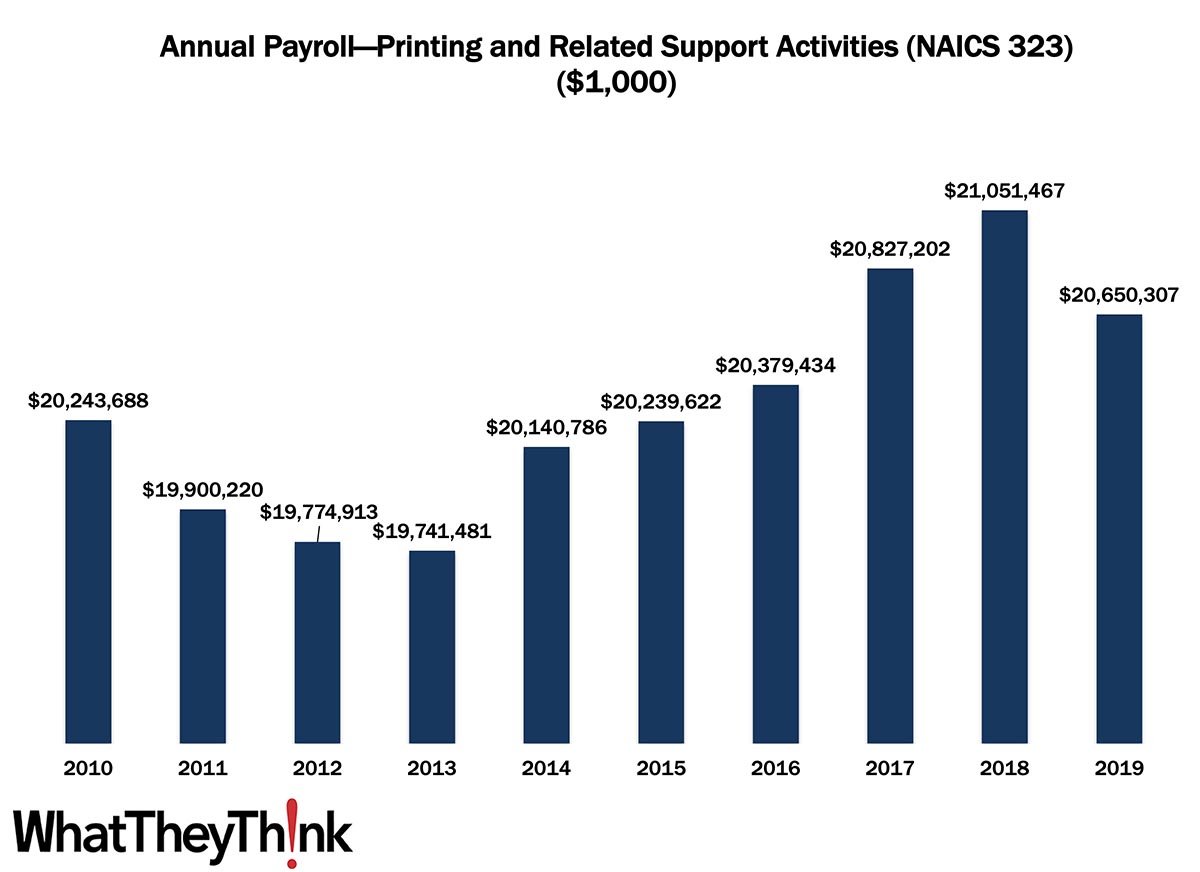

Printing Industry Annual Payroll—2010–2019

Published: April 8, 2022

According to County Business Patterns, in 2010, US establishments in NAICS 323 had an annual payroll of $20.2 billion. Payrolls dipped during and in the aftermath of the Great Recession. They rose, at least on a current dollar basis, over the latter half of the decade, coming in at $20.7 billion in 2019. However adjusting for inflation, payrolls declined by -13% over the course of the decade. In macro news: forecasters are not expecting a happy Q1 GDP report. Full Analysis

