Navigating the Soft Landing

As readers of The Target Report know, we view the printing, packaging, and related industries from the perspective of M&A transactional activity. Over the past twelve years, we have chronicled, logged, and commented on the robust merger and acquisition activity in the print-centric business segments. At the end of August each year, we take a break from our monthly commentary based on the prior month’s deal activity and look back at the past twelve months. If past is prologue, and to a reasonable extent we believe it is, then we hope to provide a high-level macro perspective on what the deal activity tells us about where the industry is headed. Which segments have experienced more, or less, deal activity? What are the trends in the buyers’ rationale to complete these acquisitions? Are acquirers adding facilities to their networks, or opportunistically folding acquisitions into their existing facilities? What does all this tell us about the potential future transactional activity within each print segment?

We review, categorize, sort, count, and chart the data we have collected, comparing the trailing twelve months (“TTM”) ended this August to the prior twelve months. This year we have included the prior four years to provide a visual bridge over the pandemic period.

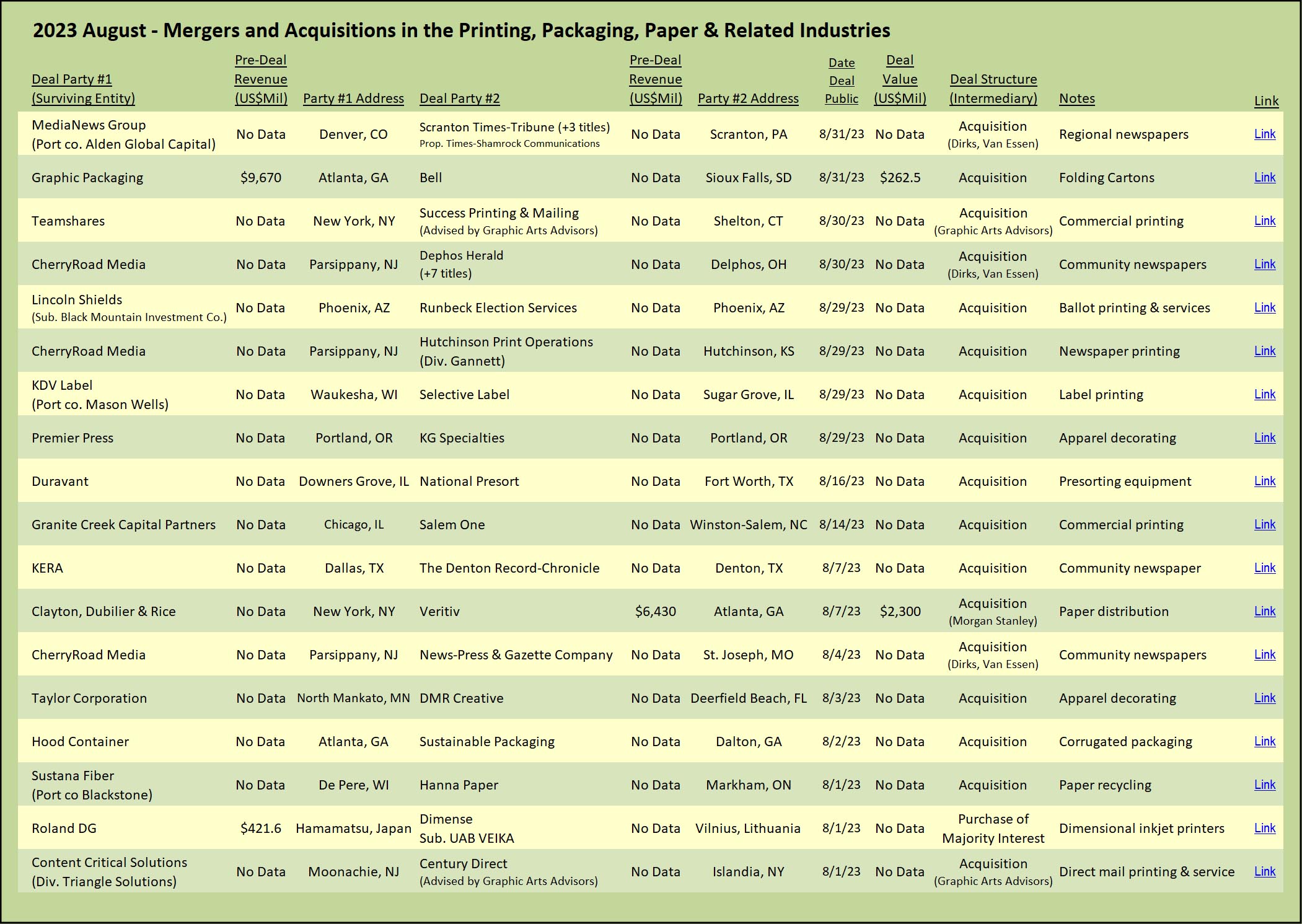

In pure numeric M&A terms, deal activity during the past twelve months was off 13.1% from last year and was the same as the pandemic year, based on our analysis of the twelve months ended August 2020. We identified approximately 192 transactions of interest during the past twelve months; exactly the same number we tracked in the period ended August 2020, when many companies took the biggest hit from Covid, and dealmakers hit the brakes.

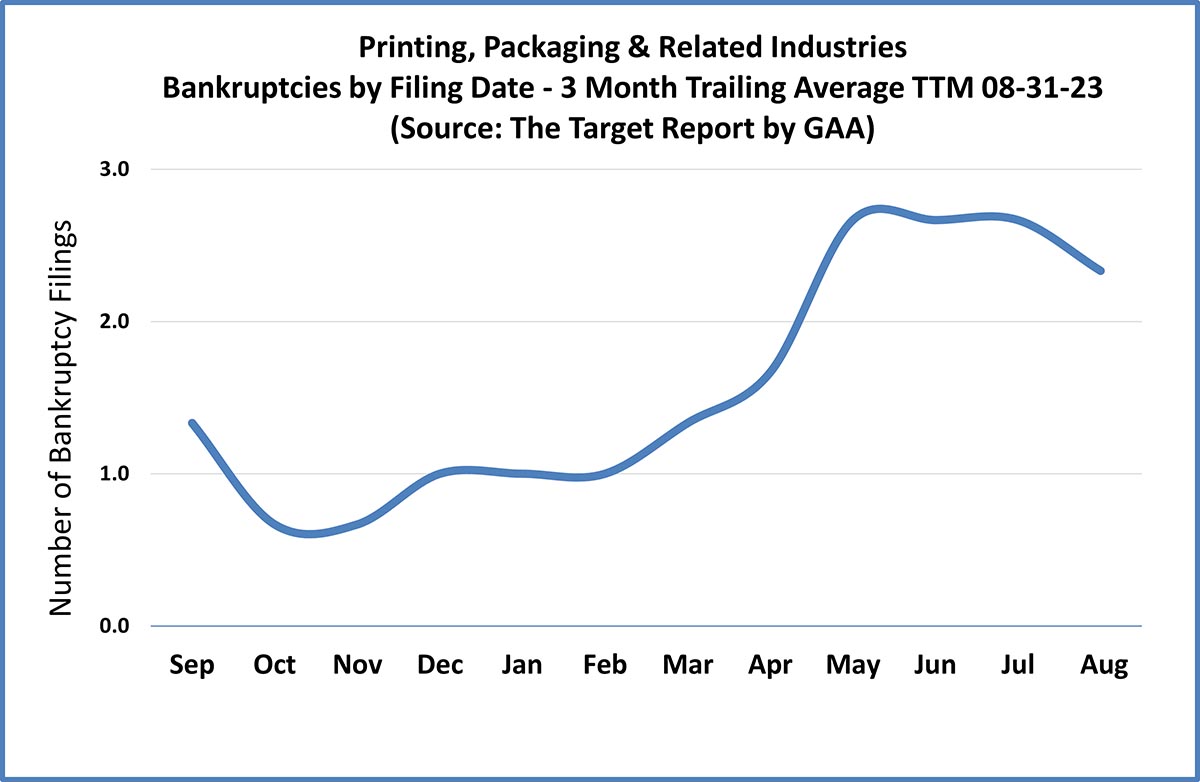

In April of this past year, we noted an exceptionally slow month in terms of number of deals, the least number of deals in any of the 140 months during which we tracked print & packaging M&A up to that point. We asked the question at the end of April: Was this an aberrant month, or were we headed into deeper turbulent waters? Will we navigate to the elusive soft landing? (See The Target Report: Sudden Drop-Off – April 2023) The answer is still not clear, but the data indicates some ripples that warrant paying attention, as does the recent increase in the restructuring part of our consulting practice here at Graphic Arts Advisors.

