Last week, we took a wide-format look back at 2016. Now let’s switch directions. What can we expect in 2017?

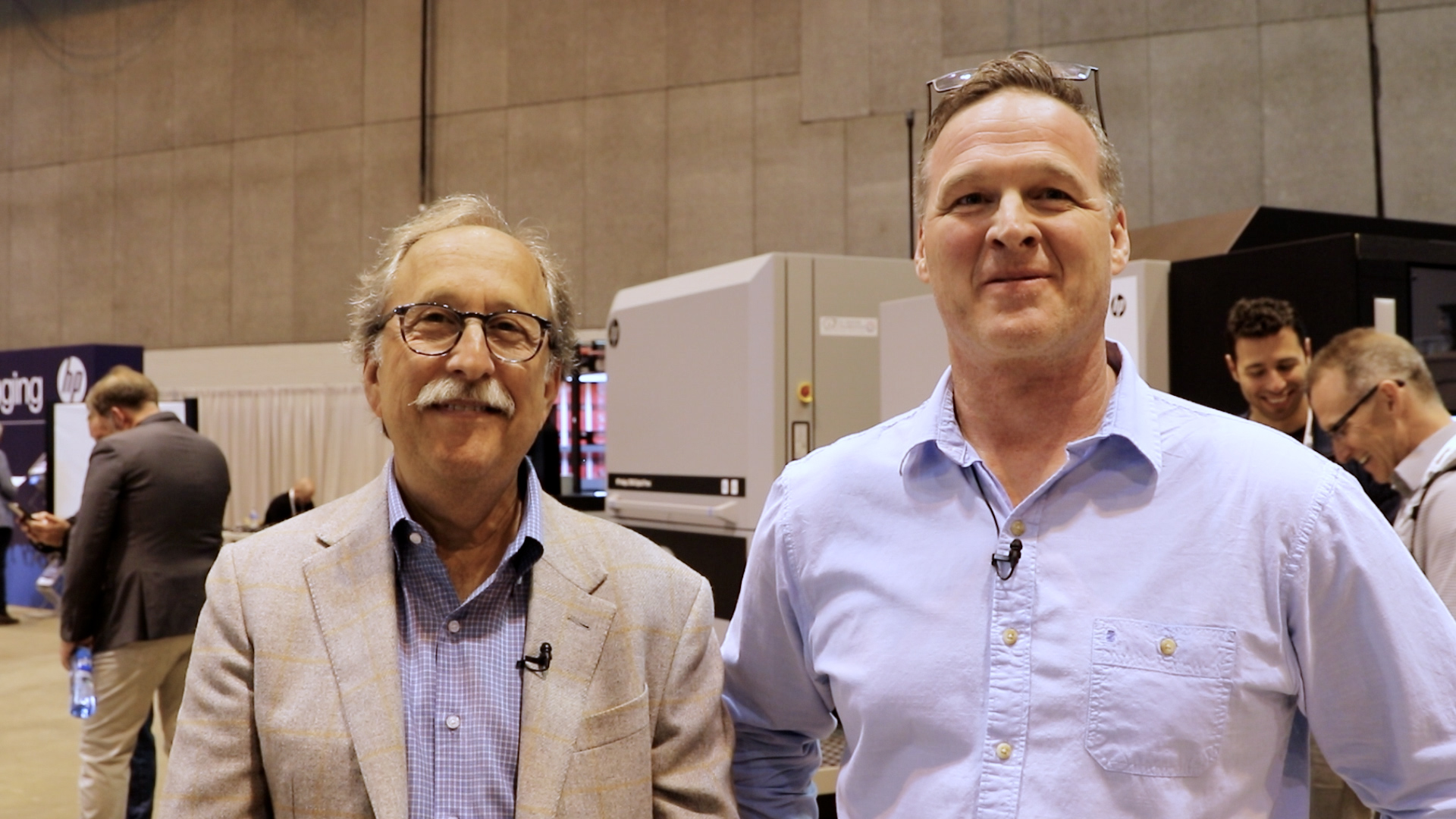

Dr. Joe Webb and I just completed our new WhatTheyThink special report, Printing Forecast 2017 that offers a qualitative and quantitative look back at both the prevailing macroeconomic and industry-specific microeconomic trends of 2016, and also looks ahead to 2017 and beyond. The report looks at hot and cold trends for 2017 (as well as some we think should be warmer than they are) and offers an economic forecast to 2021.

Although there are some dark clouds looming for the commercial printing industry in general (October printing shipments were atrocious), the business conditions data we gleaned from our Fall 2016 survey (the full results are presented in the report) indicate that 2016 was a very good year for printers, and they are optimistic—perhaps unrealistically so—about 2017. Not that optimism is a bad thing; we did some business conditions surveys around 2011 that were so depressing that the final reports should have come with several tablets of Prozac, so it’s nice to see happy people in our industry. (And isn’t it nice to see happy people in general?)

Optimism is good in another way. The economy—be it the country’s or the industry’s—is affected as much by belief (aka expectations) as it is by any actual fiscal or monetary policy. If people think economic conditions are going to be great, they’ll be more likely to spend money on products and services beyond the basic necessities. This is a good thing. Likewise, printing firms that expect business to grow in the next year or more will be more likely to invest in new equipment (if they expect they’ll need more capacity, or if they decide to pursue new product areas) as well as other items. (In the case of our Fall 2016 survey, we found a strong interest in investing in automation software to help alleviate a top challenge: managing/increasing plant productivity—a problem you don’t have if you’re not busy.)