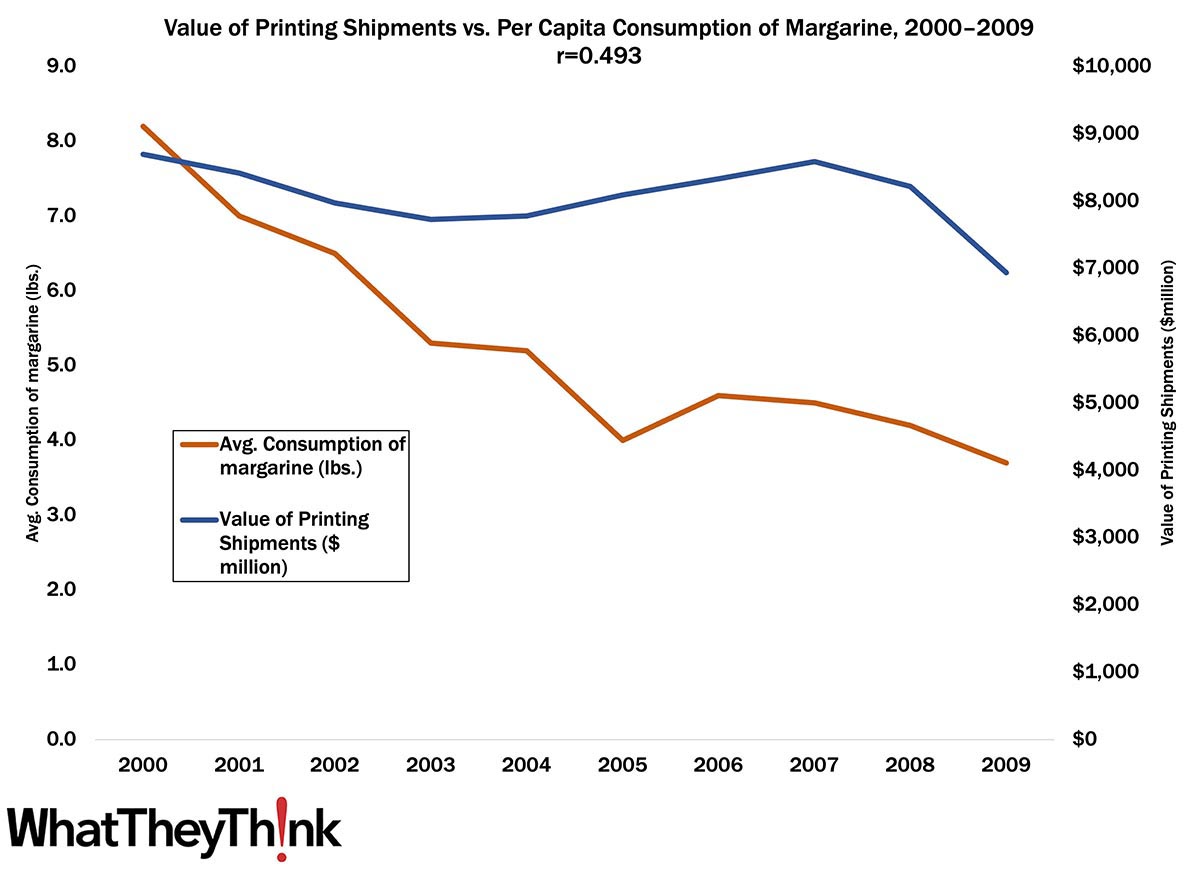

Now it Can be Told: Why Printing Shipments Declined! (April Fools 2022 Edition)

Published: April 1, 2022

In this exclusive report, we found a modest positive relationship between the decline in average consumption of margarine and the value of printing shipments. Full Analysis