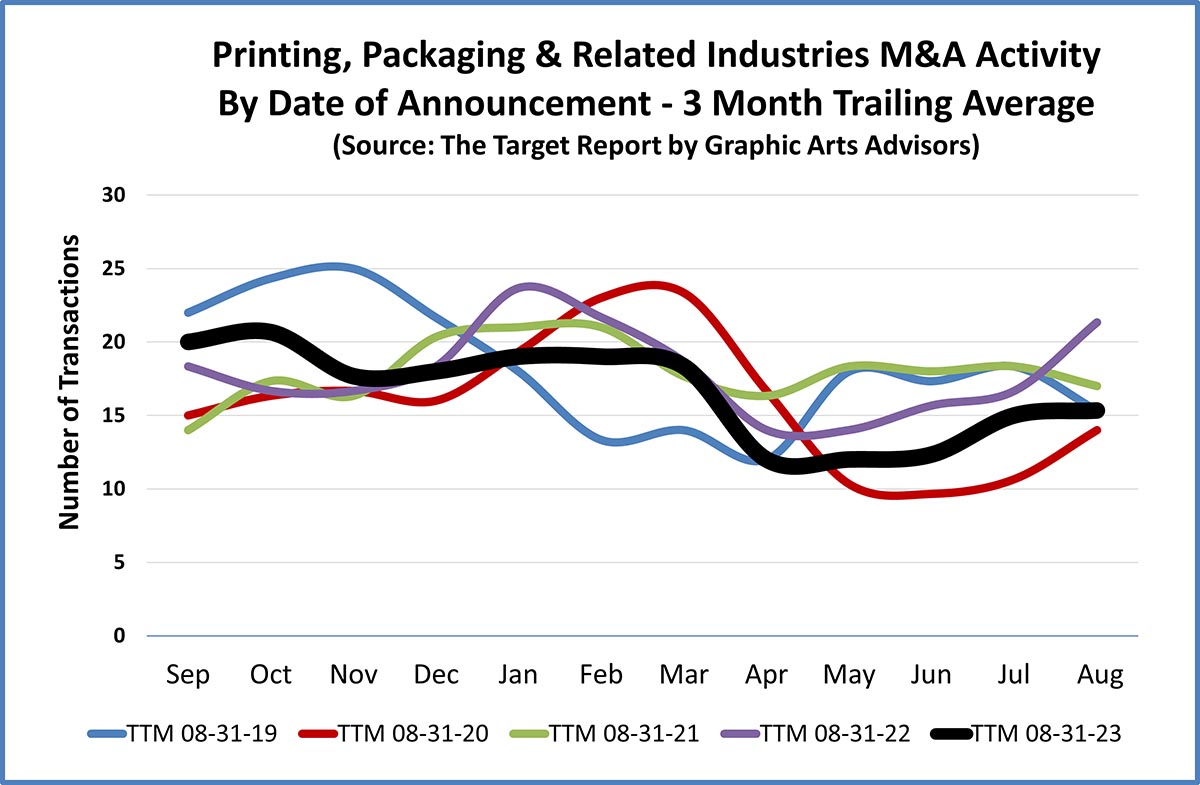

As might be expected, deal activity tends to drop off every year as we head into the summer months. We can clearly see this annual trend in the chart below, as well as the impact of the outbreak of Covid as illustrated by the red line. There was also a dip in the beginning of 2022 when the Omicron variant caused a déjà vu shutdown. We also noted a pronounced and uncharacteristic slump in deal activity during the beginning months of 2019, for reasons that were never clear, at least not to us. The most recent trailing twelve months, noted by the heavy black line, indicates that deal activity is recently running below average, exceeded on the downside only during the immediate post-breakout COVID period.

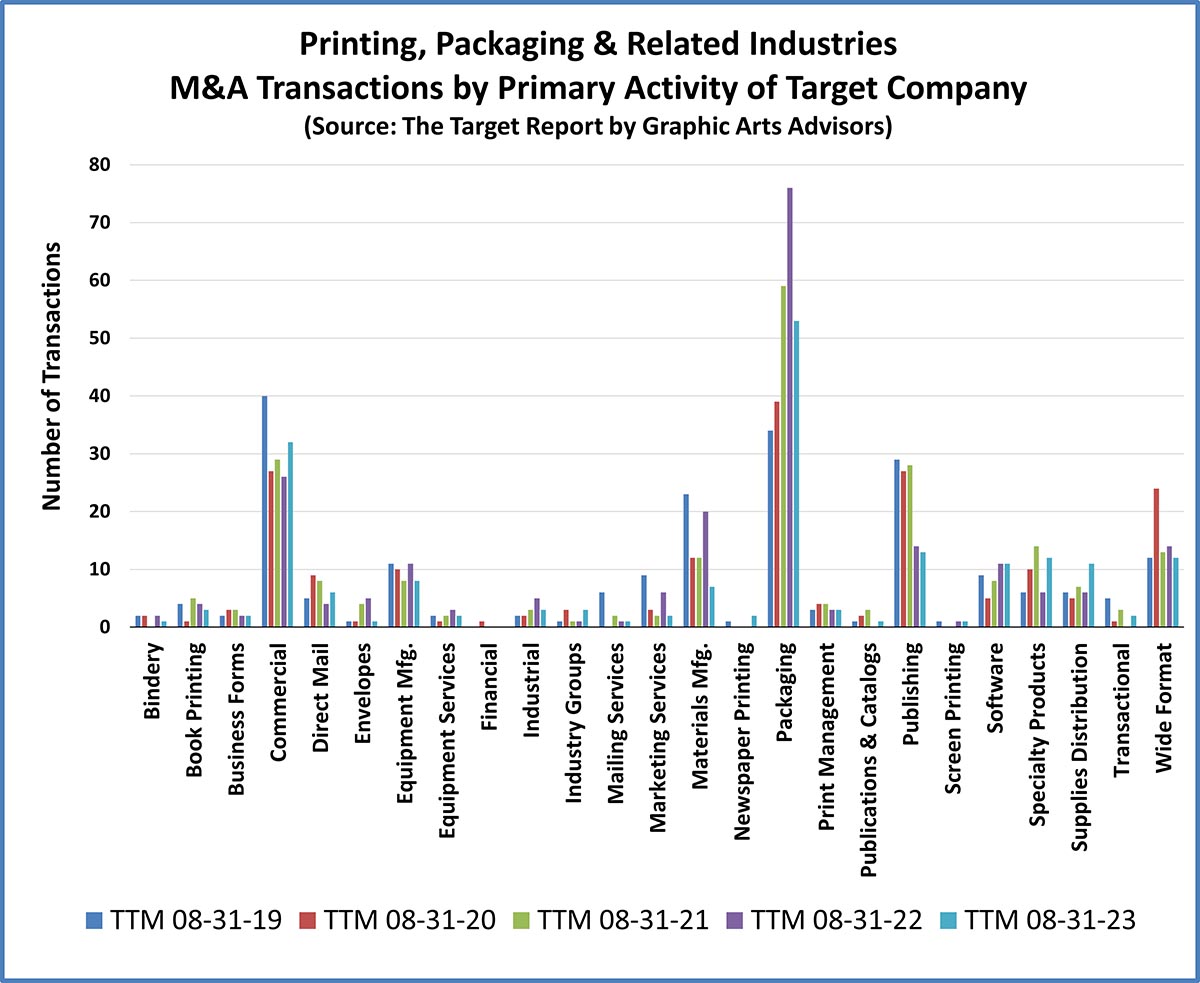

The chart above showing gross counts of publicly announced M&A deals provides a general view of the industry. However, as we know, the printing industry is not monolithic and in order to understand the market better, we categorize all the deals we have logged over the past twelve years by segment. We then dig deeper into the packaging, commercial printing, direct mail, and wide-format printing businesses, seeking to understand the rationale behind each deal, and gestalt the results by segment. We also analyze bankruptcy filings and non-bankruptcy plant closings to determine in which segments the business challenges are most pronounced.

The next chart breaks down the M&A transactions over the past five years into all the segments we track in The Target Report.

Commercial Printing

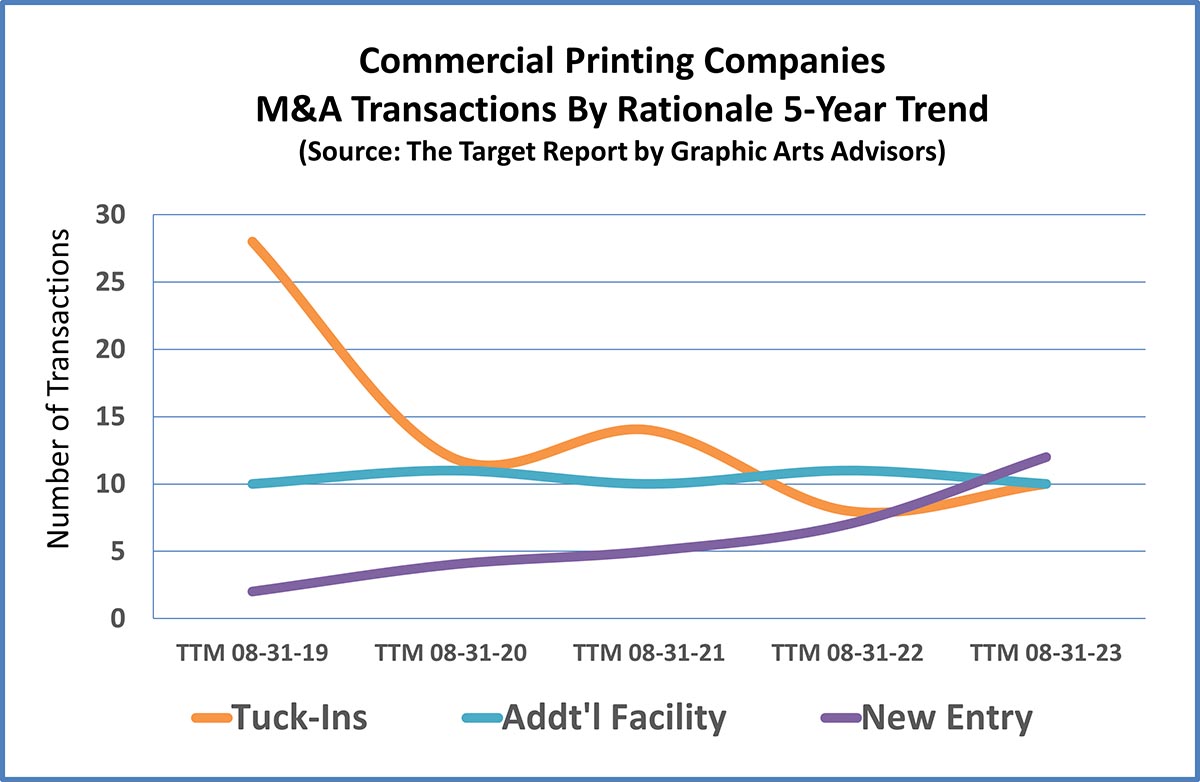

Our annual deep dive into the rationale behind the transactions in the commercial printing segment suggests that the commercial printing business has been reasonably stable, even a bit upbeat. The percentage of deals that were structured as tuck?ins stayed at approximately 30%, the same percentage as in 2022, in contrast to 79%, 44% and 48% of the deals that were tuck?ins during 2019, 2020, and 2021, respectively. In these tuck-in transactions, the customers of the acquired company are transitioned to the buyer’s production facility. Buyers will often leave the disposition of the plant and equipment to the seller, or to the seller’s agent, avoiding responsibility for trade and other debt, and possibly cherry-picking certain equipment that is needed or desirable for the smooth continued servicing of the acquired customers. In our opinion, a higher percentage of tuck?ins is indicative of overcapacity and financial stress, with the consequential result that there were fewer buyers willing to acquire an operating company within that segment of the industry.