On the other hand, too much optimism can result in overcapacity or a surfeit of equipment that will end up sitting idle if volume goes down. It can also lead to financial troubles if the new investments don’t pay for themselves, at least in part. (We saw this at the turn of the millennium; in the mid-90s, print volumes were rising and rising, and shops invested heavily in new equipment that ended up glutting the used equipment market when things started to go south for the industry after 1998.)

If you listened to Dr. Joe’s economic webinar last week, he mentioned in his comments about the latest printing shipments data that October had abruptly stopped being one of the biggest months for the industry. In a way, the industry is losing whatever seasonality it once traditionally had. I had commented about this back in May in a report from one of Durst Imaging’s “Retail 2020” events. There is now a very strong trend in retail away from any kind of regular seasonality—sure, there will always be Back to School and Christmas, but aside from those, retail marketing and its related ecosystem of print and non-print elements are increasingly at the whim of social media, responding to things that competitors have done, or other things that crop up unexpectedly. (The downside to this for the print providers that serve retailers is that materials need to be produced more and more quickly with less and less lead time.) So generally it’s getting harder to predict the busy and slow times, at least for some shops.

Our Printing Forecast 2017 report doesn’t specifically look at wide-format and specialty graphics printing (our survey sample was general commercial printers, and few of them were solely wide-format shops, although many do offer some wide-format services), but some of the data pointed to a continued movement of shops into those new product areas. A not insignificant number of general commercial shops see “adding wide-format printing capabilities” as a business opportunity, and there is evidence of planned investment in wide-format equipment. When we specifically asked what new product or service areas print businesses were looking to expand into, wide-format was the top item selected, followed by specialty printing (like coffee mugs, golf balls, smartphone cases). Mind you, there were not an awful lot of shops that were looking to expand into any of the new product areas we had included on our questionnaire (we had also included various kinds of packaging, textile printing, production inkjet, even 3D and functional printing), but for those that were, wide-format and specialty graphics topped the list.

As I wrote last year, we’re not in the midst of any great technological revolution vis-à-vis wide-format, just evolution and “filling in the blanks” in vendors’ hardware and software portfolios. However, it could be that wide-format evolution proceeds akin to what the late, great Stephen Jay Gould called “punctuated equilibrium,” whereby species spend many generations in a period of stasis with little or no evolutionary change, but every once in a while a rare event splits existing species into new, distinct ones. We’re perhaps at one of those times now, where we are starting to see new types of wide-format presses appear, predominantly in the packaging and textile printing spaces.

What are some specific application areas to pay close attention to in 2016?

Packaging. Short-run packaging is one of the most talked-about topics in the industry right now, and even if our own survey didn’t give the indication that a lot of general commercial printers have much interest in moving into that area, those who do already produce packaging will have a lot more tools at their disposal to take advantage of digital printing. I’ve also seen some very cool direct-to-shape applications. To name but three: Xerox has introduced a Direct to Object Inkjet Printer (it’s a custom solution built for specific customers not a “mass-produced” press), Heidelberg’s OmniFire can print direct to objects, and YUPO has a new technology called Sculpt for decorating embossed and debossed three-dimensional objects like plastic bottles. Does this mean the label is doomed? Not at all, but it can do for three-dimensional package printing what inkjet devices are now doing for corrugated.

The idea of printing on 3D objects leads us to...

Specialty Graphics. UV printing on 3D objects in general will continue to grow. Mimaki and Roland have long offered desktop UV devices for printing things like golf balls and especially smartphone covers, that latter a business that picks up whenever a new model is released which inevitably has different dimensions. Printing on YETI cups is also a thing now. These kinds of promotional items—which used to need to be printed in very large quantities through special ad specialties dealers and distributors—can now be done in very short runs, and be highly personalized. These items can be excellent tie-ins to corporate or other events.

Textiles. Textile printing has been growing for a few years now, and soft signage continues to be the top application, at least in our corner of the world. Direct-to-fabric is starting to penetrate, as it were, and can be a good technology for signage applications. Tellingly, Epson has just opened new digital textile technology innovation centers in Italy, so it will be interesting to see what comes out of them. Pigment-based textile inks have the potential to be the Swiss Army Knife for textile printing—they are not limited to specific kinds of fabric—but so far things have been all quiet on the pigment front. It has tended to be EFI Reggiani’s bailiwick, so next month’s EFI Connect may offer some insight into how that’s coming along.

Software. I said last year that 2016 would be the year that software became a major topic of conversation in wide-format printing, and that has largely been true, even if I was the only one talking about it. (Actually, I wasn’t.) 2017 will see a continued focus on the software part of the process, especially as the drive for automation and higher productivity continues. Color management will continue to be a bugaboo. (Earlier this month, the Idealliance released XCMYK, a new profile and color space that is, essentially, GRACoL for expanded gamut printing, such as that found in many wide-format devices. We’ll be looking at this in more detail early in the new year.)

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free