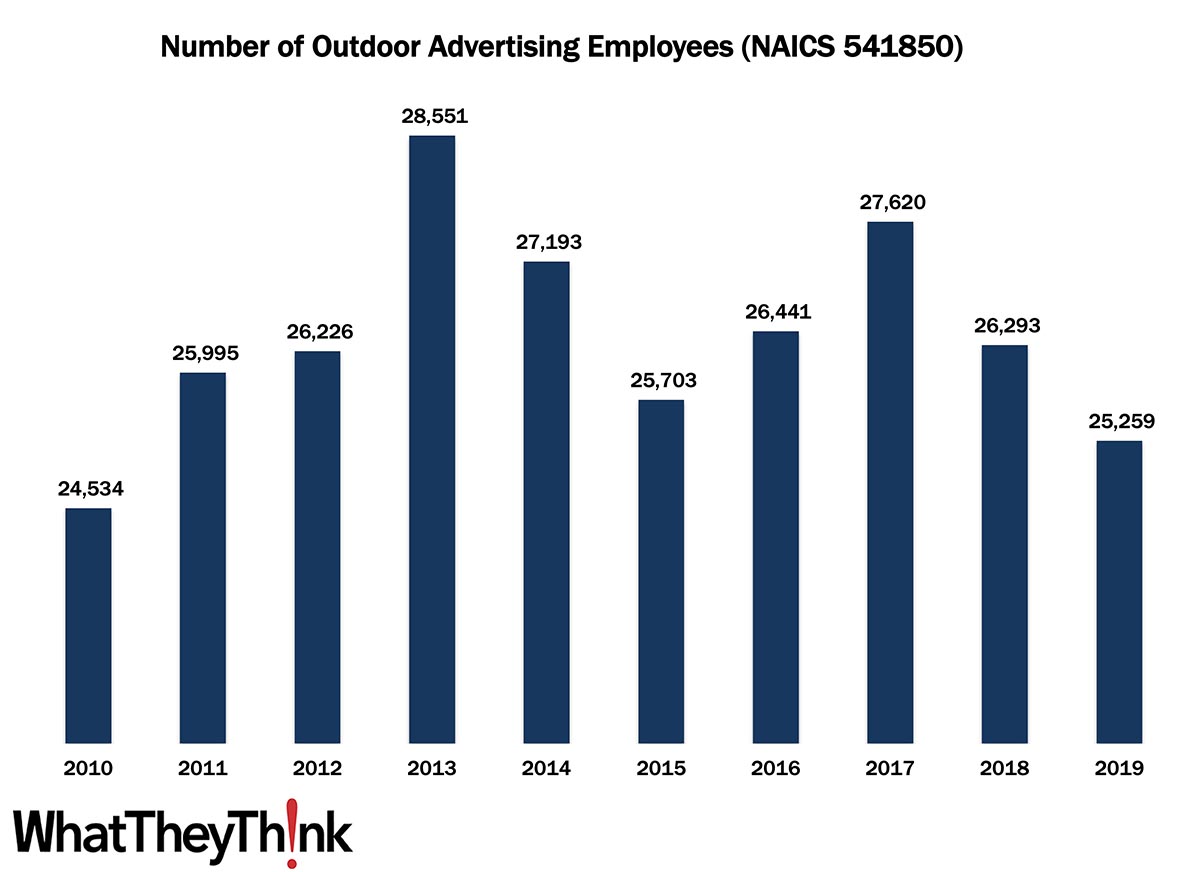

Outdoor Advertising Employees—2010–2019

Published: March 25, 2022

According to County Business Patterns, in 2010, there were 24,534 employees in NAICS 541850 (Outdoor Advertising). This NAICS actually grew post-Great Recession, with a slight decline mid-decade before climbing back up to 27,620 establishments in 2017. 2018 and 2019 saw a drop in employees. In macro news: AIA’s Architecture Billings Index (ABI) indicates that demand for design services continues to grow, boding well for commercial real estate construction and thus signage projects. Full Analysis

January Shipments: Let’s Get This Year Right

Published: March 18, 2022

January 2022 shipments came in at $6.64 billion, down from December’s $7.09 billion. We’re starting the year better than we did 2021 and reverting back to our normal seasonality trends. Full Analysis