There were 22 acquisitions in the commercial printing segment where the acquired facility was important to the buyer and will remain in operation, as-is-where-is. Notably, twelve of these were sold to “new entry” owners that were not previously invested in the commercial printing industry. This is in stark contrast to the number of transactions in commercial printing that were completed by new entrants in 2019, only two. Clearly, something has changed: outsiders are once again interested in, and more important, they are investing in the printing industry. Printing is not dead.

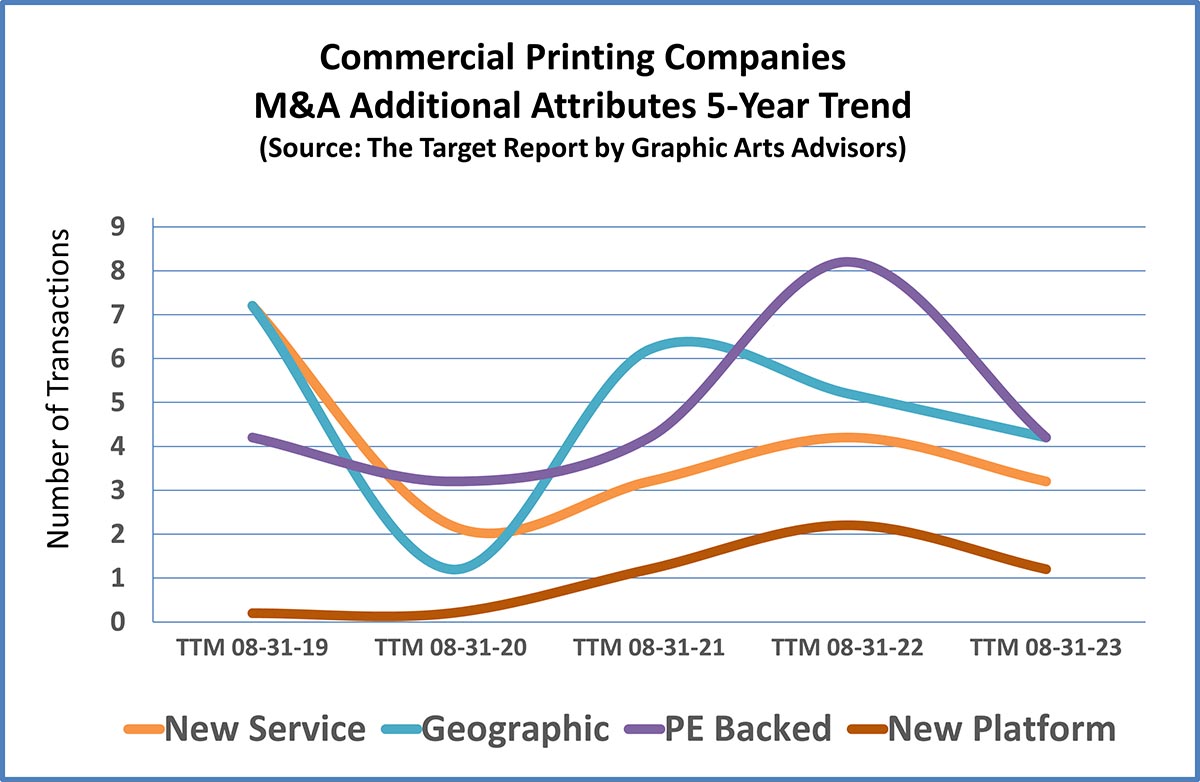

Digging a little deeper, we looked for instances in which buyers cited geographic expansion and/or adding new services as the rationale behind their acquisitions. We also noted whether a private equity sponsor was involved.

Adding to the company’s geographic footprint is still the most often cited reason for completing a transaction. Geography was followed closely by the desire to add a new service, most often a wide-format or promotional specialty company. In addition to a select group of national consolidators, there has emerged a number of serial acquirers that are executing a strategy to grow regionally in a hub-and-spoke fashion with a highly competent commercial printing company at the center (see The Target Report: Commercial Print Awakes from M&A Slumber – June 2022).

Many owners we talk with in the commercial printing segment have told us that their companies did quite well in the second and third quarter of 2022, and that positive performance continued in the first quarter of 2023. Of late, we hear that some owners are now experiencing a moderation in demand. We hear less about labor issues, although finding well-trained operators is still a common problem. Paper supply is no longer a widespread concern, except that, for some owners, there is a need to work off excess inventory that was purchased at inflated pricing. We are beginning to hear that customers are no longer accepting price increases with the ease experienced last year when just having paper stock was sufficient to land an order without a price objection. (We hear similar comments across the various printing and packaging segments, not just from commercial printers.)

With COVID squarely in the rearview mirror, owners that had put their exit plans on hold are now back in the market actively seeking a buyer or preparing for a sale process. Simply put, the average owner’s age is a strong driver to bring their company to market. Rather than commit to another round of capital equipment spending with its related long-term debt, many owners are opting to cash out.

Our candidate for the most interesting transaction in the commercial printing segment during the past twelve months was not one specific deal, but rather the series of transactions completed by private equity funds. The return of financially-driven outside investor interest in the commercial printing business is indicative of both healthier profits across the sector, as well as a social recognition that despite challenges from electronic media, print remains, and is likely to remain, a vital element of marketing and other communications. (See The Target Report: Private Equity Pieces Together Print & Packaging – September 2022.)

Packaging

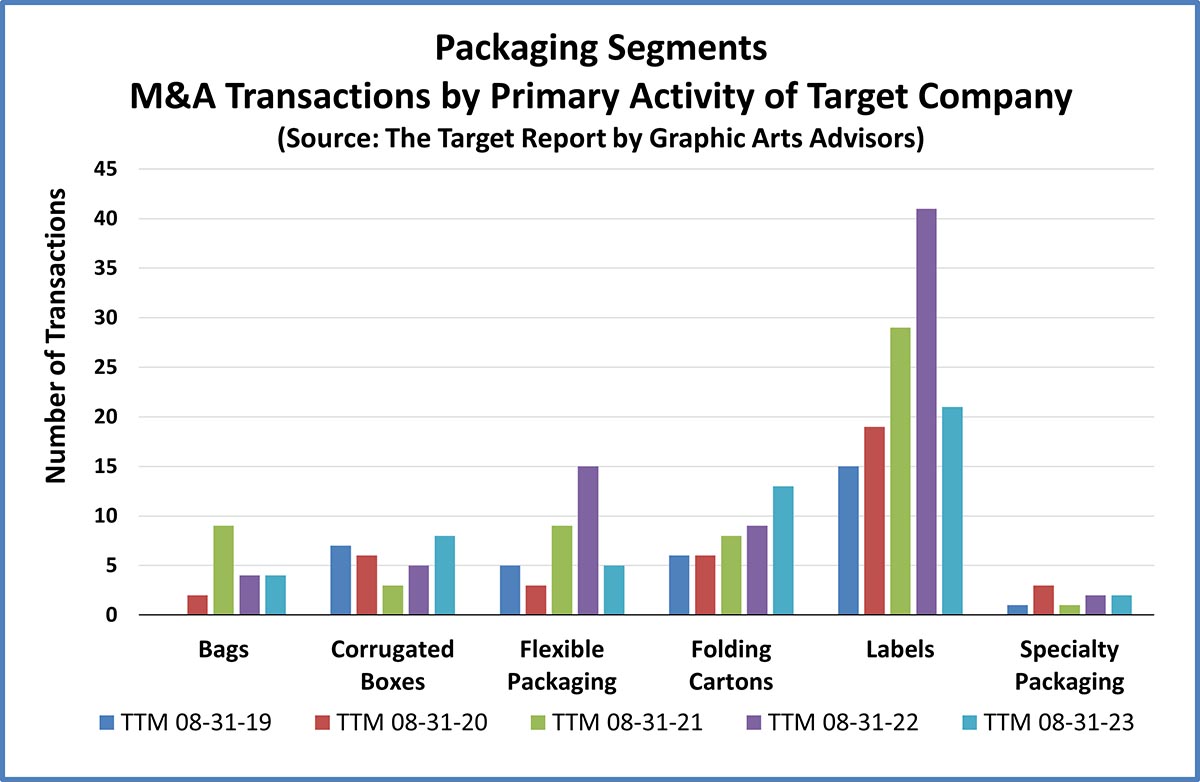

For the third year in a row, the packaging business is again the most active among the segments we track. However, consistent with the reduction in overall deal activity, we found 43% fewer publicly announced transactions in the packaging segments we track. The red hot market for label printing companies has finally cooled off a bit. We hear that buyers are being cautious due to the higher interest rates and possible future economic headwinds. The cherry companies have been picked off and consequently there are fewer stellar opportunities that fit the PE-backed platforms. Nonetheless, transactions involving label printing companies still top the chart.

