Wide format graphics ink jet printing is entering its second decade of commercialization and is belatedly being discovered by commercial print-service-providers. Wide format ink jet printers historically didn’t fit the business model of commercial printer: they were not very productive, order volumes were small, and frankly it was not a product they believed should be part of their portfolio. Fast-forward a decade; competition continues its relentless march towards devaluing prices and commercial printer profits have shrunk to the low single-digits.

Meanwhile, the Internet has opened the door to mass-customization of printed articles, opening up new consumer markets. Schools, non-profits, and even consumers think nothing of ordering large format prints to promote their special events. Easy access to wide format graphics output is provided through over 1,500 supplies superstores franchises with in-house printshops.

The ubiquitous availability of wide format output at the consumer level is opening the door to promote wide format graphics print as an alternative to traditional advertising for small businesses. Instead of spending $2,500 on a yellow page advertisement, $1,000 would enable a storefront business to put up a new promotional or advertising message in its front window once per month and leave money for social media advertising. In an age where it is more difficult to gauge the effectiveness of advertising expenditures than ever, the impulse buy driven by point-of-purchase signage is stronger than ever.

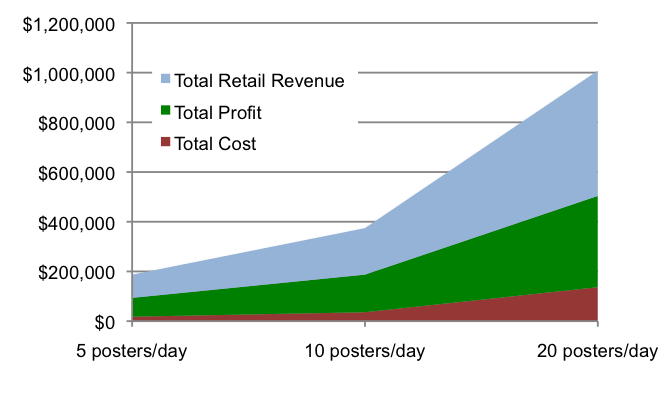

This brings us to the numbers; the profit to be made by commercial print providers if they were to tap into what we believe is latent demand for wide format graphics output. Retail pricing for wide format graphics output remains quite high for small volumes of output. A price check reveals average retail selling prices per square foot to be in the $6.00 per square foot range. Add lamination and dry mounting and the total cost per square foot nears as much as $13.00. The cost to the commercial printer (assuming he is using a $10,000-$20,000 wide format graphics printer) averages about $1/square foot for print, $1/square foot for lamination, and $0.50 per square foot for drying mounting – generating a 5X gross profit excluding equipment amortization and labor. For simplicity reasons, if one where to keep retail pricing and cost constant on a per square foot basis, printing anywhere from 5 to 20 six-square foot posters per day (at 240 working days/year) results between $75,000 to $360,000 in gross profit annually.

Figure 1 The wide format printing profit opportunity

For a typical $2 million annual revenue commercial printer, even selling as little as five wide format prints per day, wide format printing adds nearly 4% to his annual profit. For many of that size commercial printers this may well double or triple their annual profit.

To make matters even more interesting, for daily output volumes of five to twenty prints illustrated in our example there is a good selection of wide format graphics printers available that for under $20,000 can print both indoor and outdoor graphics. This opens up a “knock-on” opportunity not accessible to the 1,500+ superstores offering wide format graphics printing: printing on vinyl for banners, canvas for durable fine-art prints, even polyester fabrics to create soft signage advertising or custom furnishing decorations.

The crop of latex and eco-solvent printers now available for under $20,000 open the door to commercial print provider for a new journey, a journey onto ever expanding and incremental revenue applications. Restaurants, typically good menu printing customers, are starting to be offered wide format graphics prints as decorative designs for their backdrop murals, even ceiling panels.