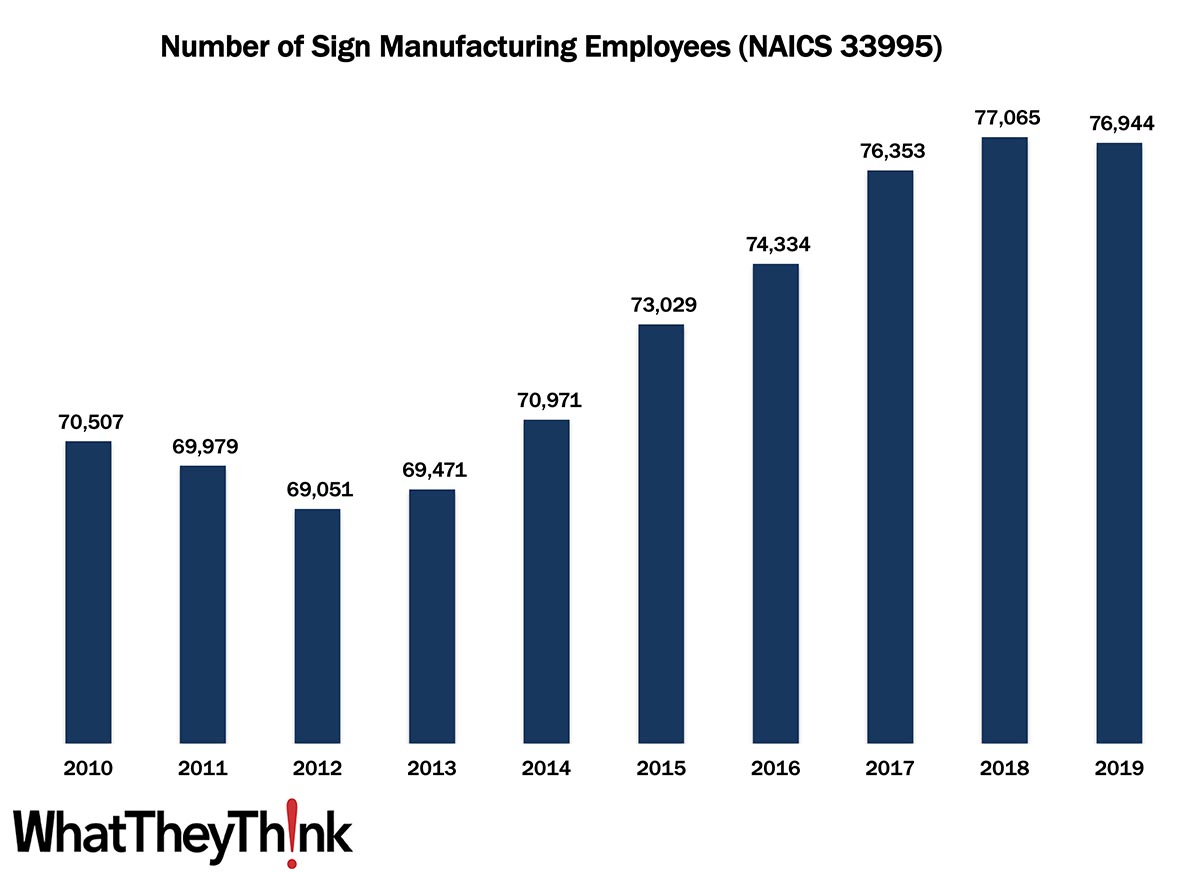

Sign Manufacturing Employees—2010–2019

Published: March 11, 2022

According to County Business Patterns, in 2010, there were 70,507 employees in NAICS 33995 (Sign Manufacturing). This NAICS category tumbled in the wake of the Great Recession, ultimately climbing to 76,944 employees in 2019. In macro news: Inflation continues to continue to climb. Full Analysis

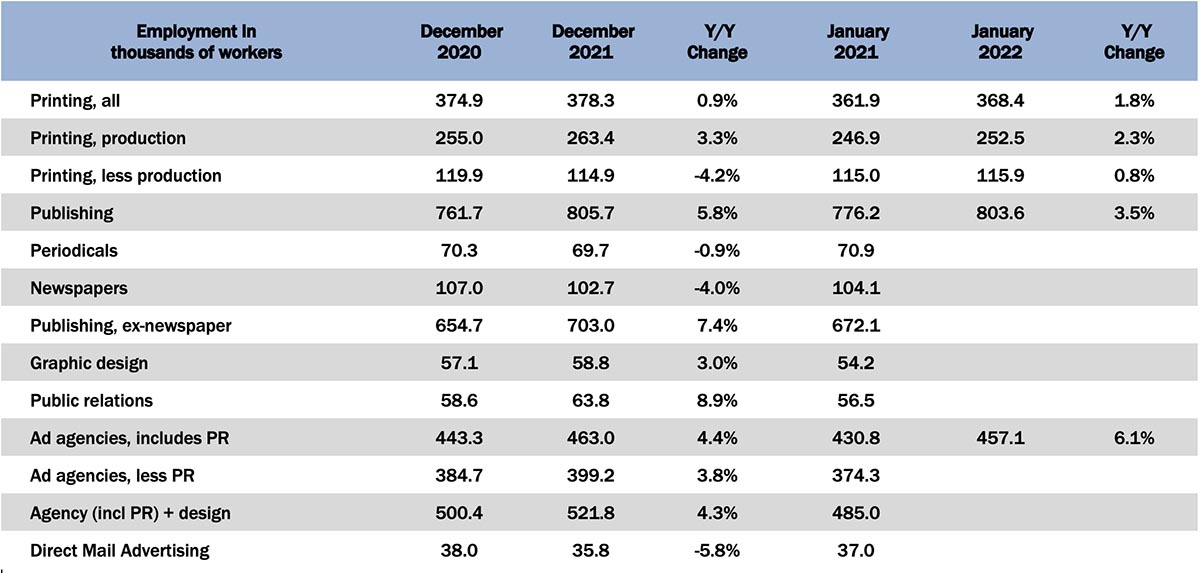

January Graphic Arts Employment—Print Production Drops from December, Non-Production Up Slightly

Published: March 4, 2022

In January 2022, all printing employment was down -2.6% from December, with production employment down -4.1%. Non-production printing employment offset that a bit by being up a modest +0.9%. Full Analysis