There has been a steady uptick in the number of transactions in which folding cartons are the primary product of the target company. We foresaw this trend and noted this in past Target Reports. We believe that the interest in folding cartons will continue to increase as private equity funds that look for the recurring revenues inherent in most packaging companies seek alternatives to the higher multiples in the label and flexible packaging businesses. Larger established folding carton companies have also been active consolidators. Social trends extolling the use of more sustainable fiber-based packaging also favor the folding carton. (See The Target Report: Label Roll-Ups are Red Hot; Are Folding Cartons Next? – March 2022.)

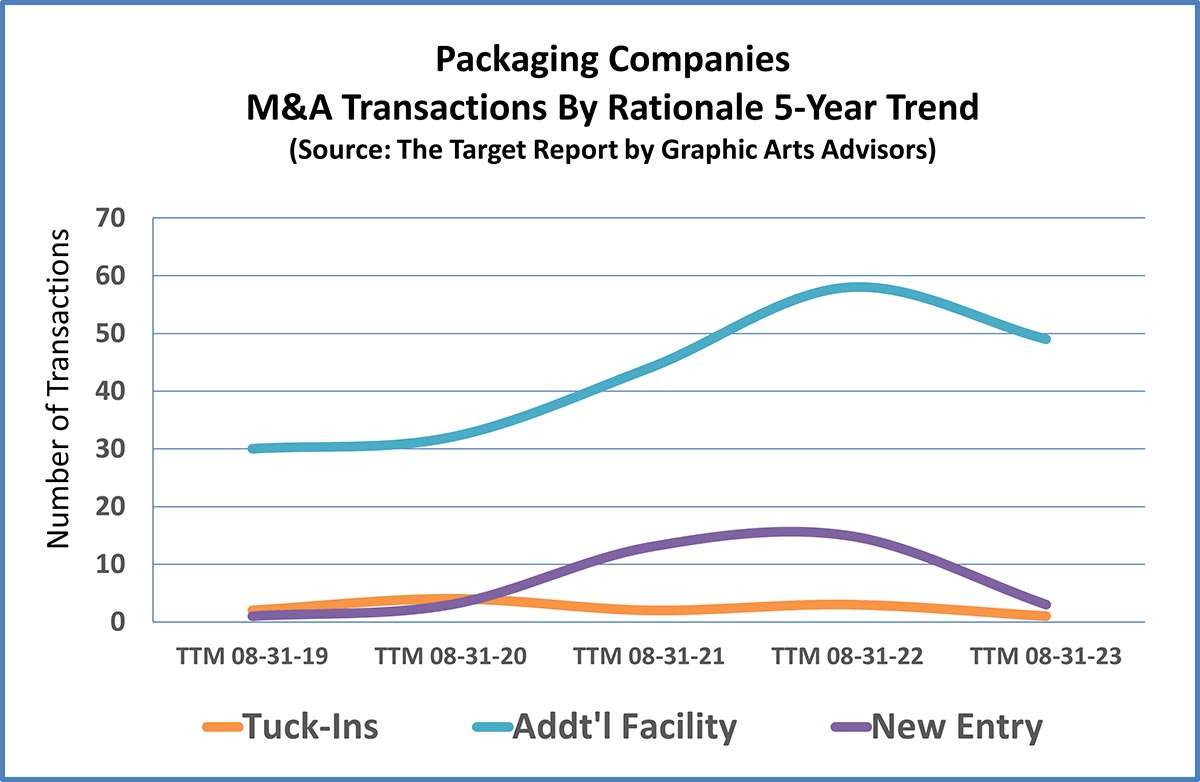

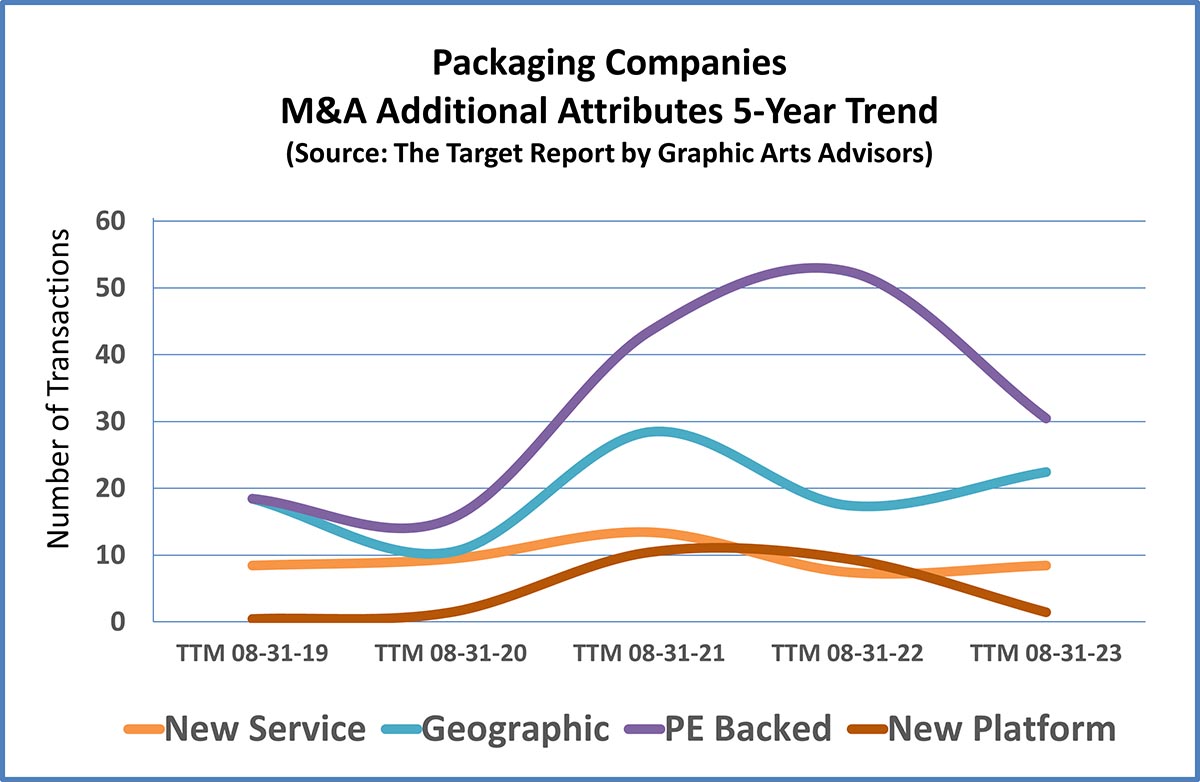

Owners and investors in the packaging industry tell a very different story than those in commercial printing, when they talk about their rationale for completing an acquisition. Of the 53 transactions that we recorded over the past twelve months in the packaging segment, only one was reported to be a tuck-in and that was the consolidation of a small plant into a nearby existing operation. In most of the deals, the buyers noted that the acquisition of an additional production facility as the critically important reason to complete the deal. Furthermore, the expansion of the company’s geographic footprint was mentioned as very important to the buyer.

Private equity was involved in 30 of the 53 total transactions in packaging, 57% of the total. In absolute terms, private equity’s decrease of twenty-two transactions accounted almost entirely for the total decrease of deal activity in the packaging segment. Last year, fifteen new players entered the packaging business, nine of which established brand new investment platforms in packaging. In contrast, during the past twelve months, there were only three new entrants, only one of which formed a new PE?backed platform.

In 22 instances, geographic expansion or diversity of the acquired locations was noted as a key element in the buyer’s logic. An expanded geographic footprint continues to loom large in buyers’ expressed logic for completing acquisitions.

Our candidate for the most interesting transaction in the packaging segment during the past twelve months was the purchase of Impression Paragraph, a folding carton manufacturer, by Canada-based Supremex. The acquisition marks Supremex’s fifth move into the folding carton business, all examples of the company’s laser-focused execution of its strategic diversification plan to acquire packaging companies and supplement its legacy core envelope business. (See The Target Report: The Box is Back – January 2023.)