To be successful in generating incremental profits with wide format printers it requires a major adjustment in attitude for commercial printers. They can no longer wait for orders and compete on the basis of service and local reach: they must proactively go out and sell their existing small business customers on helping them become better advertisers. If they don’t, the opportunity cost is losing “share-of-wallet” to the superstore printshops, or worse, losing the wide format graphics opportunity and ultimately their collateral business.

The dramatic hardware cost reductions in wide format printers able to print on a wide range of indoor/outdoor substrates have made the purchase of these devices by commercial printers effectively risk free. The counter argument that it is difficult to sell even five posters per day is really no longer valid. The education and non-profit fundraising market alone in most towns could absorb one poster per day; adding small retailers can easily help to exceed the minimum five posters a day in our illustration.

However, this also assumes that there isn’t already a commercial printer or other print provider able to reach small business in that town offering wide format graphics printing services. Statistically well under 10% of commercial printers offer wide format graphics printing services today. The implication is that given the near risk-free hardware acquisition cost, the real cost is the opportunity cost resulting from delaying an acquisition of a $10,000 to $20,000 indoor/outdoor printing capable ink jet printer. The first mover advantage is powerful. Waiting for hardware prices to decline even further is futile, as any “cost savings” will have been mitigated by having to “buy” market share from the print service provider that adapted wide format ink jet technology ahead of you.

To the estimated 15,000 commercial printers left in the United States the numbers should be loud and clear: expanding services to include wide format graphics printing is among the lowest-risk and highest incremental profit opportunities accessible. That is, for those who don’t hesitate and grasp the first mover advantage.

Discussion

By Duncan MacOwan on Feb 06, 2013

If you'd like to find out more about how to enter, or grow your profits in, the wideformat sector, attend FESPA 2013 in London in June: www.fespalondon.com for more details

By Frazer Chesterman on Feb 08, 2013

Interesting comments Marco. Or is this all too late. I have to say the recession now shows signs of problems for POP/POS wideformat printers , with large retailers in the UK such as HMV and Jessops close 100's of shops. Also manufacturers such as Polytype closing their wideformat depts down.

According to IT strategies - Industrial printing is using wide format technology is the real growth area. Estimated by IT Strategies to have a total value of €80 Billion, by 2022, this is expected to grow to well over €100 Billion.

Perhaps we should all be looking for new customers in industrial and manufacturing applications?

www.inprintlive.com

By Marco Boer on Feb 09, 2013

Hi Frazer,

I can imagine things are different in the UK just having toured commercial prints hops there last week. However, part of the point of the article was to say that at under $20,000 the return-on-investment for smaller print shops serving small, regional (or non-national customers) is still a really good opportunity. At the very high-end of the UV flatbed market no doubt only the really large and highly efficient ones will survive.

Marco

By Frazer Chesterman on Feb 11, 2013

Marco,

I agree the smaller creative print shops can still innovate to generate new business. I have observed the growth of digital wide format in the last 7 years or so and I just see a flattening of business for the wideformat manufacturers in sign and graphic. All the major machine companies are saying this. My sense is that technological improvement in inkjet will allow these machines to be turned to a new business opportunity - Industrial print - I would be interested to see your thoughts on our blog on this very subject - www.industrialprintshow.com

By Marco Boer on Feb 12, 2013

Frazer,

You are right, the evolution of WF into other ink jet applications is now starting to ramp up. 3D printing, ceramics IJ printing, textiles, etc. -- we'll probably participate in the April 2014 Industrial Print show in Hannover Germany to help with the development of these markets.

Regards,

Marco

By David Uno on May 28, 2013

27 years ago, we started with B&W copier and printing presses. It is interesting how our Aiea Copy has to evolve to grow. About 20 years ago we added our 1st color copier. 8 years ago, we added our 1st aqueous wide format printer. About 4 years ago we added an Eco solvent printer and dropped out basic price to $3/sq. ft. We also dropped our b&W wide format. A year ago, we went all digital with the removal of our offset printing equipment. We continue to evolve to stay competitive and relevant in a ever changing market.

www.aieacopycenter.com

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free