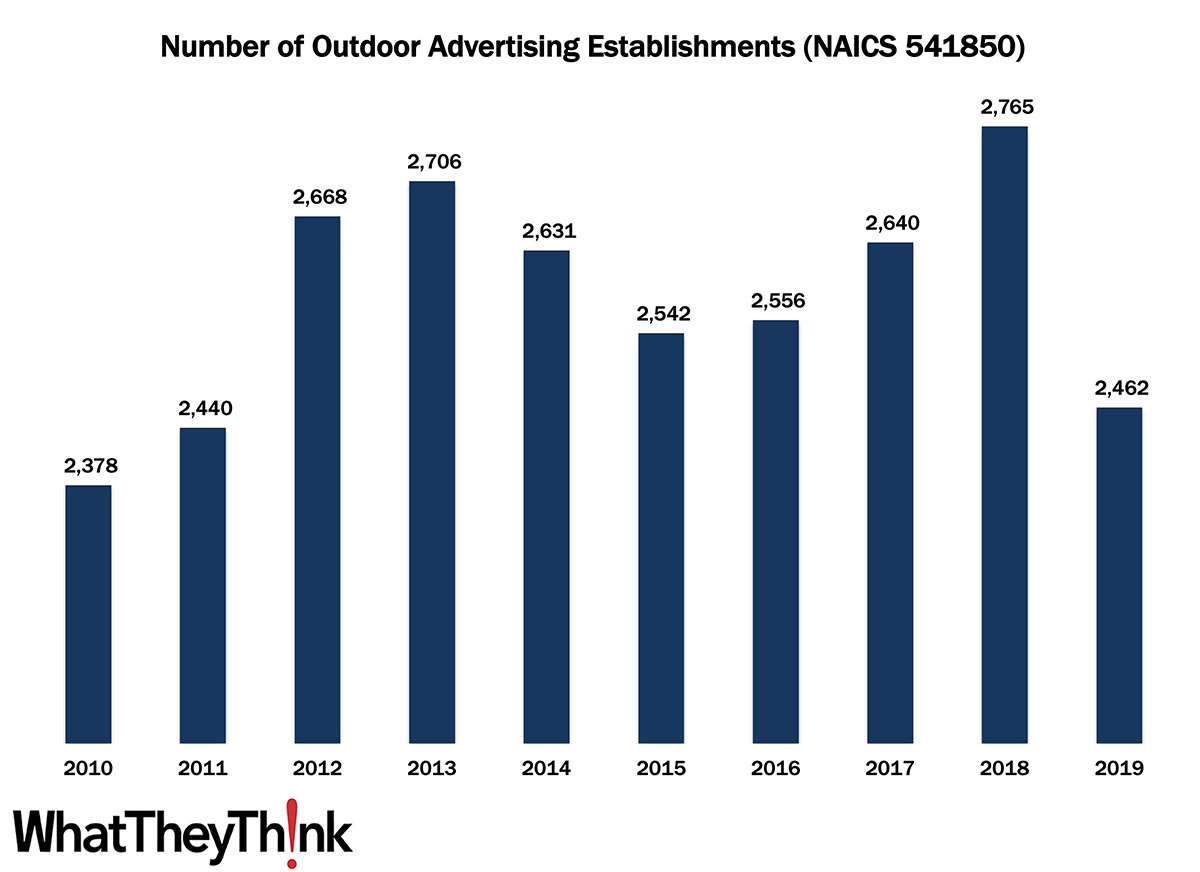

Outdoor Advertising Establishments—2010–2019

Published: February 25, 2022

According to County Business Patterns, in 2010, there were 2,378 establishments in NAICS 541850 (Outdoor Advertising). This NAICS actually grew post-Great Recession, with a slight decline mid-decade before climbing back up to 2,765 establishments in 2018. 2019 saw a massive drop in establishments. In macro news: Q4 2021 GDP revised up to 7.0%. Full Analysis