Wide-Format and Related Digital Products

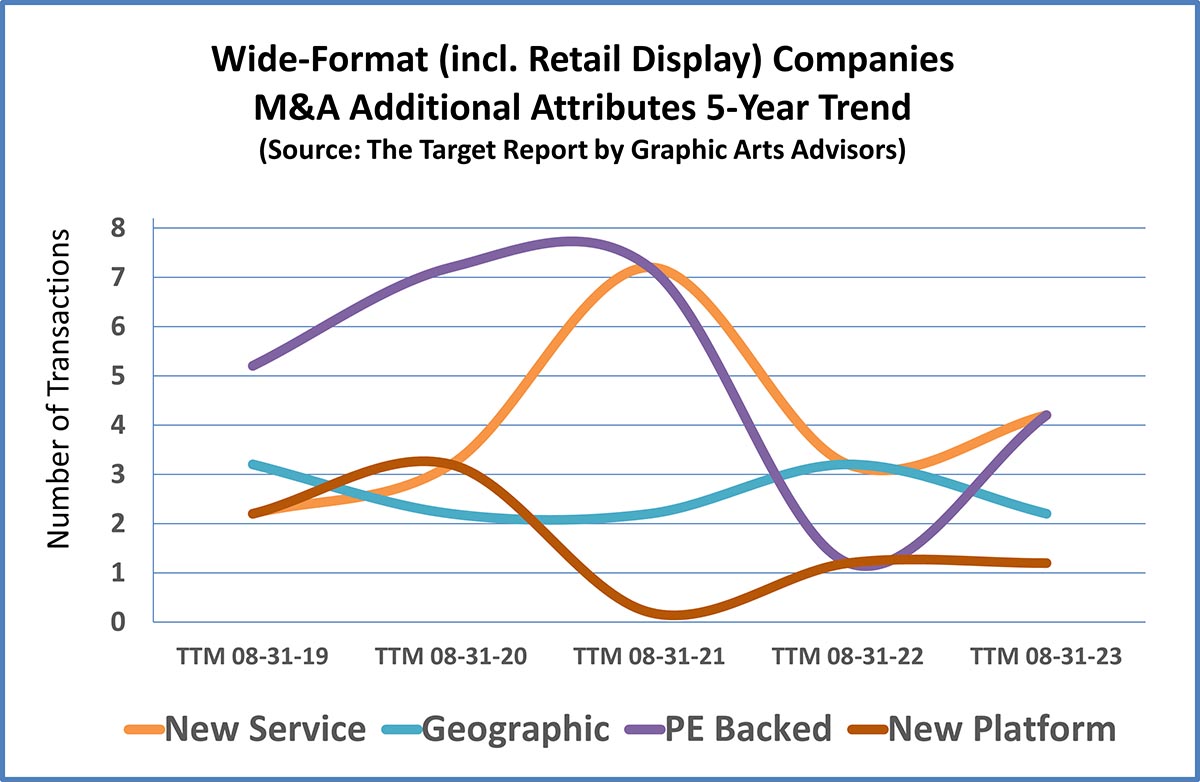

For our purposes in forming a picture of the various market segments that comprise the overall print-centric industries, we separate out companies that produce mostly wide-format and related products from the more generalized commercial printing segment. We include retail display and trade show graphic production in this category, as well as reprographics, indoor architectural environment graphics, and home décor products produced on wide-format equipment.

As noted in prior Target Reports, the salad days for wide-format printing are over. Digitally printed banners and wraps are no longer unique, flatbed printing devices are ubiquitous, and the high margins that came with being an early entrant offering large inkjet prints have been compressed by competition. Entry-level equipment is no longer expensive, flatbed cutters and other finishing technology are widely installed. Differentiation in the wide-format business has moved from those that had first-mover advantage to businesses that have perfected more complex online direct-to-customer systems, robust planning and installation capabilities, or value-added services such as printing on canvas for use as home or office décor.

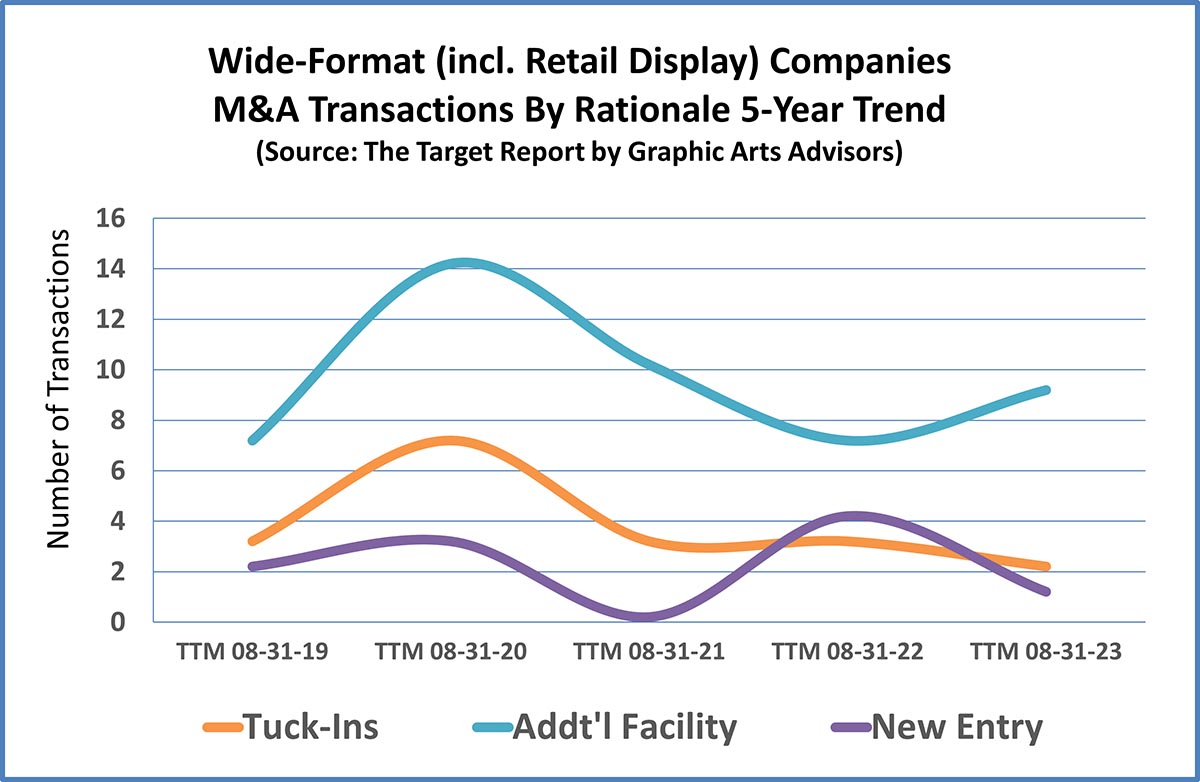

As the wide-format business matures, we find that buyers are going down the same road traveled in past decades by commercial printing companies; growth via acquisition, driven mostly by the stated desire to add a production facility. We can ascertain that the overall financial health of the segment is positive from the relatively small number of transactions that are structured as a tuck?in.

We noted 12 publicly reported transactions in the wide-format segment during the past twelve months, consistent with the number we found in 2022, 2021, and 2019, 14, 13, and 12, respectively. Only 2020 was an aberration from the norm, with 24 noted transactions. Several private equity-backed platforms are active in the wide format segment, which leads us to expect that deal activity will continue apace over the next several years. The minimal number of tuck?ins, bankruptcies, and plant closures all are factors that indicate a stable path ahead, absent any major economic disruption that might once again shut down entertainment venues and retail establishments.

Our choice for the most interesting transaction in the wide format segment during the past twelve months was the acquisition of Advanced Digital Services by Crisp Imaging, the latest in a long list of acquisitions completed by the California-based company. Crisp is an exemplar of the convergence theory in the printing industry: the integration of various printing technologies, digitally connected, enabling print companies to offer a more comprehensive range of services and solutions. Crisp Imaging added five acquisitions in 2022 alone, with a total of eight companies purchased since 2021. For some reprographers, the familiarity with wide-format monochrome printing devices and digital workflows became the foundation upon which to build a more robust business that offered a wide variety of services to a diverse client base. It was a small leap from the digital production of technical drawings to more generalized digital color wide-format printing. Crisp clearly is treading ahead on that pathway. (See The Target Report: Crisp Imaging Adds to West Coast Network – March 2023.)