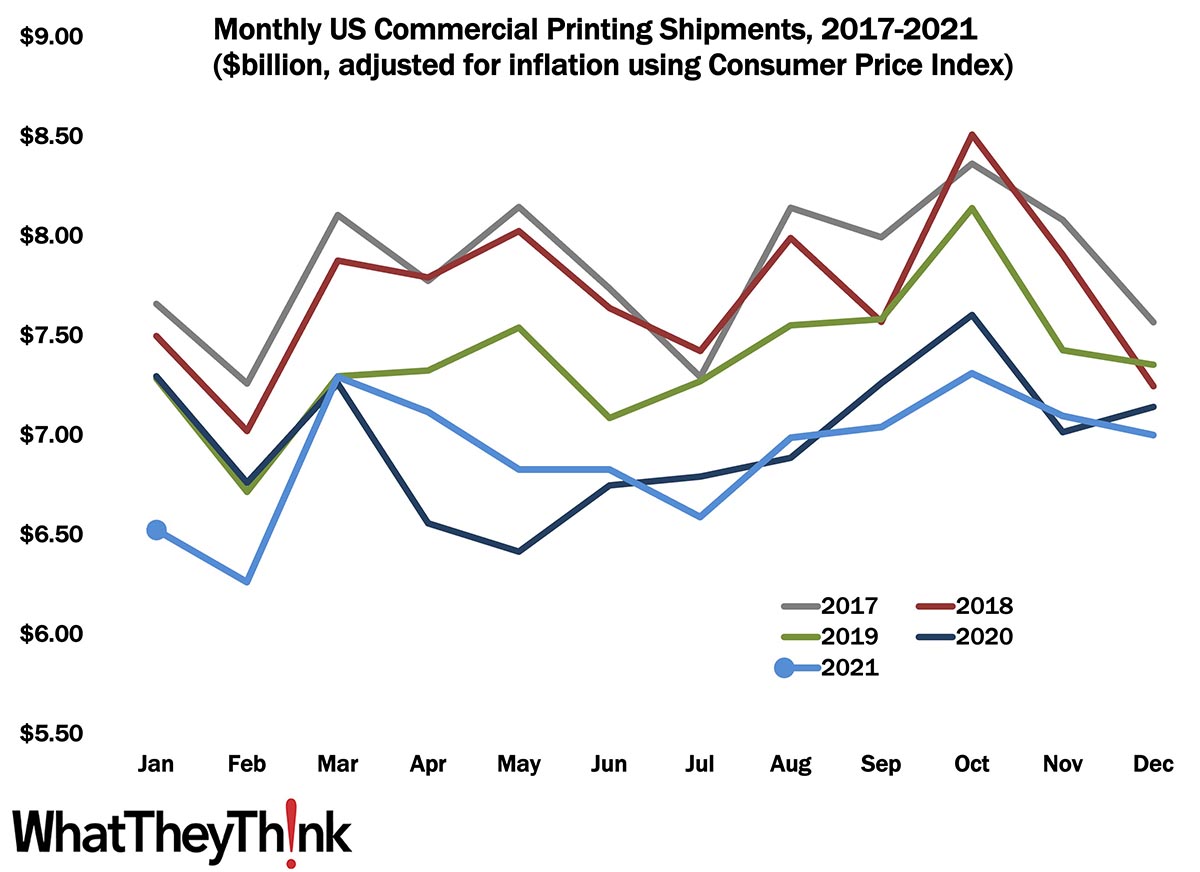

December Shipments: No Christmas Miracle

Published: February 18, 2022

As 2021 drew to a close, December printing shipments came in at $7.00 billion, down from $7.10 billion in November, keeping with the usual seasonality of a slow December. For 2021 overall, we came in at $82.87 billion for the year, just below 2020’s $83.73 billion. Full Analysis