Direct Mail

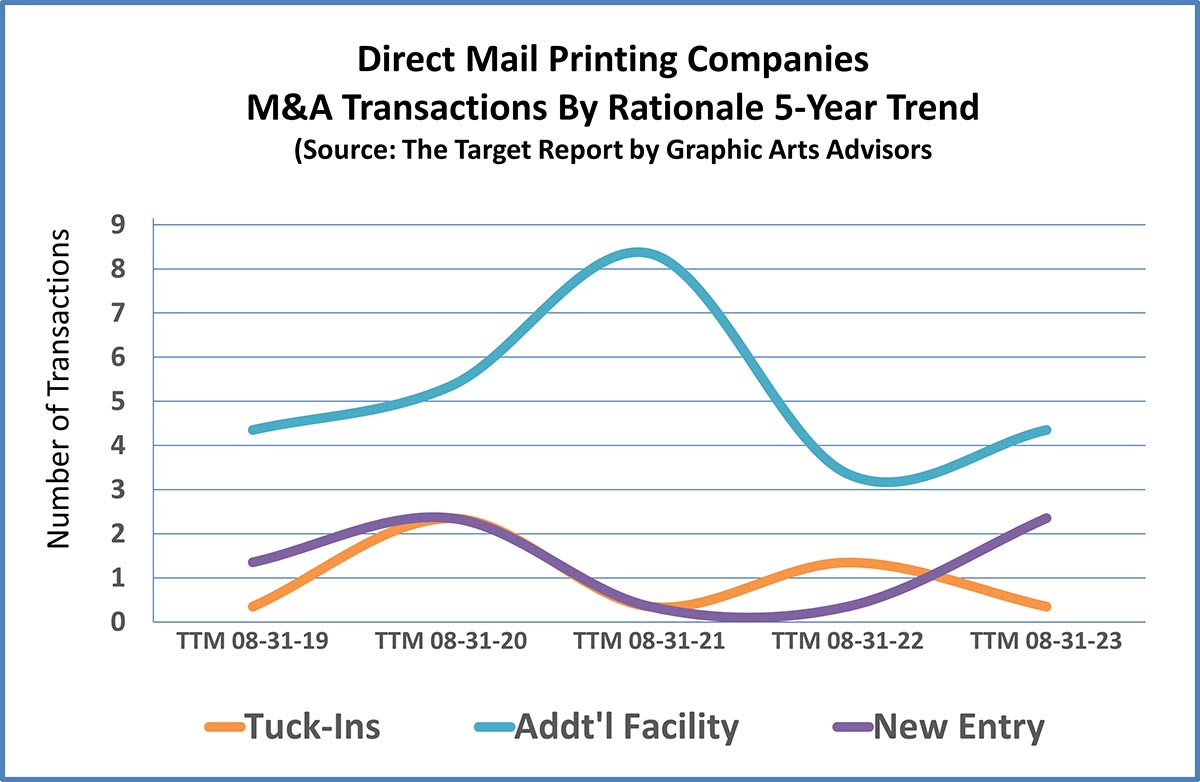

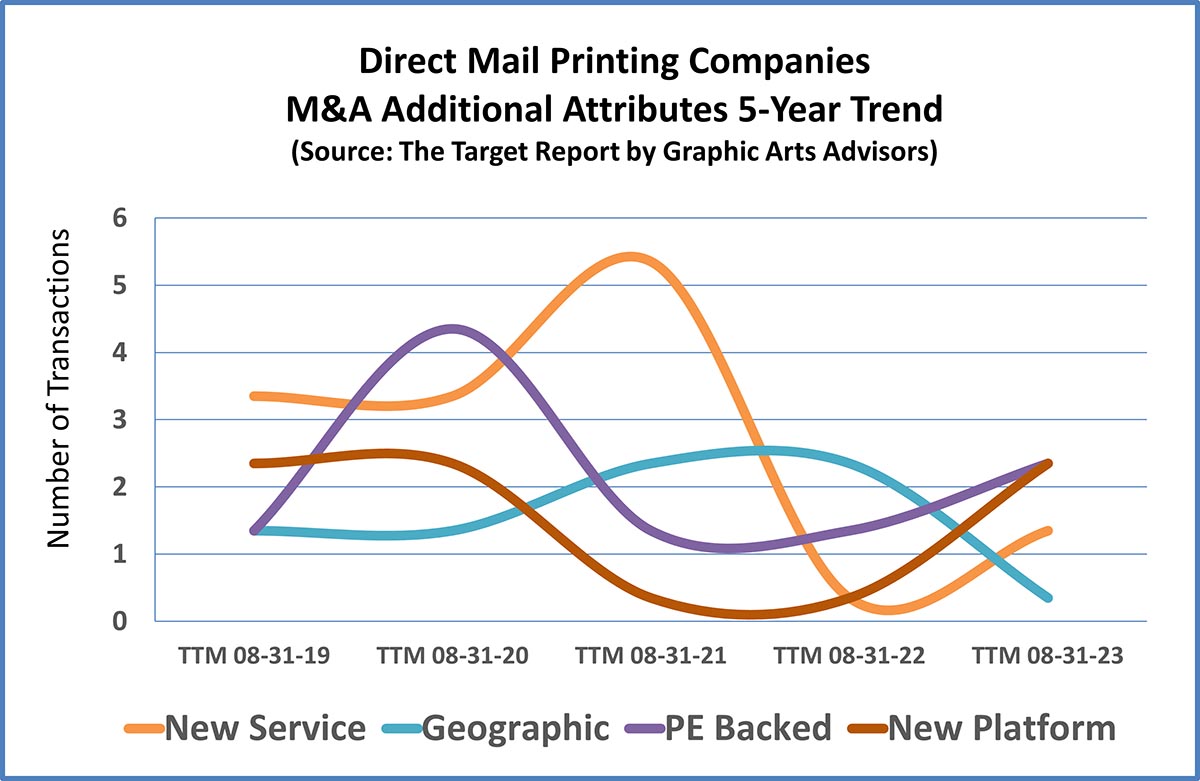

In our lexicon and analysis, direct mail printing companies are in a class by themselves, apart from the more generalized undifferentiated “job-shop” commercial printing companies that may offer some mailing capabilities. Many direct mail shops also manage, manipulate, store, and utilize data to drive improved results for their customers. Some have expanded into full-service marketing support companies, blending digital communication channels with mail campaigns.

Transactional activity in the direct mail printing segment held steady over the past twelve months, with a total of six deals announced, versus 4, 8 and 9 during the prior three years, respectively. Indicative of the overall positive health of the direct mail segment, there were no tuck?ins. In another sign of a healthy print segment, two new entrants bought into the segment, both PE-backed and representing new platforms.

Similar to the wide-format segment, the reason that owners gave most often for completing a transaction was simply to expand by adding an additional facility. All the other factors we track clustered together evenly as drivers for buyer behavior. In only one of the direct mail transactions did the buyer mention adding a service element as their rationale to move forward with the deal, indicating that most buyers believe that they already have the requisite services necessary to serve their customers. Rather, they are adding facilities to increase capacity and expand their company’s footprint within the direct mail business.

Our choice for the notable transaction of the year in the direct mail segment has to be the acquisition of Communications Corporation of America (CCA), by Moore, the direct mail behemoth originally based in Tulsa, Oklahoma. This transaction follows several others in which Moore has tilled the fertile ground for non-profit mailing services around Washington, D.C. The company has executed a clear and consistent strategy embracing all aspects of fundraising. Past acquisitions include a production procurement agency, envelope manufacturers, database services, and a fundraising consultancy that promotes a multichannel approach that utilizes television, radio, print, digital and social media channels, and of course, direct mail. No longer content to be called a direct mail company, Moore now calls itself “a leading constituent experience management company”—the latest term of art in the nonprofit fundraising business. Since that tagline phrase does not exactly roll off one’s tongue, Moore is now otherwise known as a CXM company. (See The Target Report: Direct Mail Providers Stretch Out – October 2022.)

Challenged Segments

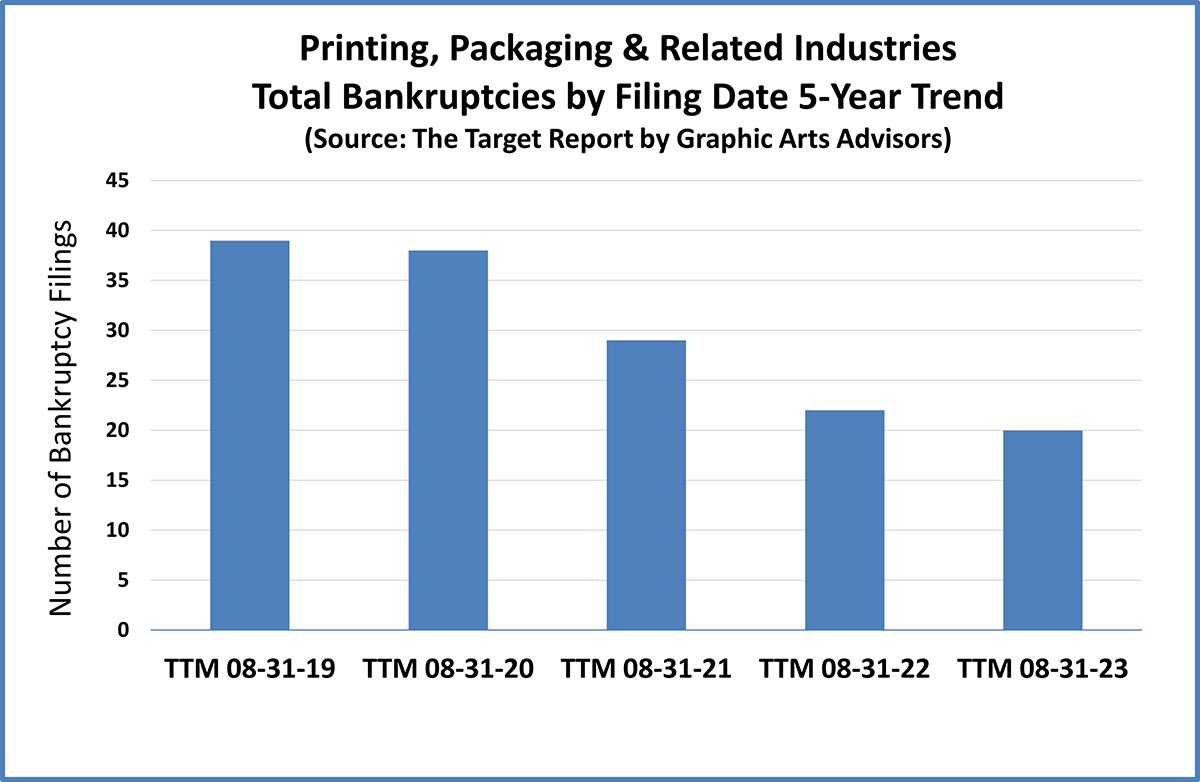

The transactional activity in an industry segment tells us that the business is changing. However, the simple counting of deals does not tell us if that activity is indicative of positive or negative change. To determine a directional indication, we track the number of bankruptcy filings and non-bankruptcy plant closures and correlate this information with the overall transactional activity. Our thesis, born out over several years and confirmed by industry stats derived from other sources, is that an industry segment with a high number of transactions that is also experiencing closures and bankruptcies is, or will be, in a contraction phase. There will be opportunities for consolidation at bargain prices for those companies that defy the downward trend.

Conversely, segments in which the number of transactions is inversely correlated to closures and bankruptcies are more likely to be expanding. Therefore, consolidation opportunities will come at much higher prices. Virtually all the packaging segments are experiencing steady transactional activity, without the corresponding bankruptcy filings and plant closures, indicating a very healthy environment for sellers as the packaging industry continues to consolidate.