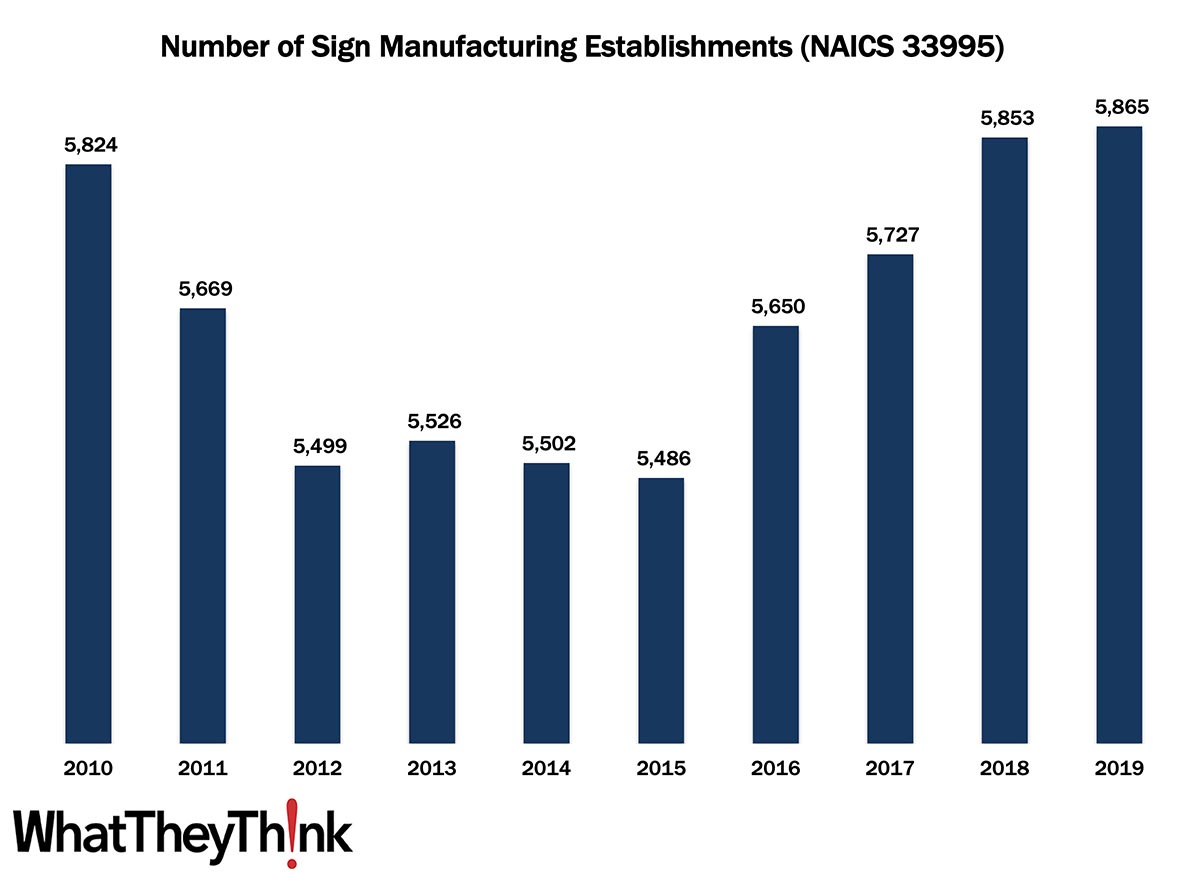

Sign Manufacturing Establishments—2010–2019

Published: February 11, 2022

According to County Business Patterns, in 2010, there were 5,824 establishments in NAICS 33995 (Sign Manufacturing). This NAICS category tumbled in the wake of the Great Recession, ultimately climbing back up to 5,865 establishments in 2019. In macro news: Inflation continues to climb. Full Analysis

Post-Pandemic Profits on the Upturn

Published: February 4, 2022

Shipments have been slowly climbing back from the pandemic recession of 2020, but profits have been on a sharp upturn. However there still remains a bit of a profitability gap between the two major asset class distinctions. Full Analysis

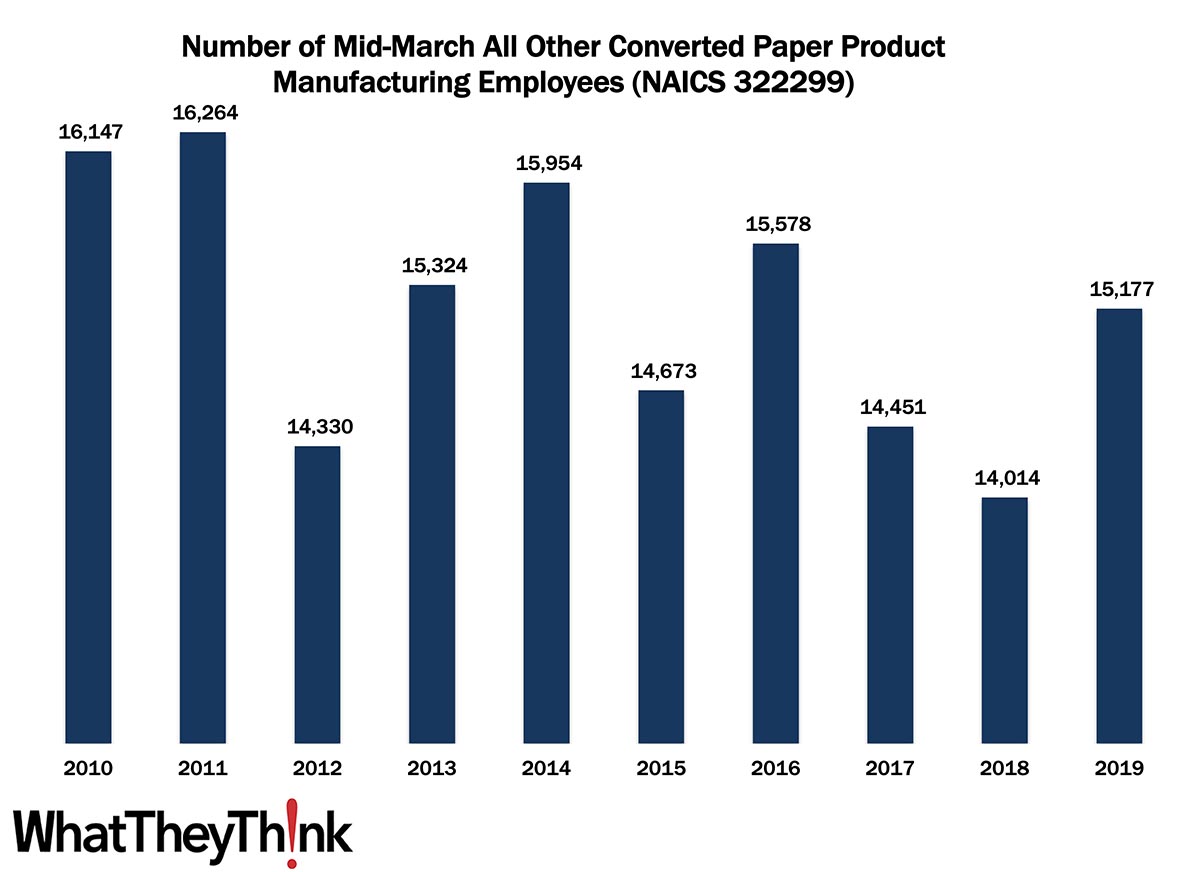

All Other Converted Paper Product Manufacturing Employment—2010–2019

Published: January 28, 2022

According to County Business Patterns, in 2010, there were 16,147 employees in 322299 (All Other Converted Paper Product Manufacturing establishments). This NAICS category bounced up and down over the course of the 2010s, ending with 15,177 employees in 2019. In macro news: Yesterday was Q4 GDP Day! Full Analysis

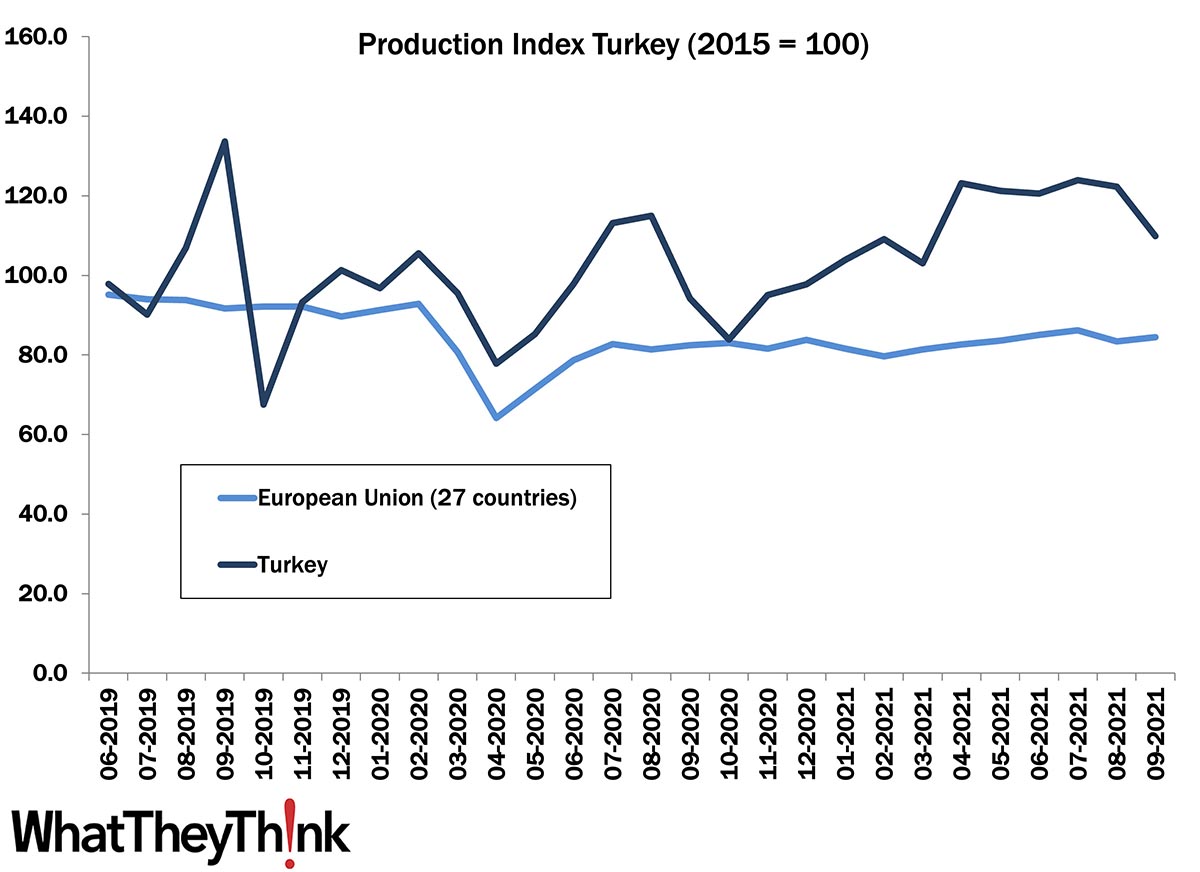

European Print Industry Snapshot: Turkey

Published: January 25, 2022

In this bimonthly series, WhatTheyThink is presenting the state of the printing industry in different European countries based on the latest monthly production numbers. This week, we take an updated look at the printing industry in Turkey. Full Analysis

November Shipments: Reversion to the Mean

Published: January 21, 2022

November 2021 printing shipments came in at $6.99 billion, down from $7.29 billion in October, and the first month that shipments dropped since early summer. Year to date, January-to-November shipments are $75.56 billion, only a bit off 2020’s January-to-November number of $76.36. If we have a really good December, 2021 could come in slightly above 2020. Full Analysis

- Innovations in Inkjet for Textile Production – live webinar

- Buying Inkjet Part 1: Does This Printer Make Me Look Good?

- LabelExpo 2023: Launches and Trends – Part 2

- Driving profitability with cut-sheet inkjet

- Zero Trust Environments for Inkjet Printing

- Kevin Roman on the evolution of professional services needs

- LabelExpo 2023: Launches and Trends – Part 1

- Inkjet Gets into “Hard Core” Applications

© 2023 WhatTheyThink. All Rights Reserved.