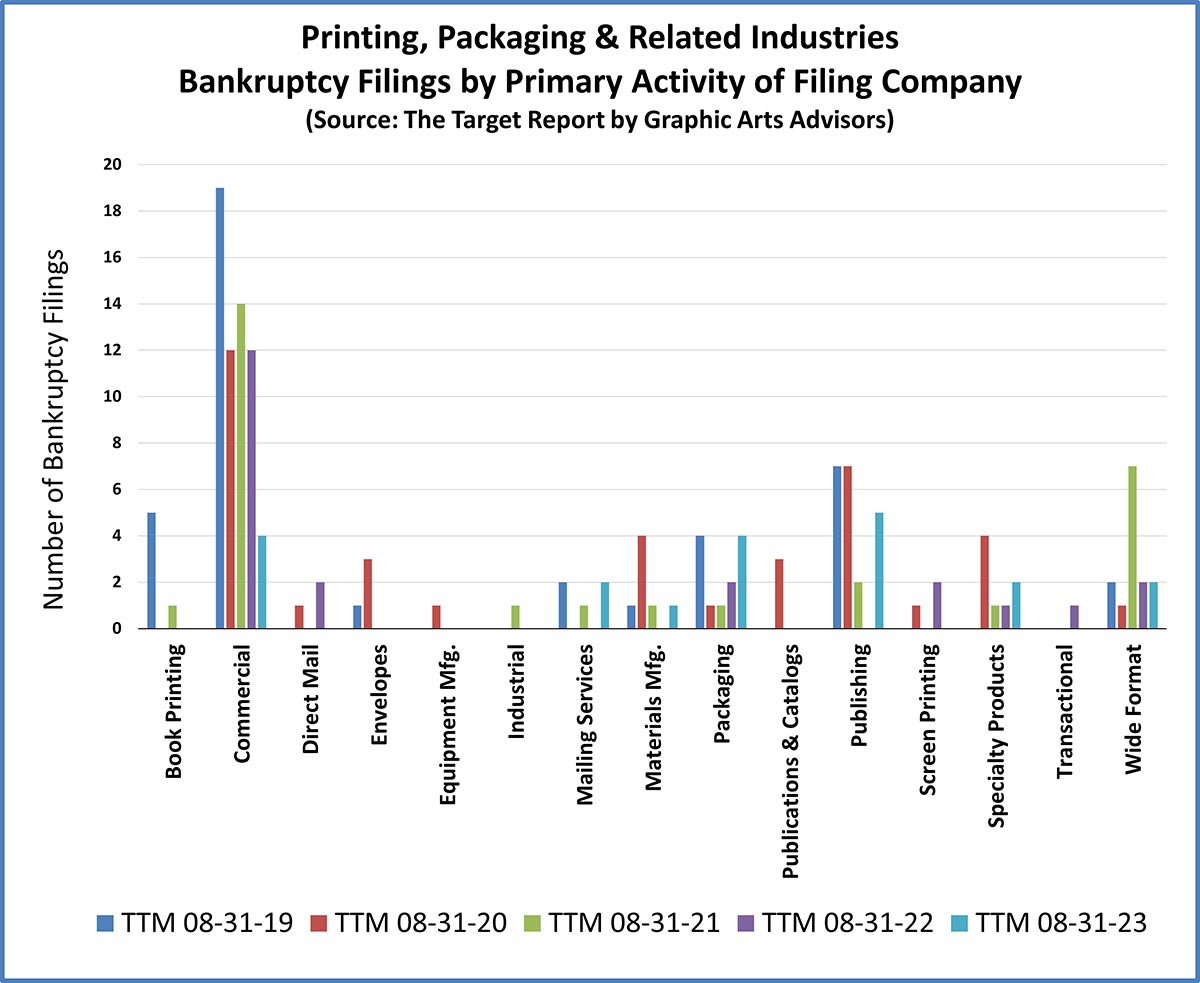

The gist of the data on bankruptcy filings is that the printing and packaging industries are doing just fine. Indicators of financial distress have all been trending downwards over the past five years.

For the first time in our twelve years of studying these trends, the commercial printing segment is not the leader in the number of bankruptcies filed. Not surprisingly, the publishing of newspapers and magazines is now the category leader.

Our candidate for the most interesting bankruptcy filing during the past twelve months, Vice Media, was indeed in the publishing segment. At one point, Vice, which started out as a printed magazine, was the tenth highest valued private company in America. The company transitioned to a media empire, focused on delivering edgy content via online channels. As we can see from the past two years in our deal logs of M&A activity, investors and consolidators are back in the print game, so one might interpret the failure of Vice Media and other electronic media as positive for print. That might be somewhat true, but it would be a mistake to interpret Vice Media’s bankruptcy filing as a halt in the inexorable move to a more digital multi-channel content delivery world. That movement will continue, however there will be fits and starts, new players and channels, and printed material will be there as the steady hand that delivers. (See The Target Report: The Party is Over at Vice Media, and Why it Matters - May 2023.)

However, before we become too sanguine about how well our industry is doing, we must note that here at Graphic Arts Advisors we have seen a notable uptick in the number of our restructuring engagements, advising owners of financially challenged and highly distressed businesses. That change became apparent in the Spring of 2023, which is consistent with the data we see for the overall printing and packaging industry over the past twelve months.

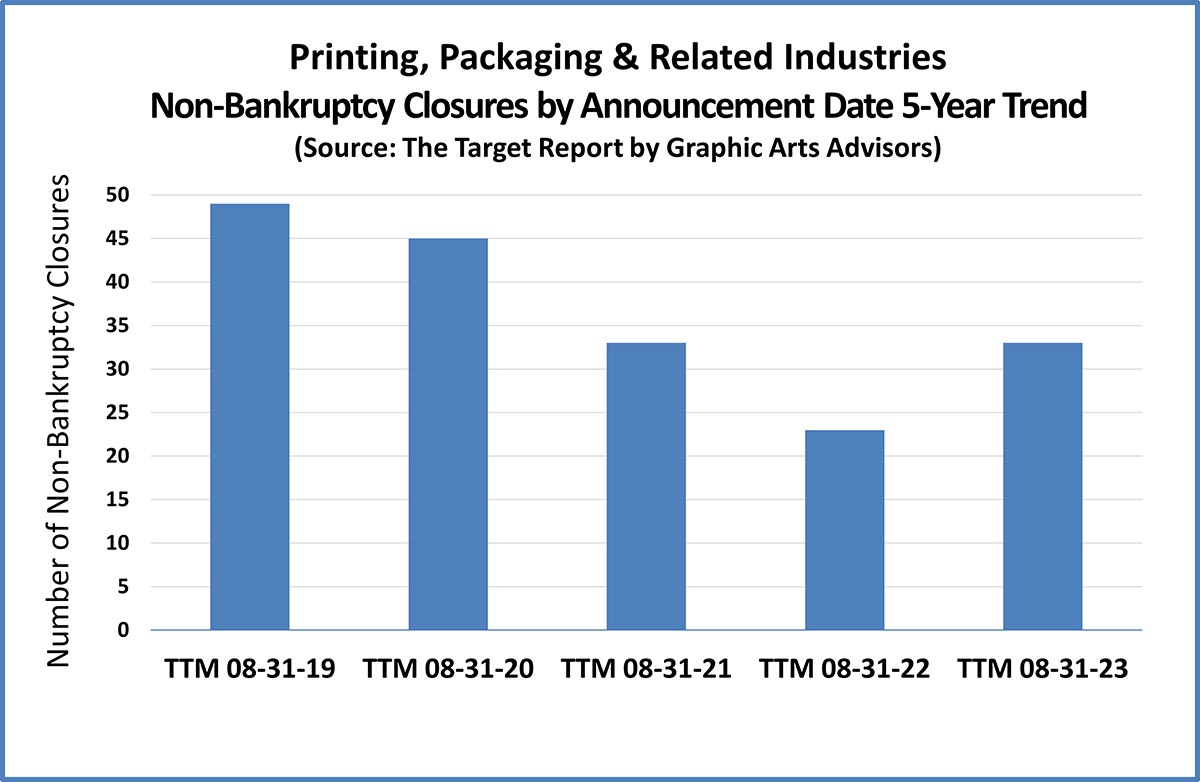

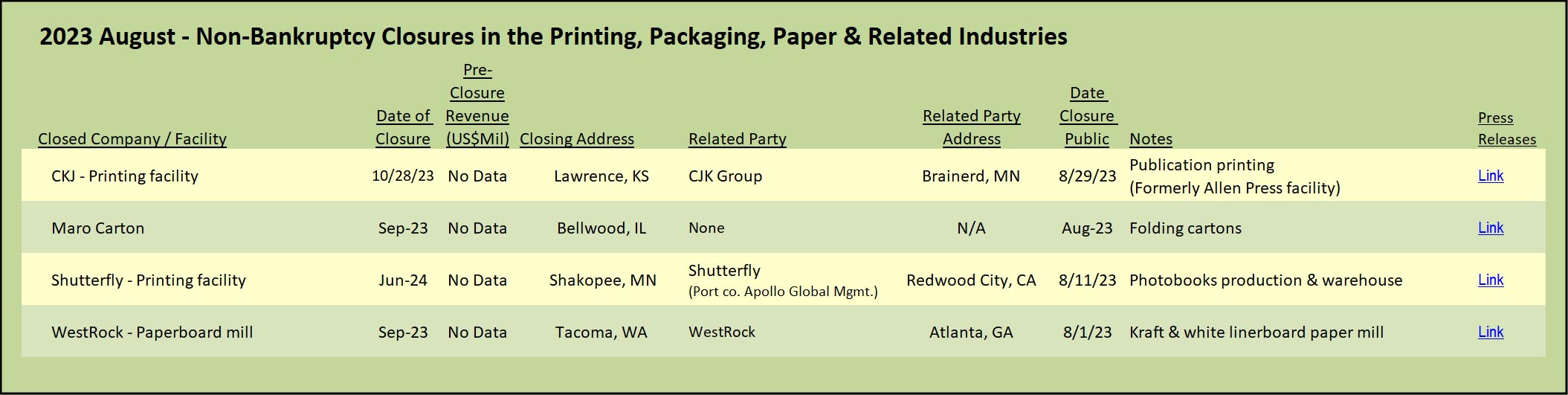

We also track activity in non-bankruptcy plant closures as a good indicator of financial challenges within each industry segment, possibly even a more prescient predictor than are bankruptcies. At the lower end of the market in terms of business size, a bankruptcy filing can be the death knell for a company in the printing industry, and in any case, bankruptcy filings are expensive.

While some companies simply close up and just disappear, others find a buyer for the book-of-business and conduct an orderly wind-down process. A closure does not always mean that the company has ceased operating; a closure may simply be due to one of the larger printing firms rationalizing their production capacity. Either way, closures are indicative of change, usually resulting from downward pressure in a market segment.

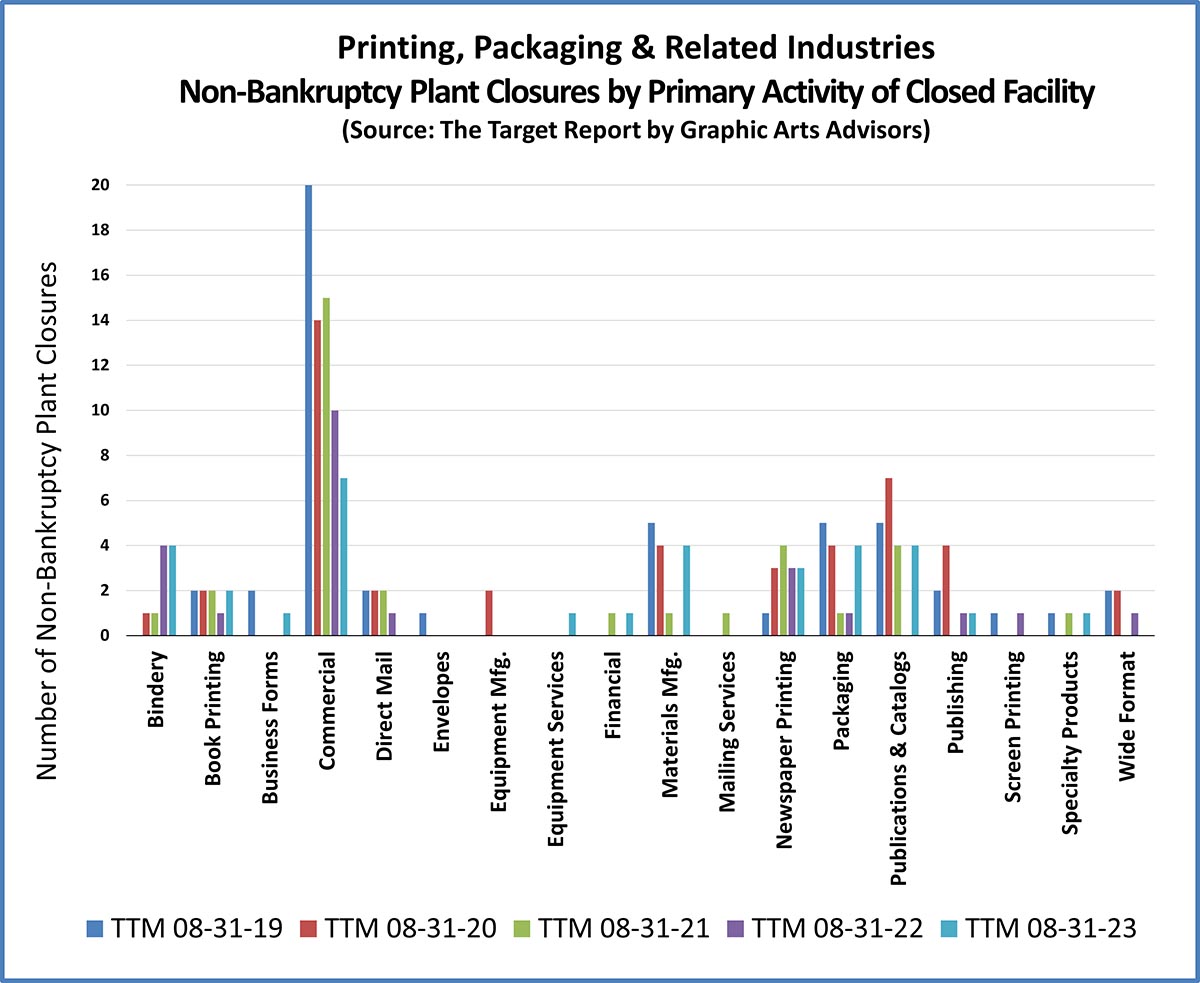

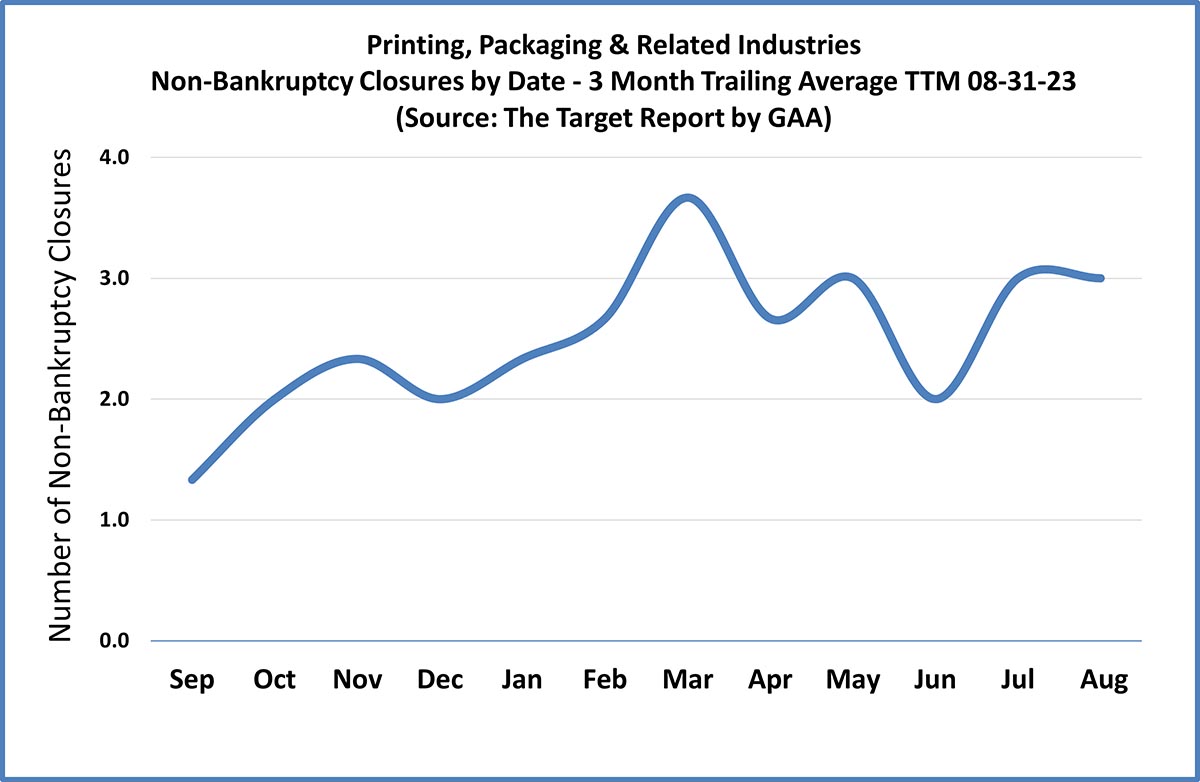

Converse to the bankruptcy filing data, the number of non-bankruptcy closures in the past twelve months increased to 33 from 23 during the prior year, but are still well below the numbers from 2019 and 2020.

General commercial printing companies once again represent the majority of printing facilities closing up shop in a non-bankruptcy closure or wind-down. Newspaper printing plants also closed in greater numbers than most other segments. Paper mills continued to cease operations and close up, as noted in the materials manufacturing category in the chart below.

We will see, over the next year, if we can stick the elusive soft landing referred to by hopeful economists. In our conversations with printing and packaging company owners across the US, we hear that much of the money from the government largess has been absorbed, loans are coming due for refinancing at higher rates, and print-buying customers are again exerting discipline in purchasing. Similar to the number of bankruptcy filings, the number of reported non-bankruptcy plant closures has crept up, beginning this past Spring. We will be watching and reporting when we enter our thirteenth year of publishing the monthly issues of The Target Report. Stay tuned.

View The Target Report online, complete with deal logs and source links for August 2023

Discussion

By Robert Godwin on Sep 13, 2023

Timely article on what looks like the near term future for the printing industry. The stalwart growth in packaging has buoyed hopes for strengthening the industry as a whole. Yesterday’s announcement on the Smurfit Kappa acquisition of Westrock echoes the Chatham Assets Management acquisition of RR Donnelley. While similar, they are not the same. Chatham is dutifully seeking to create efficiencies in the mature market RRD traditionally served. The trimming of operations will continue and a healthier company will result.

As for Smurfit this a play for growth in the robust US economy. They will take over Westrock and use their position to expand into the US market aggressively. In a mature industry, good management operational efficiency rule the roost. Even though there will be consolidation and layoffs, the industry will be healthier. Expect more activity in this regard.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free